Producers advising chronically-ill people can’t rely on protections in the Affordable Care Act to ensure their clients will have the level of coverage they need.

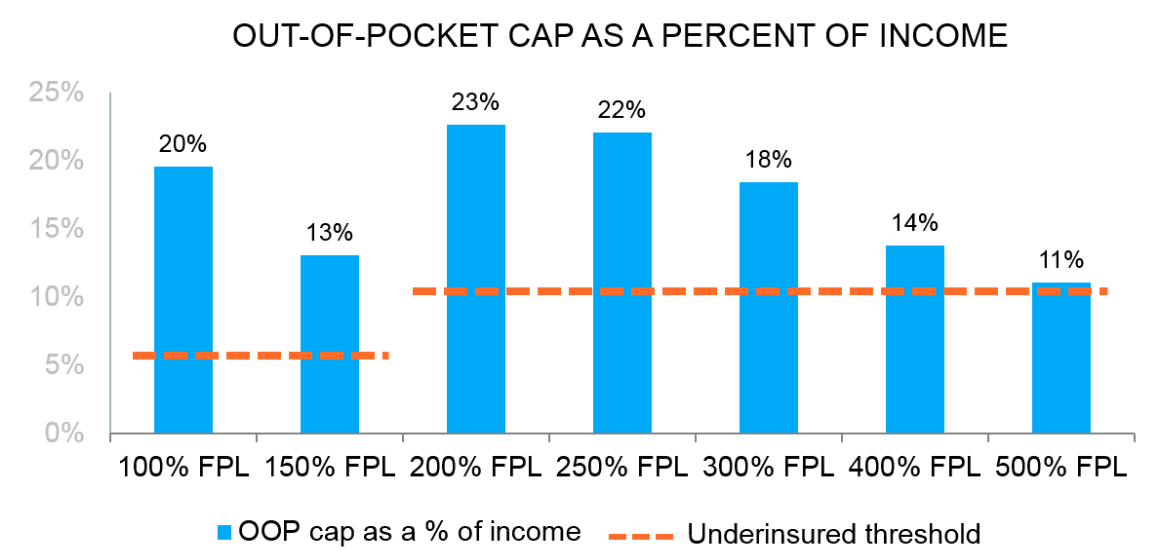

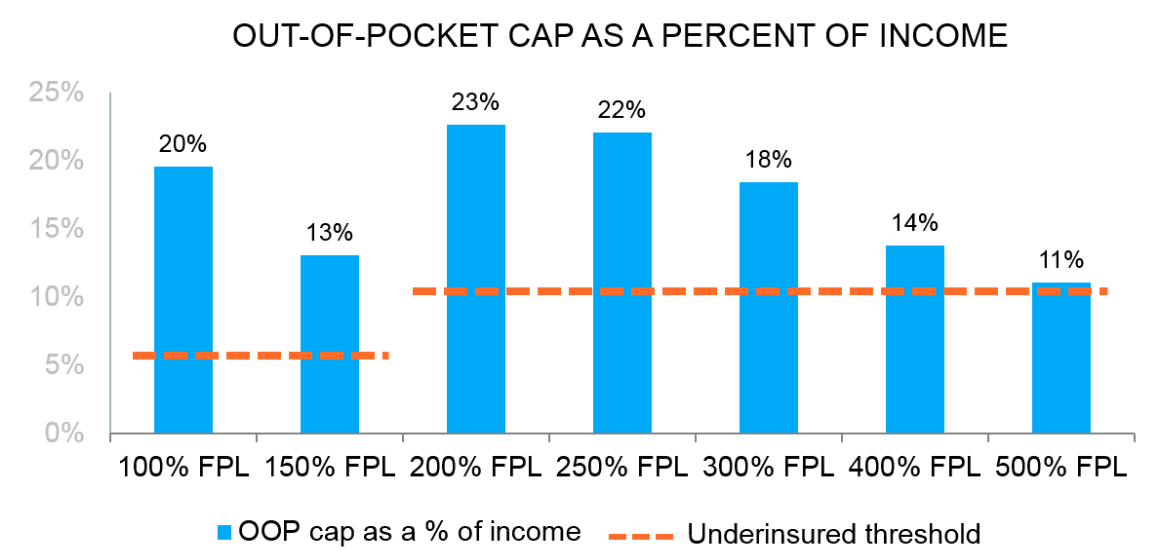

Despite administration promises that the health law’s coverage requirements and spending limits would be more than sufficient for Americans, a recent analysis from Avalere Health found that many suffering from chronic conditions will still spend more than 10% of their income on medical care—even if they qualify for subsidies.

Under the new law, out-of-pocket expenses for healthcare (not including premiums) cannot exceed $6,350 for individuals and $12,700 for families that buy a plan on the individual and small group markets. The Avalere analysis found many chronically-ill people will likely reach that maximum out-of-pocket every year, however, and consequently end up paying more than a tenth of their income to health services.

This is especially true for people who enroll in bronze and silver plans, Avalere found. That’s why Matt Schwartz, president of Schwartz Insurance Group in Kentucky, is being careful to recommend only gold and platinum plans to his clients with chronic complaints.

“The chronically ill people I’ve worked with have chosen the best: the gold or the platinum plans. I certainly wouldn’t recommend a bronze plan to them, or even a silver,” Schwartz said. “Yes, they have the same maximum out-of-pocket, but they typically don’t have

robust doctor visits or prescription coverage, and they need those.”

Wichita Falls, Texas-based producer conceded that for some of his sicker clients, no plan is ideal. However, the top-tier plans help limit out-of-pocket expenses throughout the year.

“I have a client who has cancer, who lost her COBRA coverage Dec. 31 and needed a new plan,” Fristoe said. “With subsidies, fortunately she was able to get her

a better plan and limit her out-of-pocket expense. She’s going to need to pay out-of-pocket cost regardless, but it’s how fast you get to that out-of-pocket max that matters.”

Schwartz believes producers have an important role in guiding consumers away from lower-level plans that will leave them underinsured, as explained in the Avalere report. Without guidance from an educated and experience producer, Schwartz said those with chronic conditions may make the wrong choices.

“I’m going to conjecture from my 20 years of working with the public on this, that if [consumers] have signed up by themselves or with a navigator, they’re probably with a bronze plan because of the cost and they’re going to hit their maximum,” Schwartz said. “If they’ve been helped by a competent insurance agent or broker, they’re less likely to be on a bronze plan.”

Image Source: Avalere Health LLC