Complexity and hassle is holding trade credit insurance sales back for brokers, but

Kirk Cheesman says clients could be the ones losing out

How often does a business ask itself, “What would happen to my company if our largest client failed to pay us?”

The awareness of trade credit insurance in the business community is still scarily low. We attend far too many creditors’ meetings at which managing directors and CFOs of businesses owed money are shocked to hear they could have insured against the risk of non-payment by their clients.

Trade credit insurance has always been viewed as a complicated and high-maintenance product for brokers to service. It is why only a handful of specialist trade credit insurance brokers exist.

In Australia, there are four mainstream trade credit insurers, including

QBE Trade Credit,

Atradius, Euler Hermes and Coface. However, there is further capacity and cover being driven out of Singapore and European markets, and further players are arriving in the political risk and surety markets in Australia.

The

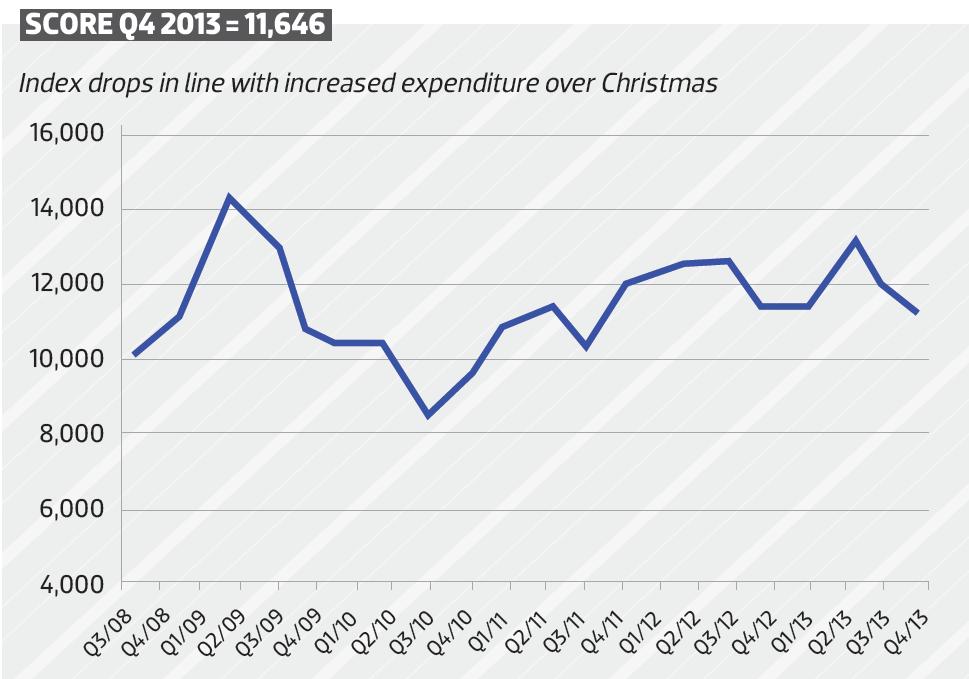

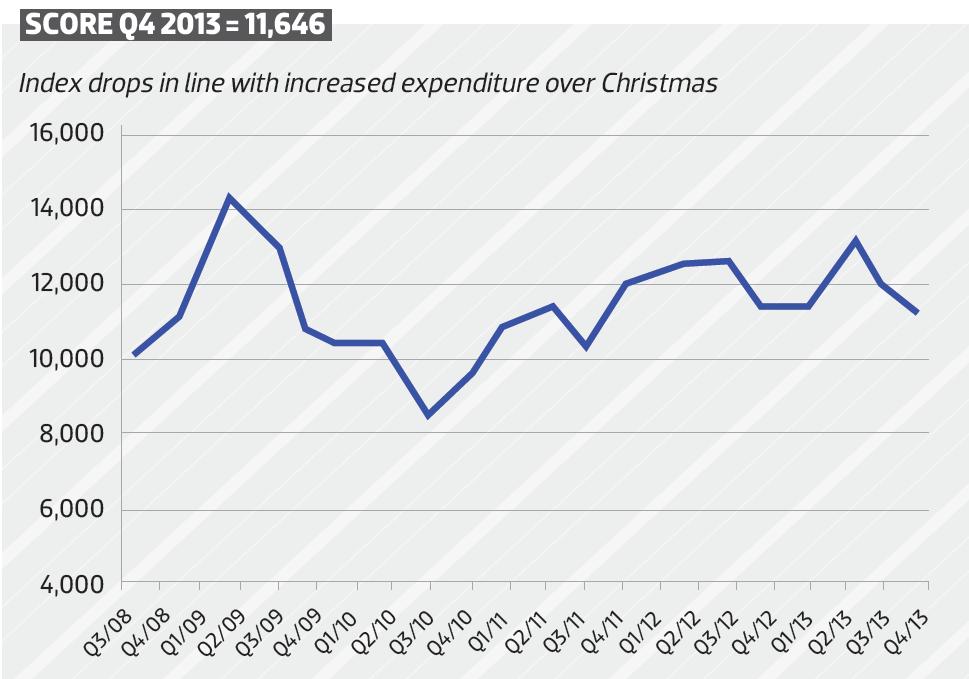

NCI Trade Credit Risk Index identifies trade credit risk by analysing credit cover, adverse activity such as credit insurance claims, collection activity and overdue reporting to provide a ‘risk score’ on a quarterly basis. The chart below shows this trend and acknowledges that while we are not currently in the ‘red zone’, we are not far away from it.

2013 Index. Click for larger image

2013 Index. Click for larger image

Recent large insolvencies such as Forge Group and Steve Nolan Constructions have been sizeable events in trade credit insurance. Insolvency levels are on the rise, and traditionally a higher number of insolvencies are incurred during March to June.

Overseas, trade credit insurance continues to be a stable product with a higher level of awareness and traction rate among businesses, especially in Europe. In 2013, Asia was the fastest-growing region for the growth of trade credit insurance.

While there are only a limited number of trade credit insurers in Australia, they are all currently eager to grow this product line. Pricing has softened since the GFC and buyer coverage has pushed through acceptance rates, which are equal to or higher than prior to the GFC.

There is a misconception that trade credit insurance is an expensive insurance product; however, when broken down, a premium rate of 0.15% to 0.35% of credit sales (average rates based on level of risk transfer) is a small amount to ensure that, in the event of default, approximately 90% of what is owed is returned to the insured.

What should brokers be doing to make businesses more aware that trade credit insurance is a viable solution to minimise credit risk? They should have their clients ask themselves five simple questions:

- What would the impact on our business be if our largest client could not pay?

- When was the last time we reviewed the creditworthiness of our top 20 risks?

- How do we assess the creditworthiness of a new or potential client?

- How do we monitor the credit risk factors of our existing debtors?

- What do we do when an account becomes overdue?

Typically, any business that has credit sales greater than $1m per annum can find a trade credit insurance solution.

So asking some simple questions could avoid significant bad debt pain in the future.

This is an excerpt from the June 2014 issue of Insurance Business. Download the issue to read more.

Complexity and hassle is holding trade credit insurance sales back for brokers, but Kirk Cheesman says clients could be the ones losing out

Complexity and hassle is holding trade credit insurance sales back for brokers, but Kirk Cheesman says clients could be the ones losing out