Singapore local telco Singtel has announced an insurance plan for mobile users in the event of downsizing or accidental death, created in collaboration with Etiqa Insurance Singapore.

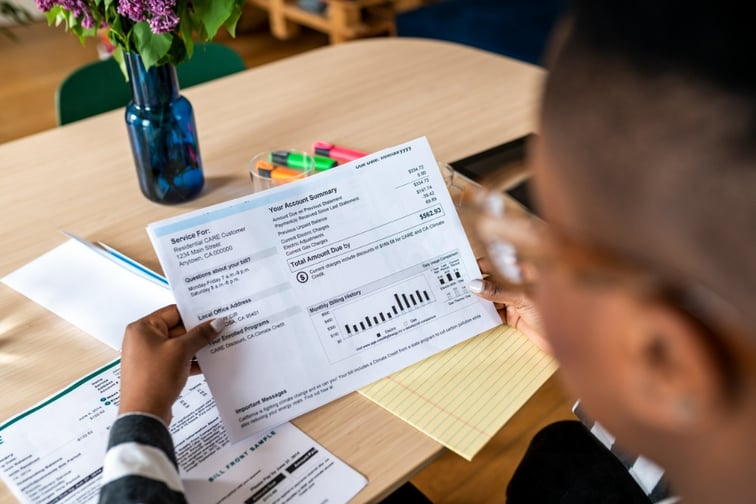

The insurance plan, called Singtel Bill Protect, offers coverage for up to one year for users’ bills that will help protect them from the effects of the current economic situation. In the event of a downsizing, those eligible for the plan can get their telco bills for mobile and broadband plans waived for up to six months, for a maximum of $600.

According to a report from The Straits Times, Singtel’s announcement comes at the heels of rising downsizing rates in Singapore. Numbers of downsized are expected to rise to about 4,000 in 2023’s first quarter, up from 2,990 in the final quarter of last year.

The plan, which also covers accidental death, provides coverage for beneficiaries of a policyholder, including a lump sum payout 12 times the amount of the last Singtel bill before death, up to a maximum of $1,200. Those eligible include the telco’s postpaid mobile subscribers who are Singaporeans or permanent residents aged 17 to 65. Singtel has more than 2 million postpaid mobile subscribers.

Singtel Consumer Singapore CEO Anna Yip said that the new policy is aimed at providing some ease for their subscribers in the current economic environment.

“We aim to help ease the strain of life’s uncertainties by ensuring that our customers impacted by adverse conditions like retrenchments can stay connected without worrying about their bills,” Yip said.

Elsewhere in the insurance company, Etiqa Insurance Singapore has announced that it will continue to sponsor the National Association of Travel Agents Singapore (NATAS) Fair this year, with the firm acting as the event’s official travel insurance partner.

What are your thoughts on this story? Please feel free to share your comments below.