Senior leaders of AR networks discuss what the AR path offers brokers today and the factors candidates should consider in selecting a network

There's no denying the growing popularity of the AR model. Brokers are seizing the opportunity to run their own businesses, while leaving responsibilities associated with owning an Australian Financial Services Licence (AFSL) to their networks.

“The costs and resources required to maintain your licence are significant, and I suspect these costs will continue to grow as legislation evolves further over the next few years,” says Shaun Standfield, managing director of Insurance Advisernet (IA).

Tony Walker, CEO of PSC Connect, agrees that setting up a business with an AFSL can be costly.

“It may also require an additional administration resource to maintain the professional standards required particularly around compliance, accounting and auditing, IT, reporting, [and] insurance,” he says. “In my view, unless your annual income exceeds $2m, it is not worth it.”

Troy Brown, managing director of Ausure, says the cost of maintaining an AFSL can vary greatly, with the cost of compliance being the largest unknown.

“An AFSL holder who has a strong compliance focus would be allocating significant financial and human resources to their compliance function and culture,” Brown says.

And Richard Crawford, Community Broker Network’s (CBN’s) general manager, distribution, talks about the time those responsibilities take away from other essential broking duties.

“What you do by putting that AFSL requirement into a business is you create complexity," he says. “It’s time that you spend on something other than serving your clients and delivering advice, which is fundamentally what the business is there for.”

Right for the job?

So, what type of person is generally a suitable candidate to run an AR business?

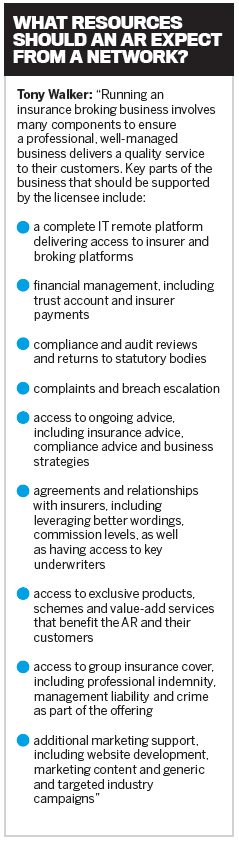

“We find many brokers who want to establish their own broking business want to focus on their customers and don’t want to get caught up in meetings, strategy sessions and long work hours that don’t benefit them, their families or … the customer,” says Walker.

Speaking in reference to PSC Connect’s own model, he says an AR should be diploma-qualified and preferably have a minimum of five years’ broing experience across all product lines.

“We expect them to be sales-focused, energetic, maintain high professional standards and be prepared to overdeliver to their customers,” Walker says. “They must also have a sound business plan that will enable them to generate a reasonable level of income. Once we understand their business plans, we will work with each AR to help them achieve their goals.”

Brown says that given they will be running their own business, an AR is typically somewhat entrepreneurial.

“They need to have the mindset of a small business owner,” he says. “They need to have a solid plan for their business and where leads and opportunities will come from.”

Standfield says anyone with the drive and ability to build client relationships can be successful at IA.

“The costs and resources required to maintain your [AFSL] are signifi cant, and I suspect these costs will continue to grow as legislation evolves further” - Shaun Standfield, Insurance Advisernet

“It relates more to having a business plan and an understanding that when you start as an AR, it will take some time to really start to generate a meaningful income. The good news is that persistence does pay off in the long run.”

Standfield says the major hurdle for new ARs joining IA is being the right cultural fit for the network.

“Any new ARs that have a solid business plan are asked to meet with some existing ARs for two reasons,” he says. “Firstly, to get feedback from a current IA adviser that this potential new adviser will fi t in and, secondly, to assist the new adviser in building their networks with IA.”

Once an offer is extended to a candidate to join IA, Standfield says, the new adviser is walked through a recently launched program, which he describes as “the A-Z in starting your own business” with IA.

“It covers everything from setting up your legal entity, what computer equipment to buy, cash flow planning, marketing, website development, branding, IA compliance regime, professional development plan, gaining access to leads we provide, and our proprietary broking and adviser advice tools.”

Walker tells Insurance Business that PSC Connect’s recruitment process involves several people, in order to ensure that brokers who sign up fit into the organisation’s culture and understand what’s required of them to achieve agreed standards and business goals.

“The last thing we want is to have an AR join us and then find in 12 months’ time it’s all too hard and they are not achieving the level of income expected,” he says. “It’s not good for either party.”

Crawford talks about the kind of candidate CBN seeks.

“Ideally, we’re looking for people with a significant depth of insurance broking experience so that they come really wellequipped there and that doesn’t distract them from the job they’ve got to do, which is to build their own business and grow their own customers,” he says.

“But even if they’re not hugely experienced, we can support them and ensure their professional development and then, beyond that with onboarding, we familiarise them with systems and tools and resources they need to operate the business, but we also coach and support them in how to go about building referral networks, finding customers, and creating plans and activity programs that will ensure their business success.”

Compliance culture

Because responsibility for compliance lies with the network, it’s essential that ARs join a network that adheres to rigorous standards.

“I would encourage any prospective adviser to spend the time to understand the compliance culture, management experience and board oversight,” Standfield says. “From Insurance Advisernet’s perspective, we can only control our own destiny by having strong procedures around money handling, compliance, adherence to ASIC reporting guidelines and timely payment of our insurance partners.”

Walker describes compliance as PSC Connect’s “number one priority” to ensure its licence is protected and that best practice results are delivered for customers’ benefit.

“This involves regular audits of our ARs to ensure they act in a professional manner and in accordance with legislation and customer expectations,” he says.

“In addition, our training programs not only extend to technical insurance knowledge to assist our ARs maintain competency but also include information about how to run a professional insurance business that will continue to develop and prosper, while remaining compliant within current regulations.”

Walker says prospective ARs should ask about the compliance training and assistance they will receive from the network and what compliance checks are in place.

“We invite any new prospect wanting to join PSC Connect to speak to some of our existing ARs to better understand the culture within the PSC network and how they have fi tted into our network,” he says. “Networks may promise a lot but the proof is in the delivery, and this is what will get the buy-in from an AR.”

Brown suggests candidates ask networks if they can actually see the systems the licensee uses to monitor ARs.

“There should be evidence of regular remote monitoring and physical compliance visits to ARs,” he says. “Ask to see examples of where the licensee has assisted ARs with compliance-related matters. Ask about complaint handling and monitoring and to see the systems that are used.

“Don’t accept verbal explanations; ask to see the systems.”

Crawford thinks compliance and education go hand in hand, and suggests prospective ARs look for a network that has a strong culture around continuing professional development and learning, and that can direct them towards clear and specific guidelines and requirements around what compliance means.

“Compliance is the minimum standard as it’s regulated. But beyond that is performance, and that’s where we try to encourage our people to operate to, so that they’re not just meeting the minimum requirements but meeting the standards that we think will make them different in the market,” he adds.

Brown describes network culture as the most overlooked aspect when people choose an AR group.

“Who owns the licensee? Is that a good fit for my business, and what does that mean for me? How long has the licensee been operating? What is their reputation in the industry? What is the culture of the group, and does it have a sense of community? Call some insurers and existing ARs to fi nd out.”

Crawford also offers guidance on how prospective ARs can look for signs of a good network culture.

“I think the very fi rst thing you should listen for is the language and how people talk about the network and its purpose,” he says. “The use of inclusive language around ‘we’ is really important. Good networks are those where there’s an undercurrent of generosity; where most of the members are there to support other members of the network.”

Walker says meeting with key members of the AR network is important, in order to get a feel for how the organisation operates and its expectations.

“As well as positive feedback, other signs of a good culture are a strong proactive management team, a robust support offering, ongoing training, and transparent processes and procedures,” he says.

Asked about feedback received from IA’s own ARs, Standfield says the network’s advisers are surveyed annually and he characterises the results as “excellent”.

“Anyone thinking about joining Insurance Advisernet can call anyone of our ARs, whether they have been with us 20 years or just a few months, as I am confi dent that all of our advisers are extremely satisfi ed with the services, brand reputation and, importantly, the support of the whole IA family.”

Walker says PSC Connect often receives positive feedback from its ARs about the support they receive from the network. “Not only administratively but also in key insurance broking areas such as difficult placements and complex claims,” he says.

“Our ARs like the freedom to build their own business, knowing they are backed by a professional progressive organisation that can help them achieve their long-term goals.”

Crawford describes becoming an AR as an “extraordinary” and “grossly underestimated” career opportunity for those wanting to run their own business.

“What the authorised representative structure has allowed us to do is build a network of people who own their own businesses and own their relationships with their customers and are delivering the kind of personal service that insurance used to be known for, and should be known for,” Crawford says.

“It’s also a fantastic opportunity for our profession to get a whole lot of new, exciting, innovative people working in our ranks.”