The conversations all started whirling:

“She’s going to wear our jewellery.”

“But what should we have her wear?”

The office was abuzz with chatter and speculation. After all, it was the Super Bowl – and this was Lady Gaga they were talking about.

“This could get interesting,” thought Laura Woop, director of risk management, payments and credit services at Tiffany & Co.

Interesting, but not out of the ordinary for the 26-year Tiffany veteran. “When we all first start at Tiffany, we’re all awed by these very expensive and flashy objects,” she says. “As you work there for a longer period of time, the shininess doesn’t wear off but you get used to the fact that you’re dealing with a lot of value.”

Tiffany’s inventory rarely stays in one place for too long, introducing a whole range of unique exposures. “As a brand, our inventory as a retailer isn’t just sitting in our stores,” says Woop. “It goes on the road whether we are hosting very important client events and we’re offsite somewhere, or there are models wearing the jewellery, or we’re putting items on celebrities at award shows.”

“Some of the unique photoshoots that we do that involve some of our million-dollar pieces moving to conduct a photoshoot on the Brooklyn Bridge, for example. Immediately, from the PR side, you see the opportunity in that, but on the RM side you think, ‘Oh gosh, this piece is going over the bridge into the Hudson River.’”

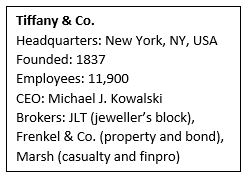

Unique risks require unique policies. Tiffany purchases a jeweler’s block policy out of Lloyd’s of London from JLT. “It’s a manuscript policy that’s been developed over time,” says Woop. “It’s got different sub-limit sections that apply very specifically to the types of things that Tiffany does. We’re not buying an off-the-shelf policy, and we’re not insuring inventory as part of our property policy as some people may do; It’s definitely a very unique approach.”

The strong relationships that Woop and her four-person risk management team have with their insurers and brokers goes a long way in shaping their risk strategy. “I think because of some of the crazy things that we do sometimes, if we didn’t have a longstanding and trusting relationship with our insurers, they might raise their eyebrows and say, ‘What you do you mean you’re taking US$50m worth of inventory to XYZ?’” she says. “When we go to them with a request or even just inform them of something we’re doing even if it doesn’t require their approval, it goes a long way in building trust so that when we do have some of these larger events that we’re planning, they have more comfort in knowing that we’re taking the important steps to protect the industry.”

In two and a half decades, Woop has seen Tiffany’s risk culture transform dramatically. “When I first started doing this, we were a much more conservative, very reserved company in our risk management approach,” she says. “Some of the things that we’re doing today we would never have done when I first started in risk management.”

Woop is determined to continue looking at the upside of risk, meaning that when Lady Gaga wants to wear Tiffany jewellery at her Super Bowl performance – arguably the biggest performance event of the year – her team embraces the challenge.

“We actually tied it to the launch of our hardware line, which was introduced right at the same time with her in the ad, so she ended up wearing that product, which is mainly a silver and gold line,” says Woop. “There were no stones involved so the values were kept very low and it turned out less crazy than it quite possibly could have gotten.”

Touchdown for Tiffany.

Related stories:

These risks are bananas: Dole CRO tackles shipwrecks, listeria

Life before LEGO: From army officer to CRO

.jpg)