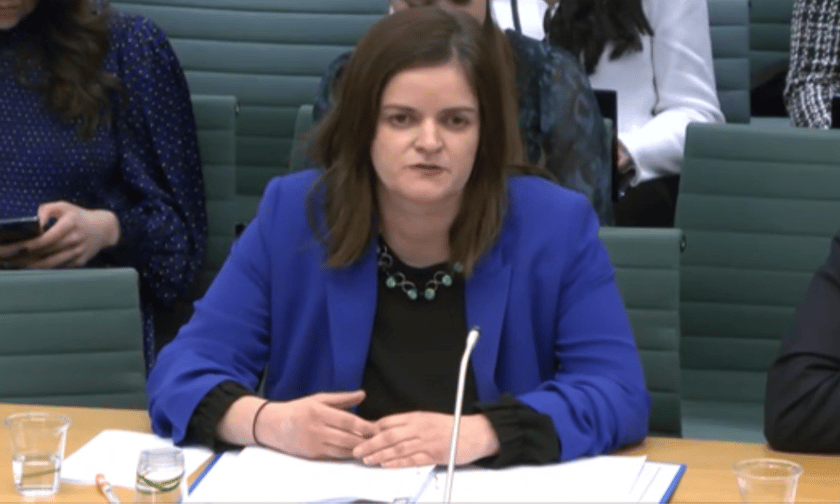

Screengrab from the evidence session streamed by Parliamentlive.tv

The Financial Conduct Authority (FCA) is working to find out how companies are detecting and resolving non-financial misconduct cases, according to FCA executive director Sarah Pritchard (pictured).

“In the supervisory work that we have just commenced, we are looking to firms to explain numbers of non-financial misconduct cases, methods of detection, and methods of resolution,” Pritchard said during Wednesday’s oral evidence session as part of the Treasury Committee’s ‘Sexism in the City’ inquiry.

“By that new piece of work, which we’re commencing right now in relation to wholesale banking, brokers, and insurance, we would expect to have details coming back through that.”

It’s been previously raised that non-financial misconduct cases – spanning acts like bullying, discrimination, and harassment – are often resolved through non-disclosure agreements (NDAs), and the FCA’s probe will soon shed light on whether it’s indeed a common resolution method.

Read more: Editorial: It’s time to kill the NDA

Pritchard, who is executive director for markets and international, also took the opportunity to make a clarification with regard to the use of NDAs.

She said: “I’d like to make it clear that our rules prohibit any term in an agreement that prevents somebody from blowing the whistle or from making a protected disclosure. So, as a matter of our rulebook, firms are not permitted to do that.

“I know there’s been a big focus here in relation to complaints disposed of by non-disclosure agreements. Actually, one of the reasons that we’re going out with the piece of work that I talked about… will be so that we can see how cases of non-financial misconduct are resolved.

“If we see, for example, the use of NDAs alongside non-financial misconduct coming through that survey, we’ll be able to take that into account in our future supervisory work.”

The FCA official added that there are valid reasons why an entity might use a non-disclosure agreement to keep settlement terms confidential but stressed that NDAs are not meant to be used to prevent somebody from articulating concerns of bullying, harassment, or sexual misconduct.

Pritchard was joined by FCA chief executive Nikhil Rathi, Prudential Regulation Authority (PRA) CEO Sam Woods, and PRA executive director for prudential policy Vicky Saporta.

What do you think about this story? Share your thoughts in the comments below.