Paul Ayton, managing director of NAS/Westcourt’s combined authorised broker business, talks to Insurance Business about working to create the country’s best AR network

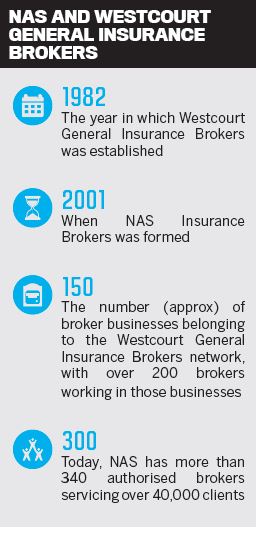

Since September 2016, Paul Ayton has led NAS/Westcourt’s combined authorised broker network, a network that came into existence when

IAG acquired Perth-headquartered Westcourt General Insurance Brokers last July. The process of integrating Westcourt with

IAG’s pre-existing authorised broker business, National Adviser Services (NAS), is ongoing. Combined, the network is today No.1 in the Australian authorised representative market.

In May, Ayton announced a new leadership structure for the network, which sees Jenette Baker as head of risk and compliance, Donna Tingley as financial operations manager and Greg Dowd serving as its chief financial officer. Additionally, as part of IAG’s endeavours to reduce the number of insurance licences in the group, the business is currently incorporating a substantial number of

CGU ARs into its fold.

Talking to Insurance Business, Ayton discusses some of the integration work undertaken to date.

“What we’ve really tried to achieve is to take the best of both organisations and make sure that we capture the value that was in both organisations,” he says. “We have tried to understand where that value lies, and we’ve also made sure that we articulate what our purpose is moving forward.”

That purpose, he says, is to support communities so that they can sustain, grow and thrive.

“While they’ve never articulated it that way, both NAS and Westcourt, in their own ways, were already aligned to that purpose and were doing things that supported what we’re going to be trying to achieve,” Ayton says.

“As a result of that, it’s not like we’ve had to make significant adjustments to the structure or the way we’re operating. It’s more tweaks and alignments to make sure that we’re getting the efficiencies that you can achieve by bringing two organisations together.”

So, will the combined network come together under one banner?

“We think there’d be benefits in having a combined brand as we bring not just NAS and Westcourt, but the CGU ARs together into one network,” Ayton says.

“But externally … we’re very happy for [our authorised brokers] to use whatever branding they’re using at the moment – which, in many cases, is their own brand. And if they do want to associate, we still own both Westcourt and NAS. But we will be introducing a new brand, but specifically for our people and the industry, not necessarily an external brand.”

Being the best

Looking down the track, he says the aim is to make the combined network the best, not the biggest.

“If we’re the best, we’ll continue to grow,” he says. “We want to build a really strong foundation [and] we want to focus on our purpose and continue to have everyone understand what that looks like.

“We don’t necessarily have a view on how big or not we may be in the future. We’re excited about the authorised broking space in itself – it is the fastest growing area of commercial insurance.”

Describing insurance as traditionally being “one of the least efficient commercial processes around”, Ayton says the network sees great opportunities to work with its strategic partners to continue to drive down the cost of obtaining insurance.

“We’re spending a lot of time sitting down and talking with our stakeholders to really identify where we can work together and be more collaborative and to find better outcomes in a whole range of areas, which should enhance the experience of a customer that’s working with one of our authorised brokers,” he says.

“We’ve been very fortunate that we get to start with a clean slate, bringing three different networks together to establish a business the way that we want to do it. We want a business and people that align to our purpose of helping communities to sustain, grow and thrive. We understand that that’s not going to be for everyone. But for those who get it, I think they’re going to be able to be part of a network that’s really customer-guided and purpose-led.”

Benefits and times ahead

Ayton talks about the benefits he perceives for the network’s authorised brokers.

“We want to make sure that we’ll have all the efficiencies and benefits you would expect from a network … and that’ll be things like supporting succession planning, providing learning and development opportunities, [and] making sure we negotiate great value propositions for our brokers’ clients through our underwriter relationships,” he says.

“What will make us different in the long run is that, as we always have, we’ll allow the brokers to control and own their own businesses, be able to leverage off the benefits that we’ll be able to deliver through our partnerships and scale, but really look to help their communities in different ways with that focus on our purpose of helping them to sustain, grow and thrive.

“We think that’s a different lens and a different way of looking at the market, and a different way I think to truly realise the value of the advice that they’re currently providing.” Discussing short-term priorities, Ayton says there’s significant time currently being spent on transitioning CGU ARs into the network.

“There are a number of opportunities we’re looking at in relation to our underwriting partnerships and we’re looking forward to coming together for the first time as one network at our national conference in August. We’ve got a number of initiatives that we want to release there,” he adds.

“I think we’ve got some really great opportunities to re-establish what an intermediated insurance network can look like and put us in quite a different space to where we’ve been.”