5-Star Marine 2022

Jump to winners | Jump to methodology

Smooth sailing

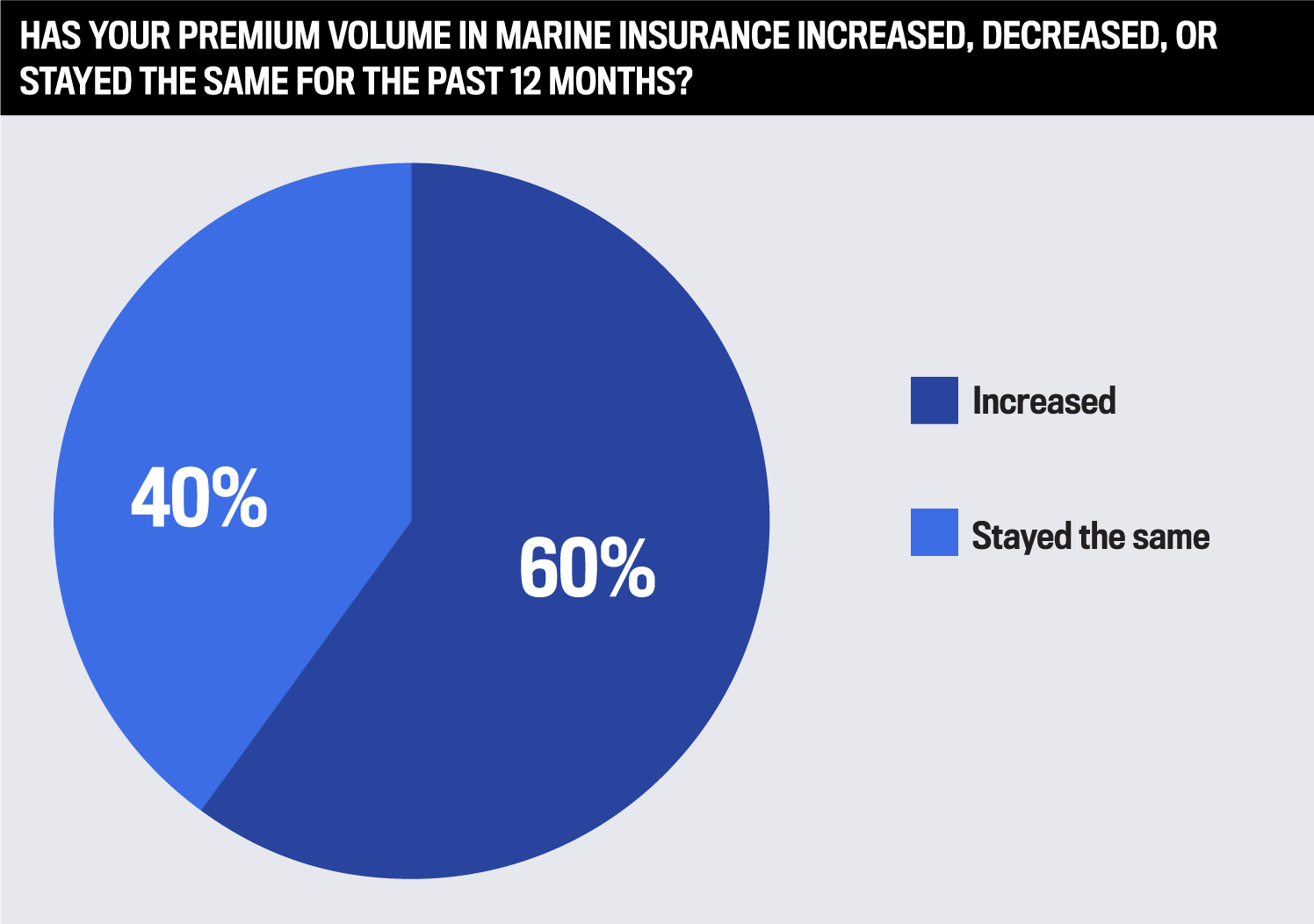

Geopolitical uncertainty, energy issues, and other challenges have caused rough sailing in the marine insurance sector. However, brokers who took part in this report say they have either increased their premium volume in the past 12 months or maintained it at the same level.

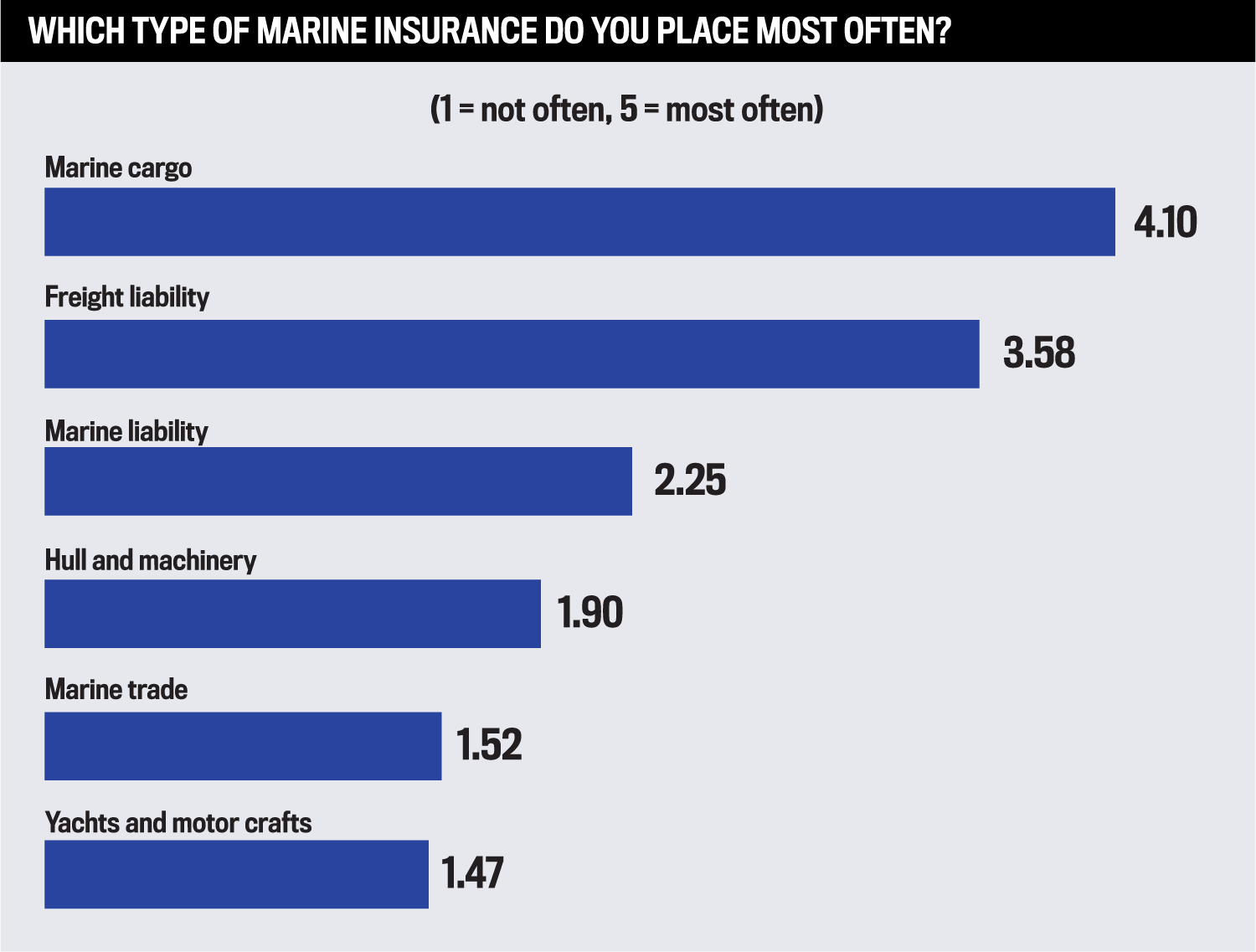

The 2022 Insurance Business UK 5-Star Marine awards recognise the accomplishments of 16 insurers who have been judged by brokers in terms of work quality, specialty expertise, and client services across the following categories: freight liability, marine cargo, marine liability, hull and machinery, yachts and motor crafts, marine cargo, and marine trade.

“Marine insurance is a specialty line and for that reason, the skill set is quite rare. Therefore, if insurers wish to grow, they either need to empower distributors to take more decisions or resource sufficiently to ensure and maintain their relevancy”

Alan Wilkins, Mercari Risk Management

"Accessibility, efficiency, flexibility and value for money” are the features that make a top-performing marine insurer, says Alan Wilkins, CEO of Mercari Risk Management, a specialist broker focused on the maritime sector and the official BIBA scheme provider for marine insurance.

He adds, “Marine insurance is a specialty line and for that reason, the skill set is quite rare. Therefore, if insurers wish to grow, they either need to empower distributors to take more decisions, or resource sufficiently to ensure and maintain their relevancy.”

The keys to success

Paul Hanson, senior underwriter - marine with 5-Star winner Arch Insurance, says many COVID-affected businesses serving the tourist/recreational sector have returned to normal. Other issues include supply chain disruption, inflation, and the war for talent.

“In such an environment, the strength of the broker relationship really comes to the fore. At Arch Insurance, we are working closely with our brokers to fully understand their clients’ risk profiles and ensure we are aligning our coverage and pricing accurately. This level of collaboration, coupled with our depth of market expertise, also enables us to consider more challenging or complex submissions.”

Arch offers marine hull and machinery, and marine trade insurance solutions to the UK market. The company delivers a broad range of coverage through its extensive broker network.

“Our marine hull and machinery product targets UK commercial vessel owners and operators, with target markets extending from small cargo vessels, ferries and water taxis to wind-farm support vessels and vessel construction,” Hanson explains.

“On the trades side, we provide organisations with a comprehensive range of covers within a single policy, including business interruption, employers’ liability, legal expenses, material damage, third-party liability, and vessels. As with all Arch Insurance’s policies, we also provide a range of risk management tools in addition to our legal expenses insurance.”

NMU, also a 5-Star winner, has been underwriting marine (cargo and freight liability) risks in the regional UK market since 1982.

“This remains a core line of business for NMU, but we have successfully branched out into cyber, construction and engineering, terrorism and marine equipment,” says Guy Smith, the firm’s head of marine and specialty. “When we are looking at our products, our distribution, and our service offering, we listen to brokers. Rather than build offerings we think the market wants, we engage at the outset by leaning on our strong relationships with our broker partners.

Smith expanded on the secret of the firm’s success. “The main thing that distinguishes us in the market is our specialist team. We have incredible expertise in our team, and we use this experience to deliver consistent, high-quality service to brokers and policyholders, and in my mind, this is a real key aspect of what sets us apart.”

“From a ratings perspective, the marine insurance market has been relatively firm for several years, but this too is starting to change as both risk appetite and capacity levels increase, while inflationary pressures and rising competition levels are also affecting market dynamics”

Paul Hanson, Arch Insurance

What else makes them tick?

Arch ensures the highest levels of customer service, which has been central to the success of their UK regional operations since they first launched operations in the first quarter of 2020.

“We were committed from day one to maintaining a regional presence with empowered underwriters dedicated to building strong broker relationships,” says Hanson. “In some ways, we have gone against the market as insurers have looked to centralise operations and withdrawn from sectors or reassessed their appetite.

“We also benefit from the fact that we have a highly experienced underwriting team who have successfully underwritten business through both soft and hard market cycles. That level of expertise across many different types of vessels and businesses means that we have the underwriting knowledge to support marine clients during challenging conditions.

“At Arch Insurance, our focus is not on offering the lowest cost cover but on delivering the highest value cover. By delivering this at what we view as sustainable prices, we can minimise price volatility and ensure our brokers are better able to manage business more effectively over the cycle.”

Meanwhile, Smith says that service has always been at the heart of NMU. “Our dedication to providing excellent service has played a crucial part in our success over the last 40 years,” he explains. “Having the right people in the business who are always striving for excellence ensures that we can deliver a consistent, top-quality service to brokers and policyholders. Our drive to find solutions forms a big part of why I feel we’ve had this great feedback.”

“Having the right people in the business who are always striving for excellence ensures that we can deliver a consistent, top-quality service to brokers and policyholders”

Guy Smith, NMU

Marine insurance matters

The sector is often undervalued and this is an issue Wilkins highlighted.

“Marine insurance has a circa USD60bn premium pool across all lines of business, which is a fraction of the overall USD6trn insurance market, yet it is the line of business which underpins the global economy estimated at USD140trn, the total value of the purchasing power of the global population. Marine insurance is perceived to be a specialist insurance sector and suffers from significant underinvestment in technology, distribution, education and training.”

At Arch, the sector is viewed as having different factors at play. “From a ratings perspective, the marine insurance market has been relatively firm for several years, but this too is starting to change as both risk appetite and capacity levels increase, while inflationary pressures and rising competition levels are also affecting market dynamics,” Hanson says.

Meanwhile, Smith says it’s been an interesting couple of years – noting that after the first hard market cycle for 18 years, rates are starting to flatten.

“Overall, performance has been strong, and our team at NMU have put in considerable effort to keep us at the forefront of the market, but this picture may be slightly distorted due to reduced movement of goods through the lockdowns and supply chain disruptions,” he says. “We’re now seeing an increase in underwriting appetite for our UK marine business, but it will be interesting to see the impact of increasing re-insurance costs as 2023 kicks off at the January 1 treaty renewal period.”

Wilkins, who previously held senior roles at Aviva, CNA, Zurich Insurance, and Arthur J. Gallagher, has an optimistic view of the sector’s future.

“Overall, marine insurance rates have increased dramatically over the past four years driven in part by the [Decile 10] review at Lloyd’s of London, which saw multiple loss-making syndicates withdraw capacity from marine insurance lines. Latterly, there has been a return of marine insurance capacity to the London cargo insurance market following a return to profitability as a result of the rating corrections, although whether current pricing levels have correctly priced in the risks associated with a changing climate remains to be seen.”

5-Star Marine 2022

- Accelerant

- AIG

- Allianz

- Arch Insurance

- Aviva

- AXA XL

- Beazley

- Chubb

- CNA

- Fiducia

- Lonham

- NMU

- RSA

- Shipowners’ P&I Club

- Travelers

- Zurich

Methodology

To select the best marine insurance providers for 2022, Insurance Business UK sourced feedback from insurance brokers. IBUK’s research team began by conducting a survey with a wide range of brokerages to determine what brokers value in a marine insurer. The team also spoke to hundreds of brokers across the country, asking them to rate the marine insurers they had worked with over the past 12 months.

The in-depth information gathered from the brokers enabled the research team to assign weighted values to each criterion being rated by brokers. At the end of the research period, the insurance providers that received the highest rankings in terms of work quality, specialist expertise, and client service were named 5-Star Award winners in marine insurance.

Keep up with the latest news and events

Join our mailing list, it’s free!