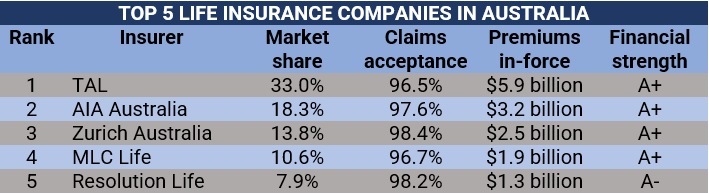

Australia is home to 24 insurers that offer a range of life insurance policies, according to the latest registration data from the Australian Prudential Regulation Authority (APRA). Of these, the top five life insurance companies in Australia control more than four-fifths of the market, with combined in-force policies worth $14.9 billion.

If you’re planning for your future and life insurance is one of the options that you’re considering to keep you and your loved ones financially secure, this list can help narrow down your choices. Apart from accounting for the lion’s share of the market, these insurers boast high claim acceptance rates and financial strength ratings, meaning you and your family wouldn’t have a hard time claiming the benefits. Insurance professionals can also share this article with clients who are on the lookout for life insurance providers they can depend on in times of need.

Market share: 33%

Claims acceptance rate: 96.5%

Premiums in-force: $5.9 billion

Financial strength rating: A+

Head office location: Sydney, NSW

TAL is a subsidiary of the Japanese insurance giant Dai-ichi Life, which completed the acquisition of the company in 2011. It was formerly known as Tower Australia. The insurer provides life insurance policies through the following brands:

One of TAL’s most popular life insurance plans is called Accelerated Protection, which has the following key features:

Market share: 18.3%

Claims acceptance rate: 97.6%

Premiums in-force: $3.2 billion

Financial strength rating: A+

Head office location: Sydney, NSW

AIA Australia is a subsidiary of Hong Kong-based AIA Group – the largest pan-Asian life insurance group and among the largest insurance companies in the world. AIA began its Australian operations in 1972.

AIA Australia is also the company behind the CommInsure brand, which it acquired in 2019. It has since ceased issuance of new policies under the brand but continues to service existing life insurance plans.

Among AIA’s life insurance offerings in the country is the Priority Protection Life Cover, which has the following features and benefits:

Apart from life insurance, AIA offers health insurance plans, as well as a health and wellbeing program that rewards healthy lifestyle called AIA Vitality.

Market share: 13.8%

Claims acceptance rate: 98.4%

Premiums in-force: $2.5 billion

Financial strength rating: A+

Head office location: North Sydney, NSW

Zurich is the Australian subsidiary of Swiss industry giant Zurich Group. It entered the country’s insurance market through the acquisition of the Commonwealth General Assurance Corporation in 1961. In 2016, Zurich announced the purchase of Macquarie Life and subsequently rebranded Macquarie plans as Zurich life insurance policies. A year later a deal to acquire ANZ Bank’s life insurance arm OnePath was announced. The transaction was completed in 2019 and Zurich has since continued to sell life insurance policies under the OnePath brand.

The Wealth Protection Death Cover, Zurich’s flagship life insurance policy has the following features:

Zurich is just one of two among the top five life insurance companies in Australia to register a claims acceptance rate above the national average of 97.7%.

Market share: 10.6%

Claims acceptance rate: 96.7%

Premiums in-force: $1.9 billion

Financial strength rating: A+

Head office location: North Sydney, NSW

MLC is jointly owned by Japanese insurance giant Nippon Life – which has an 80% stake – and the National Australia Bank (NAB) – which owns the rest.

Customers can access the MLC Insurance Life Cover that includes these features:

Market share: 7.9%

Claims acceptance rate: 98.2%

Premiums in-force: $1.3 billion

Financial strength rating: A-

Head office location: Sydney, NSW

Resolution Life, a UK-based specialist manager of in-force legacy insurance businesses, acquired the life insurance unit of ASX-listed AMP Life in 2018. However, Resolution has ceased the issuance of new AMP policies at the end of January 2019, although existing AMP policyholders are still able to manage and add to their policies.

In 2022, Resolution Life completed a significant separation milestone from AMP by acquiring the remaining 19.13% of its equity interest in Resolution Life Australasia. The deal was first announced in November 2021.

Still, Resolution Life controls almost 8% of the market and has the second-highest claims acceptance rates among the top five life insurance companies in Australia.

Claims statistics, meanwhile, are for death cover purchased with the help of insurance brokers and financial advisers calculated using an online tool from the Australian Securities & Investments Commission’s (ASIC) consumer channel MoneySmart. Lastly, financial strength ratings were taken from Standard & Poor’s (S&P).

Here's a summary of the top five life insurance companies in Australia.

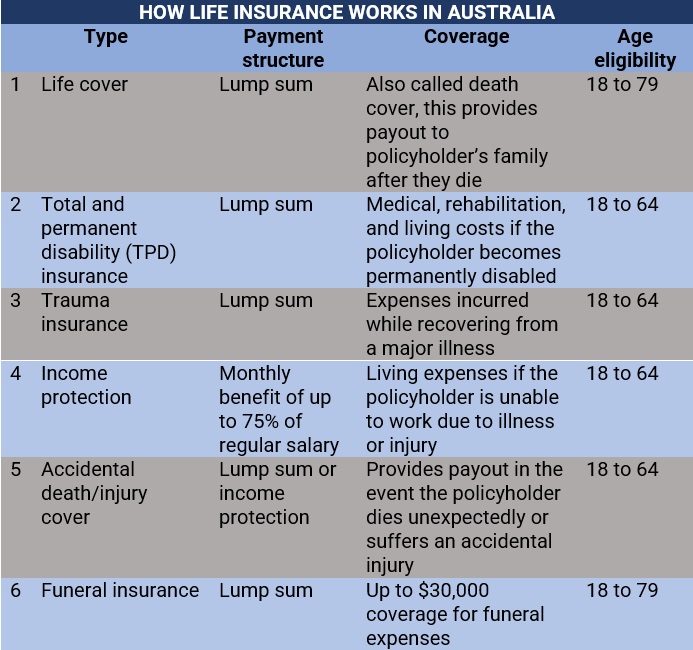

Life insurance is designed to provide a financial safety net should the policyholder die, get seriously ill, or become disabled. It pays out a lump sum payment that families can use to pay off loans and debts, as well as provide them with the financial means to meet daily living expenses.

In Australia, life insurance plans are classified into six categories, with each offering different levels of protection from varying situations. How these types of policies work is summed up in the table below:

Each person comes with a different set of circumstances, so it is difficult to provide a one-size-fits-all average of the cost of life insurance policies in Australia. Typically, life insurance premiums depend on a range of factors that determine how likely a person will make a claim. These include:

To work out how much coverage you require, experts recommend that you carefully assess your lifestyle and financial responsibilities. Among the factors you need to consider are your:

Premiums are also calculated differently depending on the type of policy. If you want to learn more about how this insurance component works, our comprehensive guide on insurance premiums can help.

If you want to find the top life insurance companies in Australia that offer policies that best matches your need, an experienced insurance agent or broker can help get the job done. You can also check out our Best Insurance Australia page, where you can link up with dependable and trusted insurance specialists across the country.

On this page, we feature only the insurance companies that are nominated by their peers and vetted by our panel of industry experts as respectable market leaders. These insurers can provide you and your loved one with the best coverage during the times you need it the most.

Have you taken out a policy from the top five life insurance companies in Australia? How was your experience? Share your story in the comment box below.