Industry experts say parametric insurance – a specialised form of insurance or reinsurance tied to a defined trigger – could be set to take off in the commercial sector

As an insurance model that uses predefined trigger and payout mechanisms, parametrics promises speedy, no-nonsense claims resolution that could help policyholders with cash flow and minimise insurance disputes.

According to a new report produced by risk management association Airmic in collaboration with insurance giants Marsh and Swiss Re, parametric insurance could soon become more mainstream in the commercial sector and help clients address some of the limitations of traditional insurance. But how does it work in practice, and where does the parametrics market stand today? IB spoke to several industry experts to find out.

“Parametric insurance works using a clearly defined parameter – i.e. a metric or an index that is easy to determine,” says Steve Harry, risk finance consultant in Marsh’s Financial Solutions Group. That can be in terms of the trigger of the insurance, the payout or both, Harry adds: “Broadly, it’s an insurance program that is triggered and/ or paid very simply using an index rather than words.”

“The way we would express it is that it improves liquidity,” Harry says. “Really what we are looking to do is mitigate the liquidity risk of a traditional insurance contract in these complex areas.”

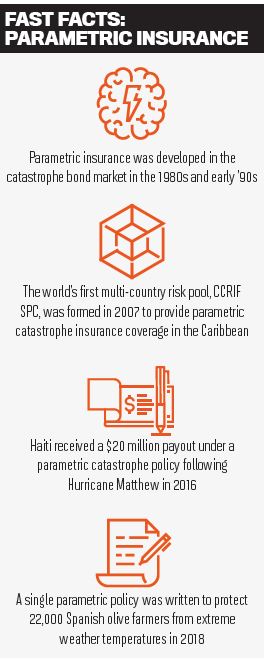

Currently, parametrics is mostly used in catastrophe bonds, but there are moves being made to apply the concept in the travel, retail and agricultural sectors – and the insurance industry has its eyes set on a much wider application in the future. While there have been very few direct parametric policies placed by insurers, Harry says that could be about to change.

“We have definitely seen more inquiries over the last year,” he says. “The data and modelling is now so much better that it’s a real reason to be optimistic that some of these deals might take off.”

According to Airmic chair Paul Goulding, while “parametrics is still work in progress … I can see it becoming mainstream in the future, because it offers certainty of timing and hassle-free payment”.

Airmic technical director and deputy CEO Julia Graham adds that there has already been some growth in the commercial market. “We are starting to see some businesses begin to take this cover seriously, and we’ve heard of some big buys in the aviation sector, for example,” she says. “Organisations have started to buy this. We think it’s bubbling.”

As for whether a client should choose a parametric policy over a traditional one, that all depends on what they’re looking for in their coverage. Those who want speedy adjustment and an easy-to-work-out scale of payment might find parametrics appealing. However, Harry points out, “some people like the uncertainty [a traditional policy] gives them, in that they can always argue about a policy contract”.

Airmic warns that commercial insurance buyers eyeing parametric solutions face a number of challenges and may need to acquire new skills. Buyers should have a good understanding of their organisation’s business model and risk landscape, and may need to get early buy-in from senior colleagues such as the chief financial officer.

Ultimately, though, parametric insurance can help businesses strengthen their financial protection by reducing the uncertainties around cover and cash flow that traditional policies can cause.

“Concerns about large, complex risks directly related to business operations are on the rise – it’s about protecting revenues,” says Christian Wertli, head of innovative risk solutions at Swiss Re Corporate Solutions. “Parametric solutions can be used as a business tool to provide certainty and speedy access to liquidity when most needed.”