With a view to shaking up the world of financial services by facilitating customers’ experiences above and beyond those traditionally provided by incumbents, the fintech space is continuing its evolution both in Australia and across the globe. Many established financial institutions are partnering with fintech companies to take advantage of the innovations they can offer.

In

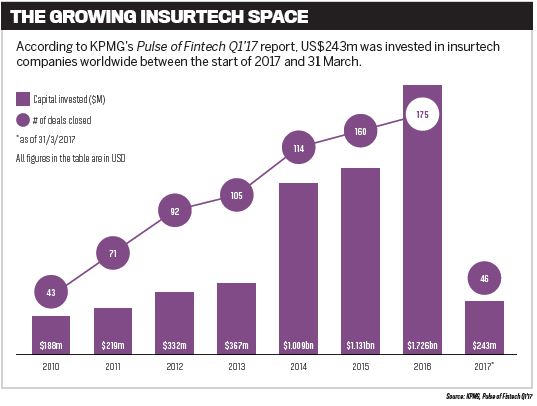

KPMG’s

Pulse of Fintech Q1’17 report, the professional services firm detailed that global investment in fintech companies totalled US$3.2bn (A$4.03bn) in the first three months of this year. It also reported the strong interest shown by global fintech players in Asia within the same timeframe, specifically citing American online finance company SoFI’s intention to leverage its most recent funding round to drive expansion into Australia and Asia. Meanwhile, online lender Prospa’s recent receipt of A$25m in funding was one of the largest ever venture capital investments in an Australian fintech organisation.

Additionally,

Deloitte’s

Connecting Global FinTech: Interim Hub Review 2017 reports that Sydney fintech hub Stone and Chalk, which opened its doors in 2015, has connected start-ups to A$100m in seed and angel investment, as well as 23 corporates, since its launch.

The global industry is burgeoning. According to global services provider Capgemini (in its

World Fintech Report 2017), 50.2% of consumers globally advised that they transact with at least one non-traditional firm. And in recent research from the World Economic Forum and Deloitte,

Beyond Fintech: A Pragmatic Assessment Of Disruptive Potential in Financial Services, it’s reported that fintechs have succeeded in reshaping customer expectations, setting higher bars for user experience by demonstrating that the experience bar set by large technology companies is achievable in financial services.

But as the fintech space continues its evolution, and the Australian industry works to catch up with the global hubs of London, New York and California, a number of challenges arise that the industry’s players must address. Among those is the ability of fintech companies to protect themselves against the cavalcade of risks that confront them.

The question therefore arises whether fintechs are properly aware of those risks, including their insurable exposures.

Knowing the risks

“Fintech start-up businesses can find themselves vulnerable to a number of exposures that might lead them into severe financial difficulty and irreversible reputational damage,” says Declan Rye, director of

London Australia Underwriting (LAUW). “As a start-up company, assuming your risk exposures are insignificant can be devastating for the business.”

He says that while those in the fintech space with a financial services background will appreciate the need for a start-up business to have professional indemnity coverage and directors’ and officers’ (D&O) liability insurance, those without that background may lack such appreciation unless certain cover is required to progress the process of regulatory authorisation.

“Many fintech start-ups actually have a limited understanding of the financial and regulatory compliance obligations including licensing and capital requirements,” Rye says.

“The purpose of the typical fintech business is to disrupt the traditional financial institutions and their often laborious platforms for financial transactions through the provision of automated digital and online services. The often high-volume nature of the transactions throws up the possibility of large aggregated losses from a single act, error or breach.”

And just how aware are brokers of the types of exposures that are common to fintechs?

“Brokers with a financial lines/tech background will have a decent level of understanding of the exposures that fintech companies could potentially face,” Rye says. “However, fintech has a broad scope and each company can be very different, therefore each will need to be considered carefully for their insurance needs.”

Rye continues: “Many fintech companies offer services to retail consumers, and so companies will need to ensure they are treating customers fairly, otherwise they could find themselves exposed to the FOS [Financial Ombudsman Service] or class actions which could prove to be extremely costly, especially for companies in their infancy.”

Rye highlights the fact of fintechs being particularly exposed to cybercrime and cyberattacks, given the nature of the services they offer.

“Companies need to ensure that they have adequate IT security and controls in place to avoid becoming the victim of a cyberattack,” he says.

Knowing how to respond

As part of the financial services sector, Rye says professional indemnity insurance is essential for fintechs – as well as being a compulsory regulatory requirement for many – and D&O liability insurance will be key to attracting top management.

“For fintech businesses, which will have a combination of technology, money and personal data at their core, protection against cyber risks and theft is also an essential part of comprehensive cover. Quality cyber and crime policies are key ingredients to the overall insurance portfolio,” Rye adds.

Rye emphasises that it’s vital for fintech companies to take steps to mitigate their exposures to risk, and having the correct fintech insurance policy is one component of that strategy.

“The financial and regulatory needs of a particular fintech business must be addressed,” he also says. “Licensing requirements often play a part and can delay the launch of a capital-starved start-up.”

Rye also stresses that all of these risks are not only start-up considerations.

“Ongoing capitalisation is required to fund risk-aversion strategies and evolution of the technology platforms,” he explains.

Ideally, Rye says, fintech start-ups should seek advice on all parts of their risk mitigation plan.

“For insurance, companies should be speaking to an experienced insurance broker to understand which is the right insurance policy and level of cover for their needs.”

Knowing the opportunities

Rye sees good opportunities in the fintech space for brokers to expand their own businesses.

“I strongly believe the fintech space is a potential goldmine for the broker who is prepared to go the extra mile to develop an understanding of the space itself and the specific exposures faced by the typical fintech business,” he says. “It is an area that requires specialist know-how.

“Sadly today, we see too many brokers taking the easy one-size-fits-all approach to placing risks in the market, leaving insureds either uninsured or underinsured. We are clearly still at the beginning of the fintech journey so the longevity is there for the broker who is prepared to immerse themselves in the space.”

“We see too many brokers taking the easy one-size-fits-all approach to placing risks in the market, leaving insureds either uninsured or underinsured” Declan Rye, London Australia Underwriting

Knowing where to begin

So, what do brokers need to know about their fintech clients, in order to be able to start sourcing appropriate risk transfer solutions for these start-ups? Rye says the best place to start is the business plan.

“This will give brokers a clear understanding of the idea of the business, the target customer, the financial projections, and the internal controls and procedures amongst other things,” he says.

“Alongside the business plan, brokers should request the client complete a proposal form tailored for fintech companies. From here, brokers will be able to assess the exposures and source adequate insurance cover for their client.”

Rye says the broker should have a full understanding of the start-up’s tech platform and its desired outcome.

“How does the client deliver the platform? Is it web-based, app-based, or both? What volume of transactions do they anticipate? Do they have any regulatory considerations which could open the door to fines and penalties? If the platform provides cross-border services then does the client comply with any sanctions or money-laundering legislation? What is the exposure to employee or third party theft?”

Rye says that in order to better understand a fintech company’s insurance needs, brokers should take time to understand the nuances of the fintech industry. And on top of that, he says, they should be working to align themselves with knowledgeable underwriters of fintech risks.

LONDON AUSTRALIA UNDERWRITING

Established in 2005, London Australia Underwriting provides brokers and clients with innovative products backed by first-class security. Any broker wishing to establish a trading arrangement with LAUW is strongly advised to contact the management team. Details available at www.lauw.com.au