.jpg)

Experts provide their insights into the motor fleet market and highlight recent and upcoming legislative changes that should be on the radar

Motor fleet insurance has not been a source of profi tability for Australian insurers in recent years, according to Scott Guse, KPMG’s Asia-Pacifi c IFRS Insurance leader.

“There has been a slight improvement this year,” he says, “but it’s still losing money.”

Guse says no dramatic change to the state of play appears to be on the horizon, but this is an area of business in which more innovation is starting to occur.

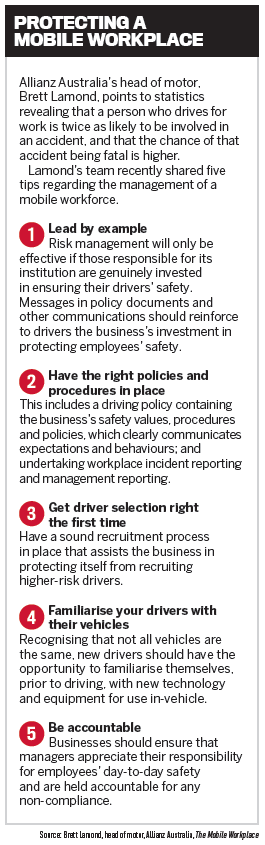

He says a lot of insurers are now going out to fl eet businesses to assist in educating fl eet drivers, facilitating defensive driving courses and other programs that can help to limit an organisation’s risk exposures.

“You tend to find that those sorts of programs actually pay off ,” Guse says. “They [insurers] invest a couple of thousand dollars up front and it will save them tenfold down the track, in terms of reduced claim numbers.”

Changing road conditions

Looking at the legislative landscape, a recent change enacted in NSW was the Motor Accident Injuries Act 2017, which came into force on 1 December 2017. The Act introduces changes to how motor vehicle injuries are compensated.

“These changes signifi cantly impact how the scheme operates, extending the cover afforded to at-fault drivers and replacing lump-sum settlements for most injured motorists with defined benefits, including regular payments for economic loss,” a QBE spokesperson tells Insurance Business.

While the definition of ‘motor accident’ has not changed, says the spokesperson, any change in legislation brings with it a risk of new legal challenges.

“It’s important to ensure that [a] Comprehensive Motor Fleet insurance policy, which covers damage to the vehicle and to third party property, includes appropriate ‘Supplementary Bodily Injury’ cover, or that similar cover is provided under the fleet operator’s General Liability insurance program,” the spokesperson says.

Tim Atkins, director of Marsh and McLennan Agency, mentions upcoming changes to the Heavy Vehicle National Law (HVNL).

“The new laws being introduced in 2018 are intended to align more closely to workplace health and safety legislation,” Atkins says.

The HVNL applies to all vehicles operating in excess of 4.5 tonnes Gross Vehicle Mass in Australia, excluding Western Australia and Tasmania.

“The law currently provides for chain of responsibility (COR) in relation to transport operations,” says QBE’s spokesperson. “Currently, these laws dictate that the parties responsible for transport tasks are responsible for complying with the laws, and for any breaches.

“Midway through 2018, the HVNL will be amended to make it very clear that every party in the supply chain has a ‘duty’ to ensure safe practices.”

QBE’s spokesperson explains that the new HVNL law prescribes that it will be “an obligation to eliminate and minimise public risks by doing everything reasonable to ensure transport-related activities are safe” – which is referred to as the primary duty.

“COR requirements will now also extend to heavy vehicle standards and maintenance, and liability of executive officers will broaden to require due diligence for safety across the HVNL. These laws and the duty imposed will apply across all business types where there is heavy vehicle operation.”

Addressing the subject of consequences for breaching the new HVNL, the spokesperson says: “Penalties for breaches of a primary duty under the new laws will be at similar levels to those under workplace health and safety laws.”

Increasingly, fleets are fi tted with telematics devices allowing operators and business owners to monitor driver behaviour and use information collected to take action to attempt to reduce vehicle accidents. The information collected can help operators ensure that a driver takes the most direct and/or fuel-efficient route to their destination.

But as QBE’s spokesperson highlights, legal responsibilities arise when an organisation installs telematics technology in its vehicles.

“Once installed, there is a legal obligation to review and monitor drivers on a regular basis,” the spokesperson says. “Depending on the size of the fl eet, this may require a full-time resource just to keep an eye on the drivers’ behaviour. It then imposes a legal risk if there is a clear indication that drivers are behaving in a way that could be a risk to themselves or others and the business does not regularly review the data or take appropriate action when required.

“Telematics has great potential; however, businesses should seek legal guidance before proceeding.”

It’s obviously essential that brokers ask the right questions when conversing with fleet operator clients to accurately ascertain their risk exposures. Atkins reinforces the need for brokers to know precisely what’s in a client’s fleet, particularly if that fleet includes non-standard vehicles, such as cranes, tractors and forklifts.

“A broker needs to identify the uses for these vehicles so that they are correctly listed and understood by the insurer,” Atkins says, adding that they should also discuss the level of deductible a client is willing to manage.

“While most are happy with the industry standard, some might opt to accept a higher level of risk to reduce their premium spend,” he says.

“Fleet operators also need to be educated about claims inflation, with the cost of repair and replacement of modern vehicle accessories gradually increasing, and the importance of informing their broker about any modified or imported vehicles that are in the fleet.”

Brokers should also “communicate the effects of currency fluctuation, as a weakening Australian dollar increases costs of vehicles’ accessory imports”, Atkins says.

QBE’s spokesperson reports that some brokers tend to underestimate the level of ‘Dangerous Goods’ cover clients require.

“Placarded loads of dangerous goods incur a minimum statutory requirement of $5m per vehicle, to cover personal injury, property damage and clean-up costs,” the spokesperson says. “This means that a B-double vehicle carrying dangerous goods on both trailers would require Dangerous Goods Liability insurance for $5m per trailer.”

On the subject of broker conversations with clients, Matthew Summers, account manager in Willis Towers Watson’s corporate team, says: “The one thing we would emphasise is the need to commence the renewal process early, and for brokers to be across major claims and loss ratios.”

Atkins says insurers are generally willing to consider the attractiveness of a client’s fleet insurance against the opportunities of their broader insurance program, so it is up to a broker to engage with underwriting specialists across insurers.

“Catastrophe exposure is another element of fleet insurance where a broker can add value,” he says.

“For example, some fleets are only used during business hours and parked off-premises at other times, which could expose their fleet to hail, flood or fire. This is a good opportunity for brokers to offer risk management strategies to lower their clients’ risk profile.”