.jpg)

Insurance Business spoke to Accident and Health International’s Renato Foenander to find out how the underwriter is making a difference to clients at claim time

When someone has suffered an injury, the last thing they want to worry about is whether they’re covered by their insurance. In times of crisis, people are looking for immediate assistance, not reams of paperwork or additional red tape.

Yet the public perception is that insurers rarely pay a claim or that clients have to jump through hoops to get their claim paid out. The industry’s image is in need of rehabilitation in the public eye, and it’s something Renato Foenander, claims manager with Accident and Health International, is eager to see change.

“We’re tasked with protecting our customers’ health, family and livelihood,” Foenander says. “In our line of business, the claim is where the customer promise is delivered.”

The good news is that the statistics are actually on the insurance industry’s side. According to recent information released by the Australian Prudential Regulation Authority and the Australian Securities and Investments Commission, 84% of total and permanent disability claims and 87% of trauma claims are paid out in the first instance.

Yet in an age where technology and social media alike have enabled easier access to insurers, minimum standards are rarely enough. One only needs to scroll through the Facebook or Twitter feeds of any large insurance organisation to see the vitriol that can follow in the wake of an improperly handled incident. Customers understandably – and not unreasonably – expect more. Immediate responses and fast turnaround times should be the minimum, not the gold standard.

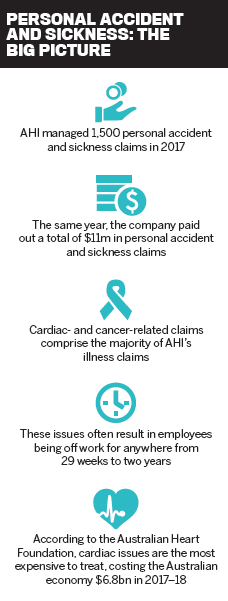

It’s this approach that AHI strives for. In 2017, the company processed more than 1,500 personal accident and sickness claims, with payments totalling more than $11m. Travel was an even bigger market. During his years in the industry, Foenander has noticed that the average age of travellers is increasing, particularly as retirees aim to spend more time enjoying the fruits of their years of labour. Some of the key cost drivers were loss of deposits, medical expenses and claims for baggage.

“These trends are compounded by 20 years of increasing hospital and medical expenses, which consistently exceed normal inflation,” Foenander says. “Should the adverse and unfortunate happen whilst an insured is travelling, you can nearly always expect an expensive claim.”

It all adds up to a not-inconsiderable sum: in 2017, AHI processed nearly 8,000 travel- related claims, with payments exceeding more than $24m.

The human touch

While many insurers are turning to technology as a primary means of meeting consumer demands, AHI still places heavy emphasis on the human touch, using technology to enhance the person-to-person experience, not replace it.

“Humans are key to underpinning your technology and driving positive outcomes for the policyholder,” Foenander says. “Technology can never be taught how to care and understand. AHI enables its people to access decision-makers in all areas of the business.”

Foenander stresses that the AHI ethos is always aimed at exceeding base standards and customer expectations. Trust between the policyholder, broker and underwriter is essential, and it can be easily broken. If this culture isn’t ingrained into staff, business will be lost quickly. In the field of accident and health, this is even more crucial, as the policies and risks being covered – as well as the claims that arise – are all highly complex.

“It’s vital to have an empathetic and proactive claims culture, where the team approaches every claim with a view to settling it as quickly and efficiently as possible,” Foenander says.

As an organisation that’s been in operation for two decades, AHI counts its knowledge of the accident and health market and its deep understanding of clients as important differentiators. To ensure it remains competitive, the company periodically reviews its policy wordings to ensure they are up-to-date and comprehensive, in line with – or frequently exceeding – the wider market.

Additionally, AHI holds regular consultations with clients and key industry groups alike to discuss insurance requirements. These aren’t just for show; they are directly geared at preparing for and assessing future trends in the market.

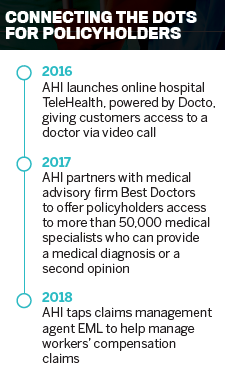

“For example, extensive research into our customer expectations showed offering adjacent services was high on our customers’ agenda,” Foenander explains. “In particular, many employer groups told us of their desire for integrated personal injury claims and workers’ compensation management reporting.”

This led AHI to recently enter into a joint claims service offering with EML, an organisation with an established reputation in managing workers’ compensation claims. EML has been an agent for Worksafe Victoria for two years, and since the start of 2018 has been the single claims agent for WorkCover. AHI will still manage and process the large majority of its claims in-house, but its personal accident and claims management team will draw on EML’s processes and network to help improve outcomes for claimants, Foenander explains.

“This partnership is really about us leveraging some of the best practice of statutory claims processes in a non-statutory environment,” he says. “It will result in alignment between the reporting processes for work-and non-work-related injuries.”

While the majority of claims generally involve a simple dollar transfer, more complex claims often require the input of multiple stakeholders to achieve a successful outcome.

“In personal accident claims, you could be dealing with the claimant, return-to-work coordinators, rehabilitation providers, independent medical specialists and employers,” Foenander says. “By bundling the personal accident and workers’ compensation claims with EML injury management processes, organisations can both save time and receive a far better understanding of their risk exposure.”

Having said that, Foenander emphasises that access to decision-makers will always remain a core value proposition for AHI clients. The ultimate beneficiary of this alignment, he says, will be those who have suffered from a non-work-related accident or illness.

“The ability for organisations to have one group managing personal accident and workers’ compensation claims enables a clearer picture of risk,” he says. “This data can be used to drive proactive solutions for worker health and safety.”