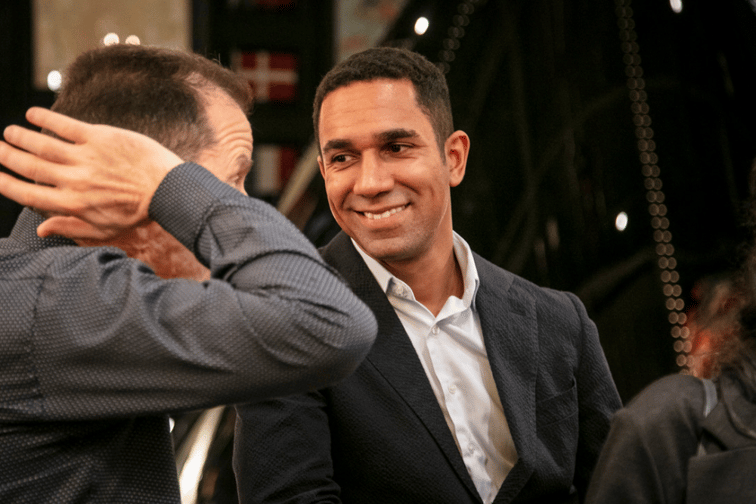

With a “dream team” assembled, an impressive panel of insurance partners confirmed, and new products in the offing, Jan-Vincent Finn (pictured), co-founder and CEO of the London-based MGA Aurora has got his eyes firmly fixed on the future.

The vision behind Aurora is clear, he said - the commercial insurance market is primed and ready for something of a shakeup, and such a shakeup can only come through leveraging technology and talent to the benefit of the wider insurance value chain. With over a dozen years of broking experience to his name – including time spent at WTW and Miller – operating on the front line of the insurance market has offered Finn a first-hand insight into where the ecosystem is not fit for purpose and what can be done to serve underserved customers.

Read more: What is the top concern for the UK’s SMEs?

“I think I recognised that the ecosystem could do a lot better for small-to-medium enterprises who were very much underserved,” he said. “They weren’t informed in making a decision, and data-driven insights and analytics weren’t as prevalent as they could be and should be for insurance buyers. Essentially, they were unable to purchase insurance in real-time… if you’re an SME and you want to buy a holistic range of insurance products ranging from property to accident and group health, it’s virtually impossible to do so today.”

Though officially registered as an MGA, Finn noted that Aurora is a hybrid entity, combining a tech-forward broking platform with the advanced algorithmic underwriting capability of an MGA. This unique model is testament to the ambition of Aurora to create a two-way dialogue between insurers and insureds, he said, and the firm sees itself as a natural partner to both.

“We are looking to serve the entire value chain,” he said. “If you look at the positioning of businesses that are in the ecosystem today, you’re either a broker, which basically means you serve only the customer, or you’re an MGA and your capacity provider is your predominant partner that you effectively serve. So they’re two sides of the same coin. What we’re saying is that while we are technically an MGA, we’re trying to make sure all the parties in the value chain – whether you’re the insureds, the broker or the insurer get a benefit from being part of the Aurora ecosystem.”

The value chain of insurance is multi-faceted, he said, and while ultimately it does serve insureds in its existing form, there is room for change. Depending on the product and the distribution route, there can be seven or eight different links in the chain which in itself highlights the inefficiencies weighing on the end client.

“And then if you look behind the scenes a little bit more, and you start peeling back the onion, you start to look at legacy systems and at the lack of ability for insurers to actually gain insight from the data that they have,” he said. “And then they’re unable to really pass that data back on effectively to the insured and/or their broker.”

At the core of Aurora’s offering is a simple question – what do insureds and their brokers actually want when they’re buying insurance? Armed with that answer, he said, his team can start utilising data, technology and their algorithmic underwriting capabilities to effectively facilitate responding to that demand. It’s a customer-centric proposition and one that is already translating well among its partners.

To date, Aurora has already partnered with Swiss Re to provide insureds, brokers and insurers with data-driven insights on liability risk exposure, while making the commercial insurance buying process more transparent. The partnership marks the very first time Swiss Re has enabled a third-party to better understand its liability exposure – which has traditionally been one of the hardest types of exposures to quantify.

In addition, Aurora is working with Mastercard in order to better understand business interruption exposures, which again is a first-of-its-kind partnership. All of this information and understanding then feeds back into refining underwriting and pricing and verification of claims, he said, which ultimately benefits both the insurer and the insured.

“And now we’re launching with a new product,” he said. “Our Global Specialist Health product looks at precision medicine in the UK – offering more tailored solutions for the likes of cancer [treatments] including clinical trials, etc. and also treatment abroad. So, for the very first time in the UK, SMEs will have the ability to seek treatment effectively in any facility in the world as organised by our partner. And then next year, in Q1, we will launch with a new product around property and BI.”

Read more: Aurora snaps up WTW hire

It’s an exciting time for the MGA, and Finn emphasised the expertise of the team he has around him, particularly that of his co-founder Bijal Patel who moved across from WTW to take up the role of chief technical officer at Aurora. Having a great team and great technology is one side of the equation, he said, but also critical is timing – and he has heard first-hand from the market that the time is right for such an offering.

“The fact is that insurance buys into the fact that the market is really underserved today,” he said. “So, if you’re an organisation, financial inclusion is not guaranteed. Today if you go online, the amount of times you’ll be kicked out of a particular website because you don’t meet their criteria and so won’t receive a quote is too common. And our founding pillar is that any insured should be able to come on to our platform, regardless of their risk profile, and get a quotation.

“So what we’re effectively doing is we’re pulling together some of the most progressive insurance companies in the world, to complement each other from a risk appetite perspective, to then provide that holistic insurance product range – and again, to cater to the underserved.”