Top Insurance Brokers 2023

Jump to winners | Jump to methodology

Albion excellence

Brokers are the lynchpin of the industry, and IBUK recognises the standout performers from the past 12 months. Those who made the prestigious list are at the top of their game and have a multifaceted skillset. They are able to think strategically, deliver for clients and be innovative.

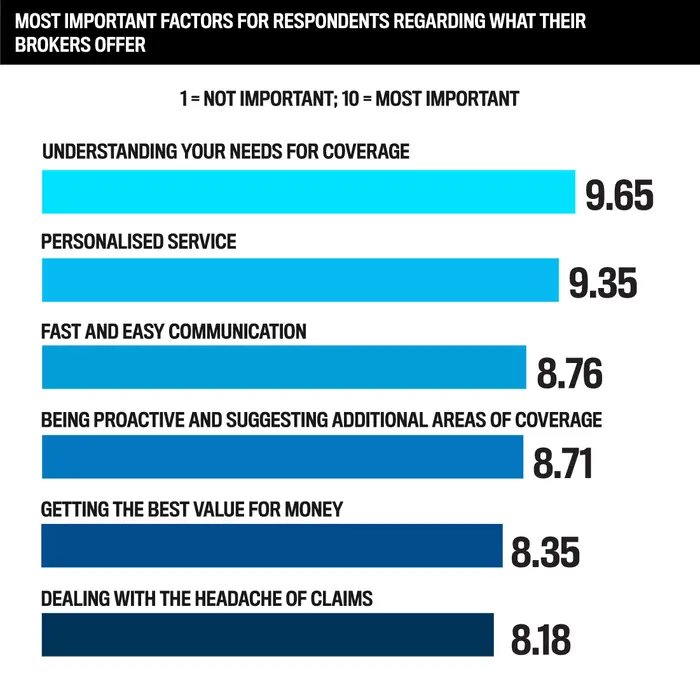

Highlighting what’s required to rise to this level, Mario Conde, partner at Bain & Company and member of Bain’s Insurance practice says, “Top-performing insurance brokers have a deep understanding of customer needs and the ability to translate those needs into the right risk cover at the best possible price. They support their customers throughout the entire claims process.”

Annabel Baker – WTW

P&C Direct Property

Since beginning her career at Aon on a graduate scheme, Baker has made a blistering start in her new role and has already been marked out as a future leader. She recently completed WTW’s Emerging Ambassador program, aimed at top talent destined for executive roles.

“I really enjoyed seeing things from a more high-level perspective as part of the program, but it’s really important to get on-the-ground experience as ultimately I’ve only been in insurance for three years, so I don’t want to rush things,” she says. “There’s fewer female leaders in the industry, so it’s hard sometimes to picture myself in that role, but it’s something that I want to push myself to do once I’ve built up the skills.”

Baker switched to WTW after spotting the chance to join a growing team and be a part of creating momentum. One of her rotations at Aon covered international property, enabling her to meet underwriters and arrive with an already-formed network.

Baker says, “I had the contacts and, to an extent, the knowledge, so it was a case of learning new systems, but I think the first approach was to sit back a little bit and get to know the team.”

However, she quickly found her feet.

“After a few weeks, I was putting my hand up for everything and pushing myself as much as I could, trying to meet new underwriters I didn’t know,” says Baker. “Overall, I wanted to learn as much as possible.”

Adding to the complexity of Baker’s role is the international element; she works across the globe, aside from the Americas. Again, she has used this as a forum to augment her skillset.

She says, “I like the variety of offices that we work with and the kinds of businesses that we place. It’s challenging to work with different people and in different industries, and therefore I’ve learned, not just on how to broker the accounts but also how to work with people from different cultures.”

Soaking up knowledge and becoming an adept operator has been a challenge for Baker, particularly in entering a new environment. She singles out her organisational approach as the difference-maker.

“Maybe it’s a boring answer, but it’s what allowed me to do various things outside of my role but also maintain my performance,” she says.

This dedication pays dividends in the global aspect of her role.

Baker says, “It allows me to keep track really well of what I’m speaking about with and who, and it also means I’ve been able to pick up more operational roles within the team.”

Baker’s organisation has moved the needle for WTW and her colleagues. On the firm’s internal tech platform, a log of all accounts is kept, and she has taken on responsibility to track this for her team. It’s one of the key KPIs that WTW records and under Baker’s stewardship, her team’s metric has increased significantly.

Annabel BakerWTW

Industry advocate

Aside from driving her own career forward impressively, Baker puts an emphasis on promoting careers in insurance.

“There’s that phrase about insurance being the hidden gem of the financial industry because it’s much more fun than it sounds to work in,” she says. “There is a recruitment issue within the industry; we need more people to come in, and I’m quite passionate about getting it out there.”

To that end, Baker is a member of the Insurance Institute of London’s Young Members’ Committee (YMC), a network representing young professionals across the London market that:

-

organises educational, networking and social events to promote learning and networking

-

assists YMC network members with CPD and career development

Part of Baker’s passion for being part of the YMC is to promote diversity and inclusion by encouraging more females and those from ethnic backgrounds to join the industry.

“It’s that thing where if you can’t see someone doing something, then you can’t imagine yourself doing it. It’s about trying to change that, and improving diversity is also important for differentiation of thought,” she says.

In addition, Baker recorded a podcast series interviewing renowned industry professionals to share their stories and inspire others. This was an idea she suggested and was part of her being a winner of the London Insurance Life Bursary Award.

Baker says, “Each one is around half an hour, but I had never done any recording like that before. It helped with my own networking as well as getting the message out because I spoke to some really interesting people. And I actually also met my mentor [Alice Kaye, COO of Inigo] through that process, as she was one of the guests.”

Challenges for the UK’s Top Insurance Brokers

While IBUK’s Top Insurance Brokers have made their mark, they are committed professionals focused on evolving and developing.

Industry expert Conde lists the key issues that these outstanding performers will encounter and need to master to maintain their standing and their team’s performance:

-

Shifting risk and pricing landscape – “Recent years have brought incredible shifts in the risk landscape of the industry at a global level and created price and risk shocks that have created anxiety and some knee-jerk reactions in both customers and underwriters, requiring brokers to be forward-thinking.”

-

Technology – “New developments like generative AI are expanding the toolkit that can drive higher broker productivity, better customer experiences and more efficient operations. Realising the benefits of these solutions and understanding how to effectively invest in them is not trivial and will require thoughtful planning, new capabilities and change management.”

-

Expertise – “The bar of expertise keeps getting higher, and finding, developing and retaining the right talent is top on the agenda.”

Top Insurance Brokers 2023

- Amanda Gray

Konsileo - Amy Kilbey

Gallagher - Anita Watson

Gallagher - Annabel Baker

WTW - Ben Macrow

Archenfield Insurance Management - Daniel Kinlan

Aon - Daniel Pirozzolo

WTW - Ethan Maule

Hayes Parsons Insurance Brokers - Florence Dennis

Partners& - Jamie Buchanan

Squared Insurance Brokers - Joanna Vickers

Verlingue UK - Liz Pope

Marsh - Mandy Williams

Talbot Jones - Neil Grimshaw

Ravenhall Risk Solutions - Peter Robinson

Prizm Solutions - Richard Talbot-Jones

Talbot Jones - Richard Tuplin

Towergate Insurance - Rob Nicholls

Thompson & Richardson (Sleaford) - Sarah Jones

Thomas Carroll (Brokers) - Sarah Wrixon

Summers & Co - Selorm Domeh

Talbot Jones - Shari Storey

Yutree Insurance - Tara Stone

Hayes Parsons Insurance Brokers - Tia Howard

McCarron Coates - Zofia Jablonska

Apricot Insurance

Insights

-

Mario Conde

Mario Conde

Partner, Bain & Company

Member, Bain’s Insurance practice

Methodology

In July 2023, the Insurance Business team conducted independent research on the UK insurance sector to find the most influential brokers who had contributed significantly to the industry over the previous 12 months. The team aimed to identify individuals who had led new initiatives in the insurance space and pushed the UK’s insurance sector forward after the enormous challenges of 2023. From a diverse cross-section of insurance professionals, we got the opportunity to spotlight remarkable examples of passion, dedication and commitment.

By the end of the research process, 25 key figures were selected for their leadership, innovation and industry contributions.

Keep up with the latest news and events

Join our mailing list, it’s free!