Insurers claiming soft pricing and low interest rates are the reason for their poor performance have no such excuses.

That is the verdict of a new study by Willis Towers Watson which looked at the previous five years of financial returns from Prudential Regulation Authority (PRA) registered insurers. It has revealed that insurers operating in similar classes of business and the same economic environment have delivered markedly different levels of returns during the last five years – with some companies proving far more effective than others in managing soft pricing and low interest rates.

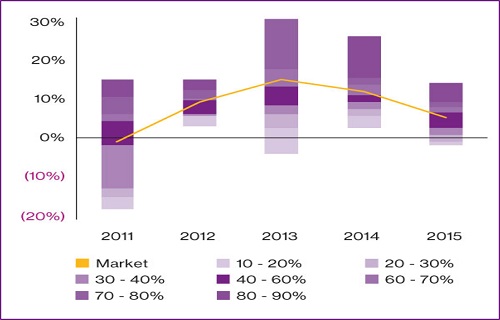

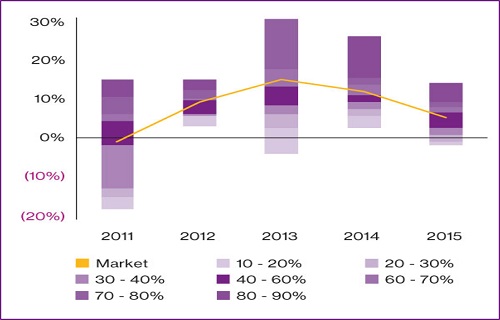

At an aggregate market level, the analysis shows that the UK non-life insurance industry has performed relatively well in the prevailing market conditions compared to other industry sectors, having averaged a return on equity of nearly 8% over the last five years. Figure one, however, shows the marked variation in performance between individual insurers, which is particularly noticeable in 2011 and 2013, but still amounts to around 15 percentage points between the highest and lowest performing companies in 2015.

Figure One: Average annual market return on equity and distribution by participant firms

(Source: Willis Towers Watson analysis of PRA returns through S&P Global Market Intelligence)

“The significant performance spread among direct competitors in the UK non-life insurance market over the last five years demonstrates that companies have the ability to break free from the chains of external factors to improve stakeholder returns,” said Charlie Gifford, a director at Willis Towers Watson.

“There is of course no magic formula, but most companies should be able to make gains from re-examining approaches in core areas, including capital, investment, business mix and disposals, reinsurance and uses of technology and analytics.”

Among the key findings of the study were that trimming business portfolios has become a viable option for differentiating returns by enabling companies to direct their resources towards markets with better growth opportunities. This, in turn, delivers better bottom line growth and frees up capital reserves.

In addition, the study suggests that there is likely to be continued growth in the personal lines market and those who are best positioned to capitalise are firms that adapt quickly to the wider impacts of technology on the risk and the market.

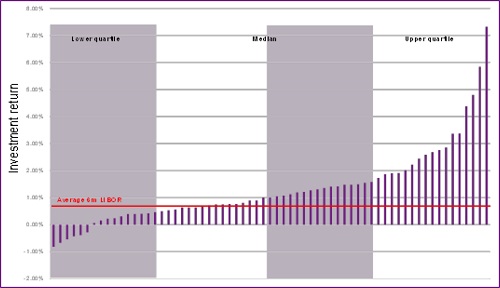

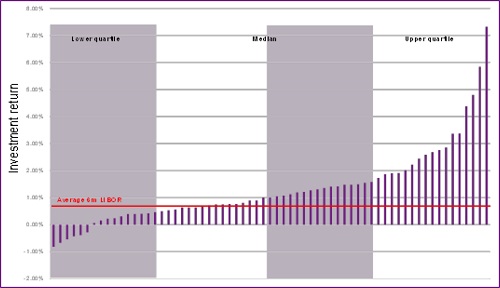

The study also revealed insurer’s returns in 2015 ranged from -0.8% to +7.3% with more than a third lower than the average six month UK LIBOR returns during the same period.

Figure Two: Spread of investment returns in 2015

(Source: PRA returns through S&P Global Market Intelligence)

Willis Towers Watson suggests that key drivers of return that are worth considering include: whether asset allocations are dynamic; hedging and other derivatives; characteristics of the bond portfolio; and use of alternative assets.

Related stories:

Willis Towers Watson’s profits fall by 37%

Willis Tower Watson poaches leader from Prudential