A report on cargo theft indicates significant new risk trends for the transport industry. The report, compiled by transport and logistics insurer TT Club and supply-chain intelligence provider BSI, examined risks both regionally and globally.

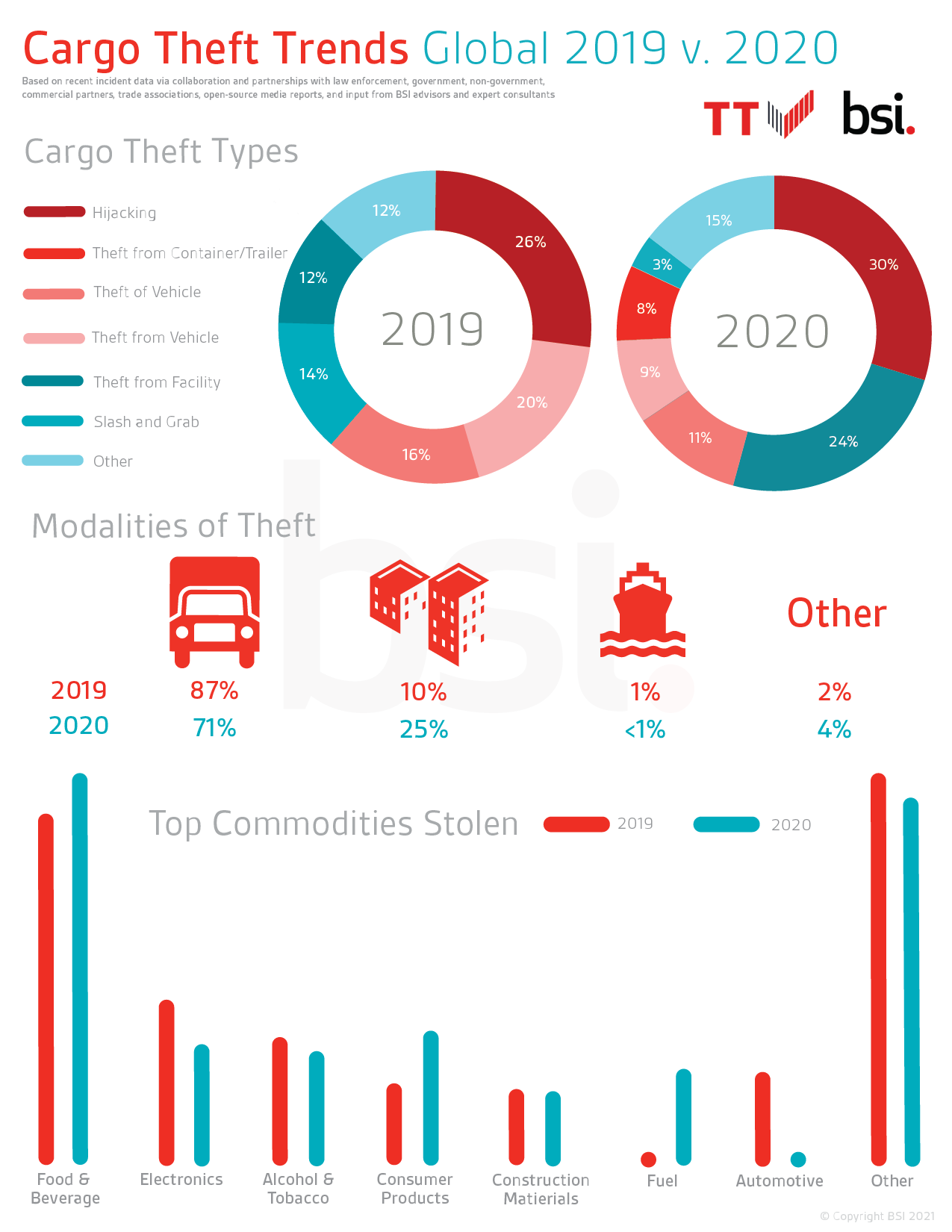

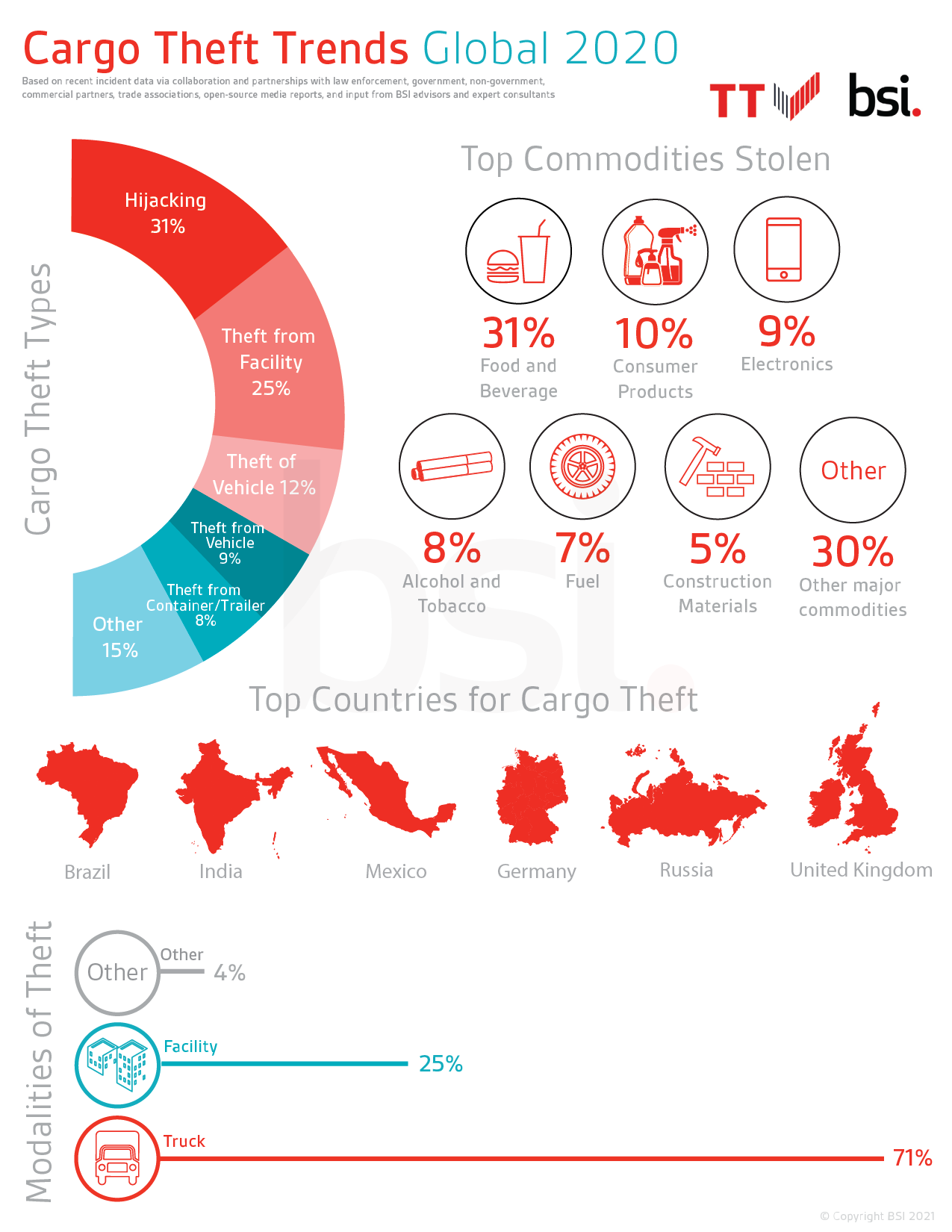

The most significant trend spotlighted by the report was the relative shift in the location of thefts. Although theft of cargo in transit remained the most common issue, its share decreased from 87% in 2019 to 71% in 2020.

Theft from warehouses and other storage facilities, meanwhile, increased to 25% of total thefts. The extent of the rise was variable from region to region; however, the trend reflected the disruption to supply chains prompted by radical changes to consumer buying patterns due to the COVID-19 pandemic.

“The effects throughout 2020 of the COVID crisis threatened supply chain security, continuity and resilience,” said Mike Yarwood, managing director of loss prevention for TT Club. “Not only did newly created high-value commodities such as PPE become targets for theft, but bottlenecks in the logistics infrastructure at ports and warehouses increased potential risks. Temporary overflow storage facilities added to the dangers in loosening the grip of existing security systems.”

TT Club also warned that while specific incidents have not yet occurred, challenges will arise in protecting COVID-19 vaccines from theft unless distribution plans are perfectly executed.

In Europe, inventories came under particular threat due to the stockpiling of goods, with 48% of thefts reported in 2020 coming from warehouses and production facilities. That’s a significant spike from 2019, when only 18% of reported thefts occurred at those locations. However, the share of thefts reported at rest areas and parking sites was down significantly – from 54% in 2019 to 19% in 2020.

In Asia, the countries with the highest theft risk were India, Indonesia, China, and Bangladesh. The share of storage-based risk was about 50% in Asia as a whole, but in Southeast Asia the in-transit risk was indicative of the prevalence of bribery and corruption, with a high percentage of thefts being facilitated by employees or customs and other officials.

In North America, theft came almost exclusively through in-transit hijackings or pilfering directly from parked vehicles. The risk of social unrest, particularly in Mexico, also impacted the risk of cargo loss in 2020, TT Club said. There was significant disruption to the Mexican rail freight industry last year, with protestors setting up blockades on train tracks. That disruption led to estimated losses of nearly US$4.4 billion.

In South America, Brazil was a 2020 hotspot for cargo theft. A key driver of high theft rates there was the presence of drug-smuggling gangs that stole to fund their trafficking efforts. As in North America, the dominant risks were from in-transit hijacking and theft from or of vehicles. These types of theft accounted for 78% of total reported losses. However, the rate of cargo theft did drop for the first time in several years thanks to efforts by police and industry to combat theft.

The infographics below give an overview of TT Club’s global findings: