Arranging care for later life can be a complex and costly endeavour, highlighting the need for long-term care insurance in the UK. Unfortunately, this type of coverage is no longer accessible across the country, but this does not mean that British citizens are left without options.

In this article, Insurance Business explains why long-term care insurance policies are not being sold anymore in the UK, what options are available when it comes to financing care, and what plans are in place to enable citizens to access affordable long-term care.

If you’re planning for your own care or helping an older loved one, this piece can serve as a useful guide. For the insurance professionals who typically read our website, this article can serve as a quick way to help people with questions about long term care insurance in the UK. Feel free to share it with them by e-mail or on social media.

The main reason why long-term care insurance policies are virtually non-existent in the UK is the lack of cap on care costs. This prevents insurers from offering affordable plans as doing so exposes them to a substantial level of risk.

Although an £86,000 cap on lifetime personal care spending will be introduced in England as part of the government’s 2021 Vision for Adult Social Care reform, this amount applies only to “domiciliary care,” or what is also known as personal care. This covers nursing and assistance – whether with washing, dressing, feeding, or managing health problems – received in a person’s home or in residential care.

Several aspects of care home services are not categorised as personal care – including accommodation, food, energy bills, lifestyle and wellbeing services, and other consumables – which can easily add up to tens of thousands to even hundreds of thousands of pounds, are not covered under the cap.

Previously, long-term care insurance in the UK was offered as a standalone product, but advisers were required to acquire specialist qualifications, which some were reluctant to do.

To address this lack of coverage, former pensions minister Steve Webb proposed a pension-insurance hybrid that can ease the financial burden among Brits accessing long-term care services. We will discuss this proposal in more detail later.

While you cannot access long-term care insurance in the UK, there are several ways for you to get funding for later-life care expenses. Here are the four main ways:

Your local council can help cover a portion of or the entire care costs, whether you are in a care home or in your own residence, if you meet certain eligibility criteria. This entails you to undergo a pair of assessments. These assessments are free of charge.

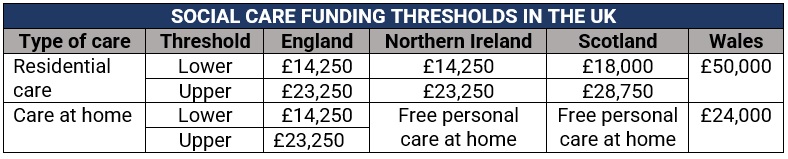

The table below shows the different thresholds across the UK for 2022-23.

Here’s a summary:

Wales does not have upper and lower limits, instead implementing a single threshold. Those whose assets are above the threshold, they will need to pay for their own care cost, while those below it may qualify for maximum funding from their local authority.

If you have a disability or serious medical issues, the NHS may partially or fully cover your later-life care costs, regardless of your financial situation. You can access public health system-funded care through these three NHS programs:

NHS Continuing Healthcare (CHC)

You can access CHC if you are dealing with complex medical issues due to illness, accident, or disability. Although this scheme mostly applies to people in care homes, you can also access it even if you are getting care at home.

CHC has strict eligibility requirements, but it may be worth pursuing if you think you may qualify. To apply, you should first ask your GP or social worker to arrange an assessment. This usually follows a two-step process:

During the initial assessment, trained NHS or social services personnel will use a checklist and decision support tool (DST) to determine your eligibility for a full evaluation. However, if these professionals find no clear evidence of your need for CHC, they are not required to complete the checklist. They also need to document the reasons for their decision. If they couldn’t come to a unanimous decision regarding your eligibility, they will need to complete the checklist.

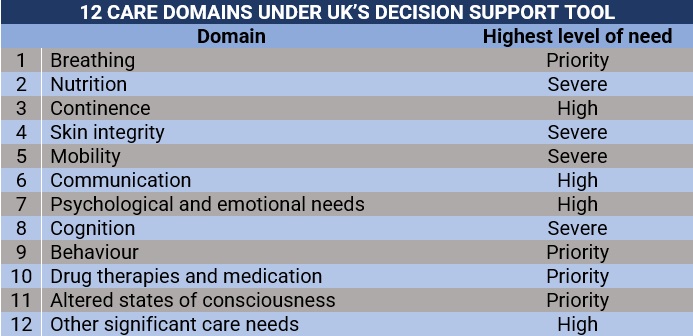

The checklist and DST involve 12 care domains that trained professionals need to consider. Each domain has descriptions of four to six levels of need, namely:

The table below lists the 12 care domains, along with their corresponding highest level of need.

CHC, however, is not available in Scotland. In its place is the Hospital-Based Complex Clinical Care (HBCCC), but this only covers those who are receiving long-term care in a hospital setting.

NHS-Funded Nursing Care (FNC)

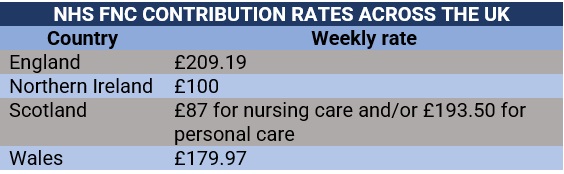

If you are ineligible for CHC, then you may apply for FNC. This provides a fixed weekly payment for your nursing costs, but only if you live in a care home and have been assessed as requiring registered nursing care. The table below shows the FNC contribution rates across the UK for 2022-23.

NHS Intermediate Care

The NHS may also provide up to six weeks of free care following a hospital stay or a brief illness, whether you are staying in your own home, a care home, or a hospital. This is usually arranged by the hospital’s social work team before discharge.

If after six weeks, you still need financial support, you will be given a plan for transferring to another service. This, however, doesn’t ensure that the financial support will continue, and you may end up paying for your care costs.

Immediate-care plans are the closest thing to long-term care insurance in the UK. Sometimes referred to as an immediate-needs annuity, this works like a standard annuity, where you receive regular payments for life in exchange for an upfront lump sum.

The payments go directly to your registered care provider. These are also tax-free, as long as you are staying in residential care. If you access care from your home, the payments go to you and will be considered income, which is taxed. In addition, you can arrange for the payments to increase over time to factor in inflation.

While immediate-care plans guarantee that you will not completely run out of money, especially if you require care for a long time, it is very costly. You may need to sell your home to purchase a plan with sufficient value and even after that, it will not automatically cover all your costs if these exceed the plan’s rates. Some plans also include a money-back guarantee if you die within the first six months after purchase.

If you’re not qualified for local council or NHS funding and you don’t think immediate-care plans are for you, you may need to pay for the costs of later-life care yourself. This can be done by utilising your existing income and assets – including pensions, savings, and investments – to cover your care expenses.

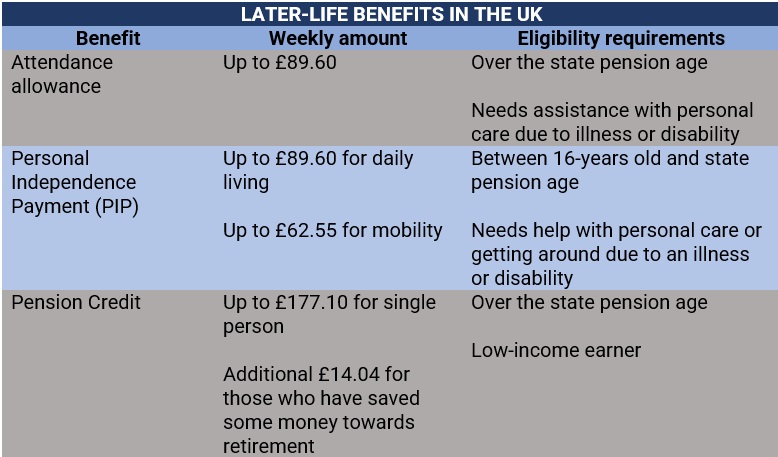

You can also take full advantage of later-life and disability benefits you are entitled to. These include some of the benefits detailed in the table below.

Care pension is a proposed coverage that will allow people near retirement to take money from their pension tax-free and pay it into this new type of insurance policy. Care pension actually works as a pension-insurance hybrid, wherein the policyholder will pay between £100 and £150 in monthly premiums to cover different later-life care scenarios. Once the policyholder passes a pre-defined threshold, the payments will go into a “special care account” until their death.

The idea was raised by former pensions minister and current Royal London policy director Steve Webb during the 2010-15 coalition government. The proposal, which is still in the early stages, however, needs to overcome one major obstacle. For care pension to work, the government will need to introduce a cap on individual care costs – something that’s also hindering the existence of long-term care insurance in the UK.

Based on the personal finance websites Insurance Business researched, the cost of home care services in the UK averaged between £20 and £30 per hour, with rates often increasing during weekends and bank holidays. This means if you require home care for three hours a day at a £25 hourly rate, you will need to pay at least:

If you’re getting care at home, live-in care rates are about £900 to £1,400 per week but can reach £2,000. At these rates, you will be paying between:

One important thing to bear in mind, however, is that there are no standard rates across the UK when it comes to later-life costs. Often, the amount you will need to pay is dependent on the level of care you require, the type of support you choose, and where you live in the country.

Most later-life care services are provided by privately run companies, which charge what they view as a fair market price. Local councils, meanwhile, usually have fixed rates that they are willing to pay. They can also negotiate lower rates with care providers based on the number of people they refer.

Unlike in the UK, long-term care insurance is readily available for Americans. If you want to learn how this type of coverage works, you can check out this guide on long-term care insurance in the US that we prepared.

Do you think citizens should have access to long-term care insurance in the UK? Should the proposed care pension push through? Share your thoughts in the comments section below.