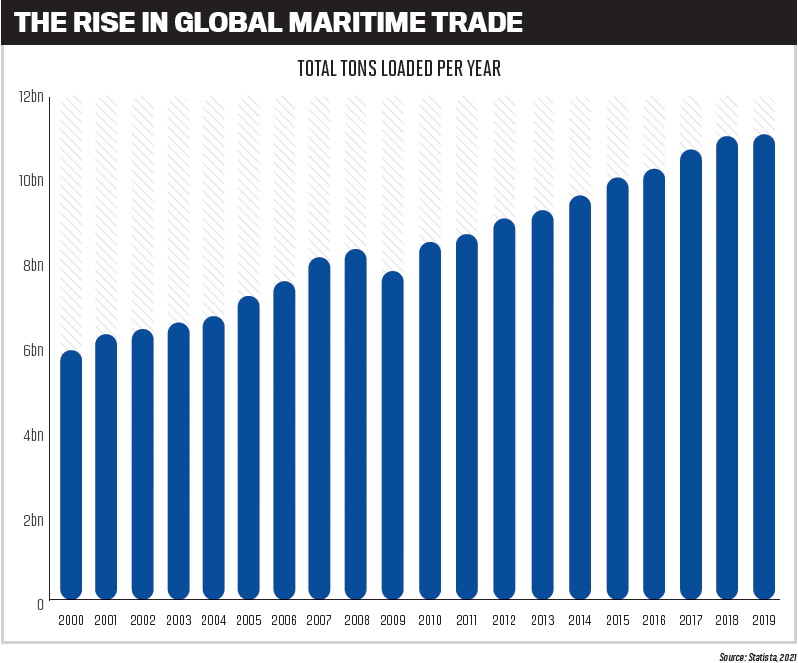

Global container shortages, extended lockdowns, a logjam of vessels waiting to enter ports – without a doubt, COVID-19 has thrown a massive spanner into the works of international trade. Yet while global shipping has been majorly impacted, the marine insurance industry has played a positive and influential role in getting it moving again. And there’s plenty of reason for optimism about the industry’s future, says Matthew O’Sullivan, head of motor and marine at Zurich Australia and New Zealand.

This optimism centres around technology and innovation, which are evolving swiftly to address the issues that have been highlighted by the pandemic.

“These are the driving forces behind the way we are conducting our business,” O’Sullivan says. “The future is here. In fact, it arrived a few years ago, and the pandemic has just made us as an industry sit up and take notice. Never before has trade and marine insurance been on the front page of the news … this is a great demonstration of the importance we play in the overall picture. It is a really exciting time to be part of the marine insurance industry.”

Innovation in the shipping industry includes online placements, digital surveys and the use of macro data in the assessment of cargo risks – all of which enable insurers to offer more tailored and more innovative solutions to customers.

“A number of companies in the market are now solely focused on providing data to the marine insurance market,” O’Sullivan explains, “and the resultant increase in efficiency in the underwriting and claims process is not only dramatically improving the end customer’s experience, but is facilitating a far more efficient movement of trade.”

A 2020 supply chain survey by EY found that greater supply chain visibility, efficiency and resilience were top of mind for enterprises, and O’Sullivan says this is where data – especially real-time data – and digitalisation are key.

“The reliability of an enterprise’s supply chain is key, and businesses are prepared to pay more for this, as the lower-cost options that may have existed in the past have proved unreliable,” he says. “I am currently a member of the International Union of Marine Insurance [IUMI] Big Data and Digitalisation Forum, and at the recent annual conference, we focused on the way in which the insurance industry is driving the move to greater use of real-time data in the supply chain. We need to continue to drive this innovation through the industry.”

Arguably the world’s most precious cargo right now is COVID-19 vaccines – primarily to save lives, but also to enable the opening of borders and easing of restrictions, and therefore breathe new life into the global economy. The logistics involved in shipping vast quantities of the vaccine are daunting. Added to the risk of theft and cyberattacks is the need for the vaccines to be kept at very low temperatures. However, technology has been able to address the challenges of temperature consistency, storage, air shipments and more, O’Sullivan says.

“The rollout of vaccines has highlighted the degree of sophistication that already exists in the transportation of sensitive cargo,” he says. “Once again, data is key. For example, temperature sensors are now driving further efficiencies across the industry as logistics companies are able to monitor real-time data about their cargo.”

Here, too, insurers have played an important supporting role. Last December, Lloyd’s of London unveiled a development fi nance-backed program to insure the distribution of the vaccine in emerging economies. And earlier this year, Aon collaborated with insurtech Parsyl to deliver a solution that combines sensor data and analytics with transparent cargo insurance coverage for COVID vaccines. This enabled insurers to cover loss of vaccines due to being transported or stored outside of agreed-on temperatures, allowing for effective risk management and claims support.

Zurich, too, continues to play an integral role in the distribution of the vaccines, O’Sullivan says, “whether through our global relationship with pharmaceutical companies or supporting the local distribution and logistics efforts in many countries around the globe”.

Data-driven sustainability

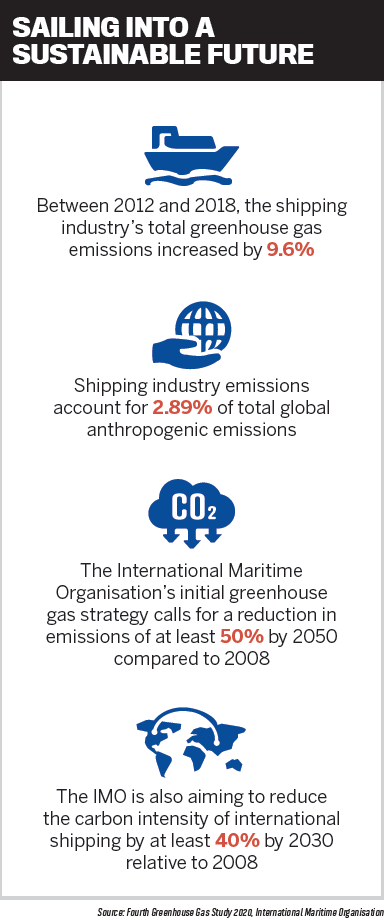

Data-driven sustainabilityThe pandemic hasn’t been the only major disruptor of marine transport. The increased incidence and gravity of extreme weather events means more frequent – and costly – routing changes, damage to port facilities and an overall rise in operating costs. Unsurprisingly, this has thrown the spotlight on the urgency of developing sustainable solutions in both the marine insurance and marine transport industries. Once again, it’s technology to the rescue.

“Global trade is the lifeblood of the world’s economy, and the use of data has led to a vast improvement in all aspects of ship-ping,” O’Sullivan says. “Data allows shipping companies to operate their ships in a far more fuel-efficient manner through better loading and distribution of cargo on vessels, quickly adjust trade routes to avoid heavy seas or weather that affects fuel efficiencies, and develop and construct vessels that are now more fuel-efficient than ever.

“This has not only created improved conditions for the transit of goods, but equally resulted in a decreasing impact on the environment. In addition to this, the shipping industry is embracing new and more sustainable fuel sources, like hydrogen, and at the same time reducing the more climate-damaging fuel components like sulphur.”

Forums such as the International Maritime Organisation (IMO) and IUMI are in constant consultation with the industry to ensure there is a collective effort to ensure a more sustainable trade of goods.

“The theme of the recent IUMI Annual Conference was ‘Pathways to a Sustainable, Resilient and Innovative Future’,” O’Sullivan says. “We as an industry presented, discussed and debated ways we can contribute to improvements in sustainability across the whole maritime industry. I feel there is a really bright future for a more sustainable trade environment and am proud that the insurance industry will play its part in securing this.”