Legal & General, the £10 billion revenue British insurer and asset management giant, has put on hold its ambitions to acquire a China business license and in the process will be significantly reducing its onshore workforce. The change comes as part of a sweep by new broom chief executive Antonio Simoes, who last week also started moves to sell Cala Group, one of the UK’s biggest house builders.

Initially, the company aimed to apply for a Qualified Domestic Limited Partner (QDLP) license, enabling it to offer offshore products to Chinese investors. However, this strategy has now been shelved, and as a consequence, the company reduced its local team from approximately 10 members to just two last month.

The decision aligns Legal & General with other global financial entities that are scaling back their operations in China due to the volatile market conditions and economic uncertainties.

Despite retracting its application for the business license and reducing its local team, Legal & General remains optimistic about China's long-term market potential for asset management. The firm expressed its intention to continue engaging with existing Chinese clients interested in international markets, positioning the move as a strategic pivot rather than a complete withdrawal from the Chinese market.

Previously, Legal & General had been vocal about its interest in expanding into China, highlighting the country's compelling demographics and the opportunities it presents for growth, particularly in the fund management sector.

"We've got to grow really quickly from here and we're not short of opportunities. We are looking at our options right now … but the demographics (in China) are compelling," ex-CEO Nigel Wilson told The Telegraph in August 2021. He left the company in 2023 after over a decade there, and was replaced by Simoes, a banker with experience at HSBC and Santander.

This development is part of a broader trend where international financial firms are re-evaluating their presence and strategies in China amid shifting market dynamics and geopolitical tensions. For Legal & General, this recalibration involves maintaining a focused, albeit smaller, operational footprint in China, emphasizing its existing business of managing offshore assets for Chinese institutional investors.

The PRC government is, however, attempting to woo foreigners even as its local insurance sector is facing a grim landscape. President Xi Jinping, who is also general secretary of the CPC Central Committee, said earlier this year that by boosting opening-up (to foreign financial institutions), China will work to enhance the efficiency and capability of financial resource allocation, improve global competitiveness and rule-making influence, and maintain a steady and prudent rhythm and intensity.

There are currently 67 foreign-invested insurance institutions and 70 representative offices, with assets totaling 2.4 trillion yuan (US$360 billion) in China at the moment.

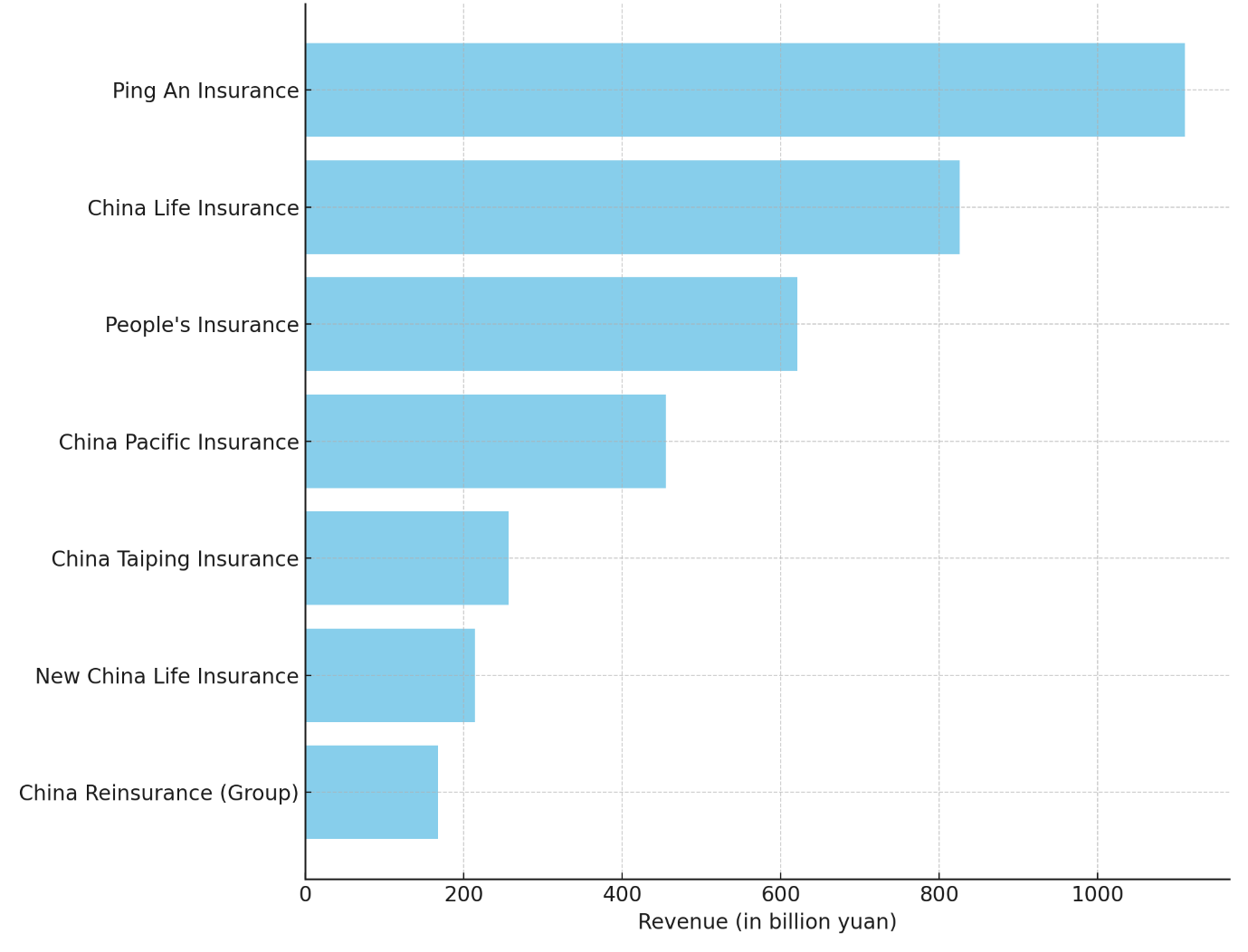

Ping An Insurance 1,110.57

China Life Insurance 826.06

People's Insurance 620.86

China Pacific Insurance 455.37

China Taiping Insurance 256.28

New China Life Insurance 214.32

China Reinsurance (Group) 167.94