.jpg)

Global insurance companies are seeing sustainable, long-term value in insurtechs, and they’re putting their money where their mouth is

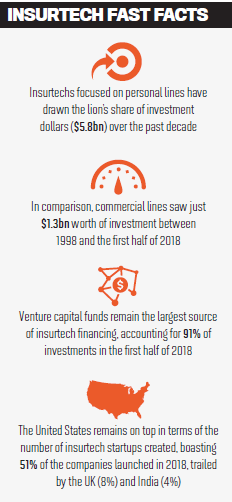

Growth in the insurtech space might have happened later than similar developments in other financial services industries – it reached its peak in 2016 with the launch of 177 insurtech startups – but the drop to 88 launches in 2017 doesn’t mean the insurtech gold rush is coming to an end, according to a recent Deloitte analysis on the sector. Deloitte found that funding continues to flow into insurtechs – investments in 2018 are on track to meet the $1.83bn in funds raised in 2017.

Today, several insurance giants have their own investment arms focused on promoting insurtechs that add value to the industry and clients, and have helped usher in a major evolution in the contributions of these technology companies in recent years. Martha Notaras, partner at XL Innovate, a global insurtech venture capital firm backed by AXA XL, looks back on 2015, when the insurtech space was just beginning to boom.

“Suddenly, people started talking about [insurtech], but it wasn’t quite clear whether it was going to catch on,” Notaras says. “We started the fund after a lot of the distribution plays had already been created in terms of the aggregators, but at that time, nobody was really talking about that as being insurtech.”

It was only when startups began proposing services aimed at personal lines (Lemonade was one of the fund’s early investments) that people started looking at insurtech as something unique in the insurance landscape. Since then, insurtechs have evolved to touch on commercial lines as well.

“We’re starting to see a lot more companies that are handling commercial,” Notaras says, “and they’re not necessarily re-creating commercial insurance companies.”

Attitudes have also transformed over time. Notaras notes that in the early days of insurtechs, startups tended to regard existing insurers with contempt. Today, however, technology experts are identifying and addressing some of the limitations facing the industry – whether it’s in data or regulation – and their contributions are being welcomed.

Argo Group is another insurer with its own investment outpost, Argo Ventures, which backs early- and growth-stage startups in financial services and insurance. The fund focuses on insurance technology, risk management, fintech, enterprise software and any other tech solution that has an insurance component to it, according to Oleg Ilichev, head of investments at Argo Ventures.

“Whenever there’s a tech startup that touches insurance, we want to be front and center on entrepreneurs’ minds,” Ilichev says, adding that for seed-stage companies, Argo Ventures’ experts will be “their eyes and ears and partners in insurance”. For growthstage insurtechs, Argo Ventures helps with continued expansion and figuring out the next iteration of their businesses.

Ilichev says all areas of the insurance value chain are seeing new entrants to the marketplace that are contributing something beneficial, though he notes that not all insurtechs are built for the long term.

“The bigger question is who’s going to be the winner,” he says. “I think there are a lot of companies that are just building features and are not really long-term, sustainable, disruptive businesses that are venture backable.”

He adds that brokers need not worry about being replaced by technology. While some insurance products can be delivered directly to insureds, many insurance offerings become bespoke very quickly, depending on the type of class being underwritten. “We’ve found that the brokers are going to be here to stay,” Ilichev says, “and insurtechs that are actually building software to make the brokers much better at their jobs are going to be the successful approach.”

By now, it’s clear that insurtech isn’t just a fad, though what shape or form the sector will take in the coming years is anyone’s guess. For future investments, the XL Innovate team is looking for businesses that are addressing pain points in the commercial insurance process.

“One of the defences has always been that commercial lines are so complex that insurtech won’t make progress into that,” Notaras says, “but we’re seeing that actually there are data and analytics that drive the commercial lines, and also that there are certain operational efficiencies that you can drive into.”