Property insurance has always been a staple business line for brokers.

Insurance Business went on a mission to get inside the heads of the nation’s leading property insurance pundits, to find out what’s in store for products, premiums, competition and customers in 2014

Depending on what part of the market you play in – and where you are based – property insurances may have been a tough game, or an easy one, over the last few years.

And as highlighted by our Brokers on Insurers Survey for 2014, brokers are either full of praise – or highly critical – of the insurers who are delivering products to their customers.

So what are the insurers actually thinking?

Insurance Business asked leaders in the field for their take on four key areas shaping the SME property insurance market – product, price, competition, and the customer.

PRODUCT

Andrew Norris, QBE: As property insurance is such a mature product, any changes this year would most likely be cosmetic. The current focus on price, and improving the accuracy with which we can evaluate risk, means product development has taken somewhat of a backseat. There is the possibility “bare bones” covers may start to emerge, for larger and catastrophe loss exposures. As property cover for small to medium enterprises has mushroomed over the past decade, pricing has also seen some necessary increases. So we think more bare bones-type policies, reducing cover to only include the key fundamentals, will potentially start to be introduced to minimise these growing costs and help support affordability.

Michael Badger, ACE Group: The market provides broad coverage on property programs and there is pressure from brokers to expand limits further in response to market competition. It is clear that brokers and clients have high expectations in relation to obtaining tailored coverage for their property portfolios, and this is an area ACE takes pride in delivering on.

Neil Dempsey, Assetinsure: We have not seen any significant changes in product or coverage. In some cases requests are being made to implement higher sub-limits. Most online platforms have pre-agreed wordings and standardised endorsements to include the most common covers. Typical of a soft market you may see more machinery breakdown covers being included under the ISR.

Jarrod Wilson, CGU: Over the last five years, SME policies have been expanded considerably to include coverage that is similar to ISR product offering. Technology innovation has provided greater flexibility on policy systems and has enabled us to tailor policy coverage to meet the changing needs of both customers and partners.

PRICE

Jarrod Wilson: With more sophisticated pricing models, we are able to better understand and rate individual risk and to establish pricing based on that risk. If the risk profile improves, this will be reflected in our pricing. Reinsurance rates are holding up in both our SME and medium-commercial business. Our focus remains on improving our service and strengthening our offering.

Neil Dempsey: We feel that the SME market is competitive but that pricing is generally more stable than commercial and corporate business. We have experienced requests for significant rate reductions on commercial accounts and we will review them on a case-by-case basis. The problem with comparing rates from one year to the next is that it does not always reflect the true level of deterioration if deductibles come down and sub limits go up. We will see continuing downward pressure on rates due to growth expectations and surplus capacity.

Scott Condren: The SME market is very competitive at the moment, with a growing number of insurers increasing their appetite in this market. Larger corporate customers with a strong culture of risk management are able to achieve premium savings in the current climate. If they can demonstrate how they are mitigating against risk, they can make a real difference to their premium costs and invest the savings back into their business.

Andrew Norris: Overall we’re expecting the market to stay highly competitive while catastrophe loss experience remains benign, although there are a number of other factors also playing a role in fostering competition. The number of new players entering, and seeking entry into the market, is one which has been having an impact for the last few years. The current change our industry is going through, in terms of mergers, acquisitions and restructuring operations, is also likely to be a key driver, as underwriters and brokers look to position themselves to best take advantage of any potential gains that may come from organisations going through these exercises.

COMPETITION

Michael Badger: Competition is strong amongst property insurers and driven by abundant available capital. Some of this capital is being provided by non-traditional insurance capacity seeking better returns than otherwise available in a low interest environment. Insurance buyers will continue to benefit from competition whilst insurers remain profitable. In 2014, as with every year, underwriting discipline will underpin the ACE approach.

Neil Dempsey: There is a surplus of capacity in the Australian market and this will drive a more competitive environment for as long as companies want generic growth. That outcome will not be achieved over the coming year as it will be hard to grow if rate reductions continue to be supported at the pace we have seen over the last 24 months. Other factors driving competition are reduced costs of reinsurance over the last 12 months and a relatively benign loss environment.

Andrew Norris: Competition is high and we think it will continue to be high in those segments where each insurer is gaining a positive return. At the other end of the scale, as price is such a focus at the moment, we expect that in those segments where insurers are finding the return to be less than optimal, the pricing competitiveness will be much lower, reflecting insurers’ risk appetite in these areas.

Scott Condren: The property insurance market is currently very competitive for both SME and corporate customers. There is a good supply of capacity available at the moment and many reinsurers are looking to provide additional capacity as the year progresses.

Jarrod Wilson: More broadly, the SME market is a growth market and competition remains high. Modernising our core technology has enabled us to remain aligned with emerging customer expectations and stay well ahead of our competitors. Barriers to entry are largely around scale. It’s difficult for a new market entrant to develop the scale quickly in both SME and mid-commercial. Whilst we keep abreast of our competitors, we are not driven by what they do.

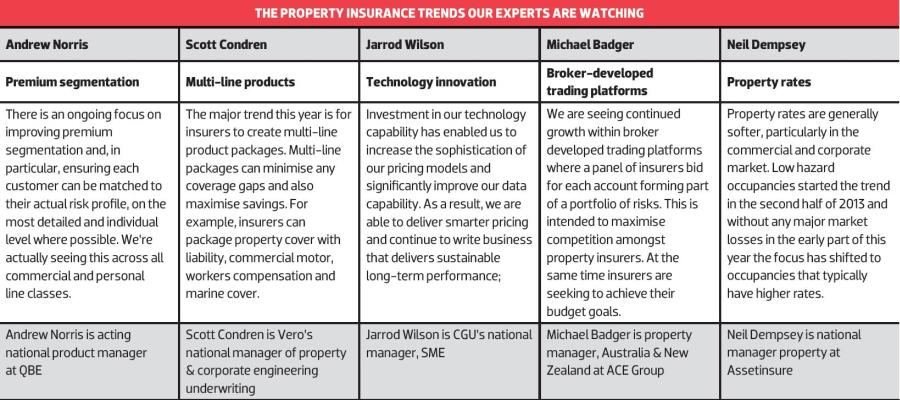

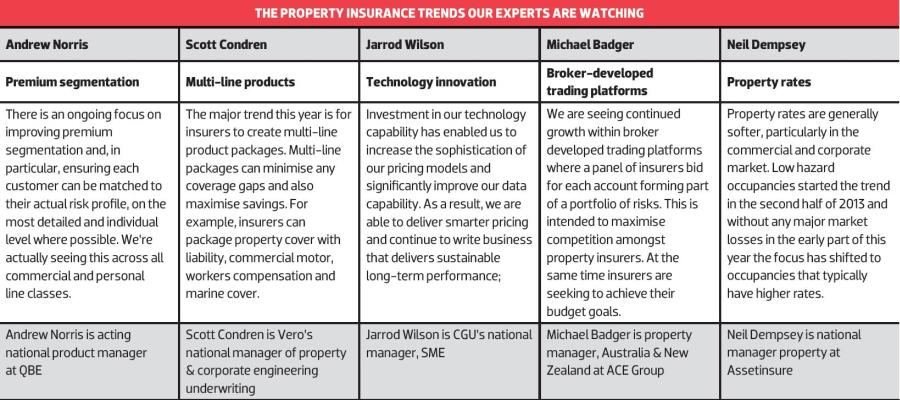

Insurnace Trends our Experts are Watching (Click for larger image)

CUSTOMERS

Scott Condren:

Insurnace Trends our Experts are Watching (Click for larger image)

CUSTOMERS

Scott Condren: Many SME owners don’t understand the value of using a broker and have been looking elsewhere for their insurance needs. However, the advice and expertise that brokers provide can prove invaluable to these customers, so more needs to be done to promote the benefits of using an insurance broker.

Vero is committed to highlighting the many benefits of using brokers. Fortunately there are plenty of good stories to tell, because those customers who do use brokers have clearly shown that they understand the value. For example, the 2014

Vero SME Index showed that 92% of broker clients are satisfied with the service they receive.

Vero will continue to champion the cause of brokers and the importance of quality, expert advice.

Neil Dempsey: A number of business sectors are being affected by a downturn in the economy and it is understandable that the price of insurance protection is under scrutiny. Loss free accounts will more than likely secure better terms and conditions over the next 12 months. Coverage is unlikely to change a great deal with most property policies enjoying relatively broad cover and generous sub-limits.

Jarrod Wilson: We know our customers are relying more on digital platforms as a touch point for accessing information about our products and services. Digital is about ensuring we find ways to extend our capabilities to our partners and customers in a cost-effective and sustainable way.

Our insureds see their businesses as unique. They therefore expect that their insurance should be unique to them – so they are looking for policies which are aligned to their industry segment and are tailored to suit their individual circumstances.

Customers are also seeking to better understand insurance. For example, they want to understand how to set a sum insured correctly and to ensure they have covered their key assets appropriately and are making informed decisions about their policy coverage. Business interruption insurance is one area of insurance where we know customers are seeking more advice. We work closely with our brokers to help them educate customers on policy coverage so they can make better informed decisions when choosing a policy cover.

Matthew Badger: The continuing changing economic and business climate sponsors different needs and considerations by insurance buying clients. Product understanding, communication and responsiveness are key determinants in selecting insurance programs and products. Organisations have a wide range of risk measurement and treatment platforms with insurance forming part of risk management strategies. At ACE, we never lose sight of the fact that we are helping businesses safeguard against their unique property risks so they can grow and prosper.

This is an excerpt from the June 2014 issue of Insurance Business. Download the issue to read more.