Best Insurance Companies to Work for in

Australia and New Zealand |

Top Insurance Employers 2023

Jump to winners | Jump to methodology

People power

IB’s Top Insurance Employers of 2023 are some of the best insurance companies to work for in Australia and New Zealand because of their commitment to creating an environment for their people to thrive and perform.

However, what’s a top employer? Industry expert Andrew McKechnie, head of workplace solutions for New Zealand at Mercer, explains that top employers:

-

present a relatable organisation that feels right

-

offer a partnership of trust and transparency, one that fosters feelings of collaboration

-

provide remuneration, benefits and employee value propositions that are competitive in a tight labour marketplace

Fellow industry expert Meghan Donnithorne, director of tech and transformation and government division at Robert Walters, NSW, says top employers typically:

-

maintain high employee satisfaction with a good culture and an engaged staff

-

offer strong compensation both in salary and employee benefits

-

deliver a flexible working environment

-

provide opportunities for training and career progression

-

maintain a diverse and inclusive environment

Top Insurance Employer puts people first

NZbrokers CEO Jo Mason reveals the strategy she adopted to successfully tackle difficulties around employee compensation.

“By being as flexible as possible with our team, respecting their private lives and the stresses and demands of these, and being kind when required have helped,” she says. “Being a small business with less than 20 employees, it can be difficult to organise compensation packages that aren’t cost prohibitive. We work hard to focus on both monetary and non-monetary compensation, recognising and rewarding as appropriate.”

NZbrokers differentiates itself by:

-

embracing flexible and mixed location working with a strong focus on culture and staff wellbeing

-

maintaining an open, inclusive office with regular staff surveys on work environment trends

-

making work rewarding by empowering brokers to deliver the best customer service

Highlighting how NZbrokers’ initiatives have been successful, the firm was ranked:

-

4.72/5 vs. benchmark at the 80th percentile of 4.27 on a yearly staff engagement survey in 2021

-

4.83/5 in 2022 on the same survey

-

9.5/10 on its ambassadorship score

On the survey, employees noted the following about NZbrokers:

-

“Diversity, inclusion and teamwork”

-

“Puts members first and plans for the future”

-

“Supporting our charity partners at a time of high need”

-

“Good positive team spirit”

Jo MasonNZbrokers

NZbrokers underlines its superiority as an employer by being committed to continually improving the employee experience.

“We need to constantly reassess our offerings to our employees and view them as our biggest asset that needs to be supported. The wellbeing of employees is increasingly under scrutiny, and staff are considering work-life balance to be at the forefront of their priorities,” says Mason.

“Monetary compensation is no longer the primary consideration, and I believe this will only continue. Our people need more,” she says. “They should feel valued as individuals, and we have a belief that employees must feel that they can bring their whole selves to work. Valuing employees as people and respecting all our diverse points of view goes a long way to making all staff feel that they belong.

“He Tangata, He Tangata, He Tangata! [Māori translation: It is the people. It is the people. It is the people!]”

Top Insurance Employer makes work enjoyable

Wayne Tower, CEO of IQumulate Premium Funding, faces his own set of challenges and compensation isn’t one of them.

“We have, for a long time, had a well-understood and transparent remuneration and incentive scheme,” he says. “We have received immense support from shareholders and the board to continue to refine how we reward our people, and we are very comfortable with the structure we have in place today.”

IQumulate Premium Funding differentiates itself by:

-

offering tools and opportunities for learning and development and providing management support that puts the individual in the driver’s seat

-

providing a hybrid work environment with great offices where people can come together and connect

-

having fun: encouraging teams to get together, celebrate success and collaborate

IQumulate Premium Funding has been recognised as a Kincentric Best Employer in 2023, with a score of 78.

As part of IB’s research survey, IQumulate Premium Funding employees noted the following:

-

“Inclusiveness and good work-life balance”

-

“Strategy and investing in technology”

-

“Recognising staff, community and integrating fun into the workday”

- “You can literally call the CEO and have a chat”

“Going forward, there will no doubt be an impact on the employment market as a result of the interest rate movements, but we operate in a remarkably resilient industry, so I don’t see a huge change for us in the near term, hence our focus on creating a great work environment to ensure we retain and attract great people,” says Tower.

Top Insurance Employer pays fair wages and offers the chance to grow

The general manager at Frank Risk Management, Emma Haugh, took action to help her employees deal with the current economic turmoil. She increased salaries to account for inflation and augmented work-life balance with the provision of five weeks of yearly leave as standard.

Haugh also notes that technology is playing a greater role in the insurance space, and as a result, candidates who possess tech skills and niche expertise will be in demand.

“It’s vital to create a culture and space where your people enjoy coming to work, where they feel appreciated, have ample opportunities for personal growth and development and receive fair compensation,” she says.

Frank Risk Management further differentiates itself by:

-

prioritising development and knowledge enhancement opportunities to give employees the authority to do what they do best

-

fostering a culture of collaboration where everyone is encouraged to state their opinions

-

maintaining a positive work environment, including physical fitness options, where people enjoy going to work

Employees noted the following as part of IB’s research:

-

“Supporting their staff and providing a great environment and a supportive team culture”

-

“Always looking for workflow efficiencies and current systems to benefit our roles”

-

“Managing staff mental and physical health”

-

“Creating a great culture within the staff and creating a great learning environment for newbies”

Wayne TowerIQumulate Premium Funding

Future insurance sector trends

Industry expert Donnithorne feels that the following will be key future employment considerations:

-

adjusting yearly salary increases to account for the rising cost of living

-

checking salaries against the market and the current skill levels of employees

-

capitalising on immigration to gain international talent to address special skill set needs

And fellow industry insider McKechnie predicts insurance companies will also face challenges such as:

-

sustaining growth through talent attraction and retention

-

adopting strong and strategic workforce plans

-

ensuring workforces and organisations are closely aligned with internal and external requirements

Emma Haugh Frank Risk Management

Best Insurance Companies to Work for in

Australia and New Zealand |

Top Insurance Employers 2023

1,000 or more employees

- Vero

500–999 employees

- AIA New Zealand

- Crawford & Company Australia

100–499 employees

- DUAL Australia

- Fidelity Life

- Honan Insurance Group

- Open

- Sedgwick New Zealand

- Southern Cross Travel Insurance

99 or fewer employees

- Aurora Financial Group

- Berkley Insurance Australia

- Bridges Insurance Services

- Community Broker Network

- Delta Insurance New Zealand

- DUAL New Zealand

- Dunk Insurance

- Elliott Insurance Brokers

- Fast Cover Travel Insurance

- Frank Risk Management

- FTA Insurance

- Holman Webb Lawyers

- Initio Insurance

- Innovation Group Australia

- InsuredHQ

- Interlink Insurance Brokers

- Shielded Insurance Brokers

- Simplex Insurance Solutions

- Solution Underwriting Agency

- Woodina Underwriting Agency

- Wotton + Kearney

- Zurich Australia Insurance t/a Zurich New Zealand

Insights

-

Andrew McKechnie

Andrew McKechnie

Head of Workforce Solutions,

New Zealand

Mercer -

Meghan Donnithorne

Meghan Donnithorne

Director – Tech and Transformation and Government Division

Robert Walters NSW

SUBMIT YOURS

Methodology

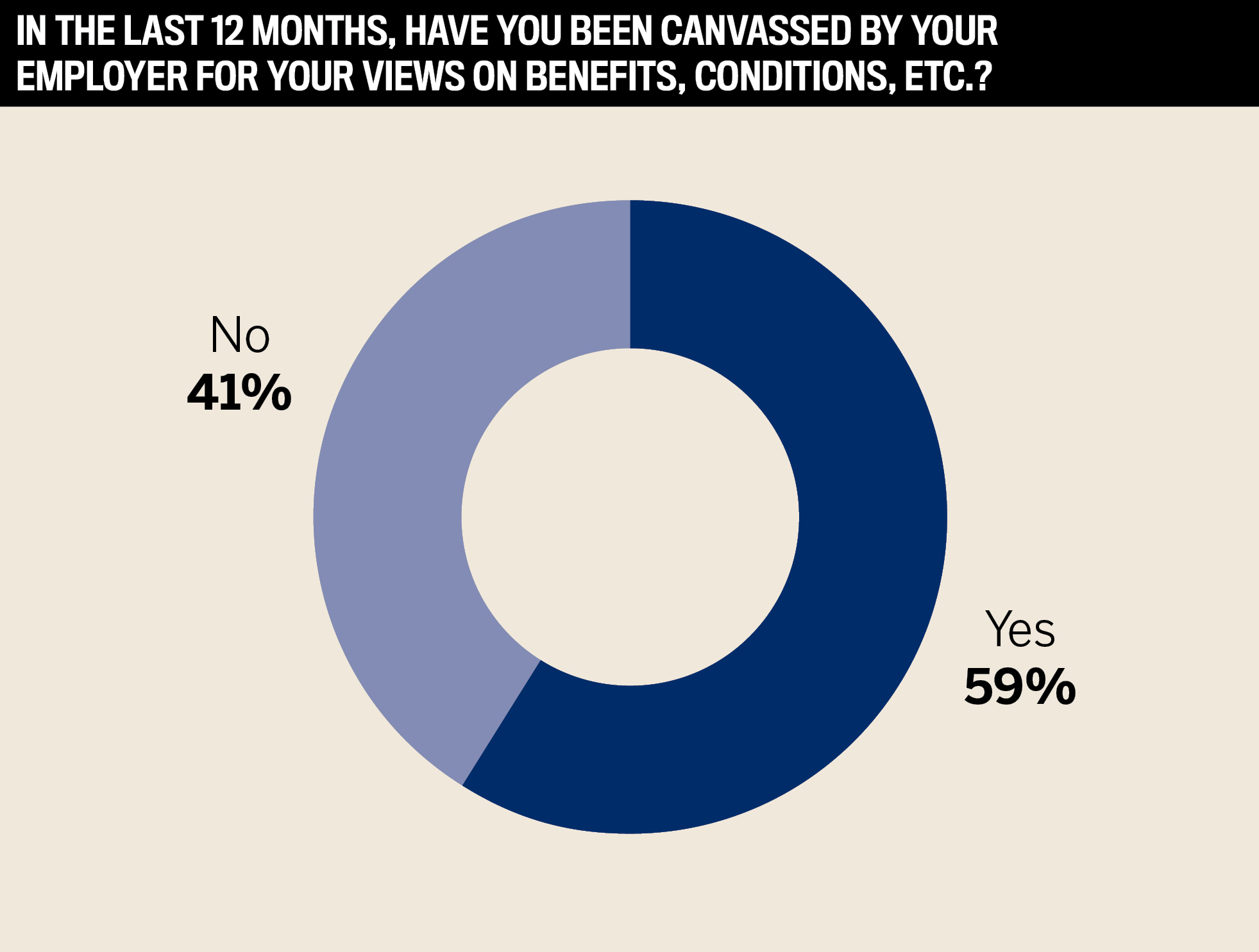

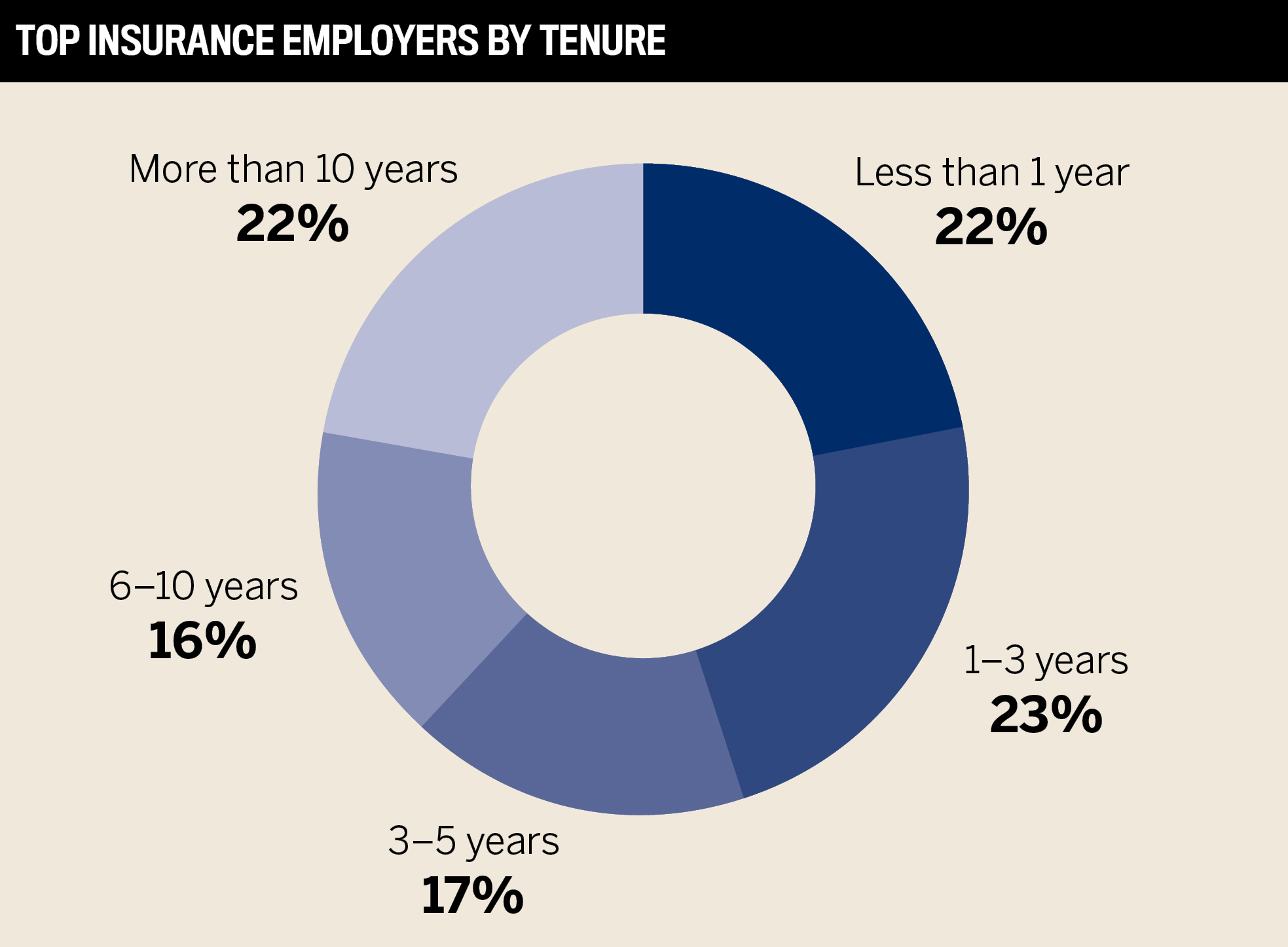

To find and recognise the best employers in the industry, Insurance Business invited organisations across Australia and New Zealand to participate by filling out an employer form outlining their various offerings and practices. Next, employees from nominated companies were asked to complete an anonymous form evaluating their workplace on a scale from 1 (poor) to 5 (excellent) on various metrics, including benefits, compensation, culture, employee development and commitment to diversity and inclusion.

To be considered for the final list, each organisation had to reach a minimum number of employee responses based on overall size. Organisations that achieved an 80% or greater average satisfaction rating from employees were named Top Insurance Employers for 2023.

Keep up with the latest news and events

Join our mailing list, it’s free!