Long-term care is a term used to describe the range of services and support given to those who are unable to care for themselves because of age-related impairments. This type of care can be provided at home or in nursing homes, assisted living facilities, or adult day care centers.

This is what long-term care insurance, also called LTCI, is designed for. It pays out the cost of medical and non-medical services provided in these venues for senior-aged individuals who have lost the ability to care for themselves.

Unfortunately, the high cost of long-term care services can easily exhaust a person’s retirement savings. This is why industry experts recommend taking out long-term care insurance for those who can afford to. Apart from helping seniors protect their retirement fund, this type of coverage gives them the option to get the best care possible.

If you are an insurance broker with people asking questions about long-term care insurance, this is an excellent article to share with them.

The answer to this can vary from state to state and country to country but in the USA, the policyholder needs to get certification from a reputable healthcare provider that they can no longer perform at least two of the following activities without direct assistance. These are also referred to as “benefit triggers,” And most countries have some form of this:

Policyholders may also be eligible for long-term care benefits if they have a debilitating condition, including Alzheimer’s disease, dementia, and schizophrenia.

In addition, most policies require beneficiaries to pay for care services out of pocket for a certain timeframe, also called an “elimination period.” This usually lasts 30-90 days, after which the insurance provider begins the reimbursements. LTCI plans pay out up to a daily limit for care until the lifetime maximum is reached.

Some insurers offer married couples a shared care option, allowing them to share the total coverage amount and draw from each other’s pool of benefits once one of the spouses reaches the limit on their policy.

Just like other types of insurance policies, premiums for long-term care insurance plans are influenced by a range of factors. These include:

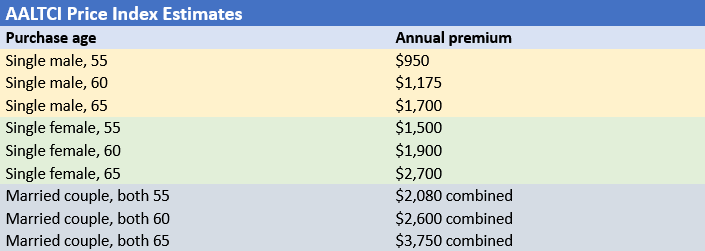

The American Association for Long-Term Care Insurance (AALTCI) recently released its 2022 Price Index detailing how much policyholders of different ages, gender, and marital status can expect to pay in annual premiums. Here’s a summary of the costs for a policy with $165,000 worth of coverage. According to the industry body, the rates shown below are for “Select” health policies, which are more expensive than “Preferred” health plans.

Read more about the break down of long-term care insurance costs by age here.

Because such policies provide health-related coverage, it is easy to confuse long-term care insurance policies with other forms of health plans. However, there is a vast difference in terms of coverage.

Read more: A guide to finding the best affordable health insurance plan

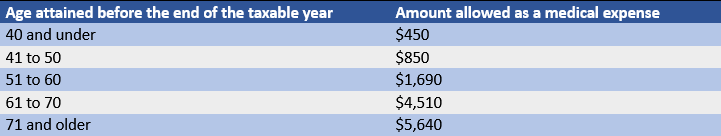

The Internal Revenue Service (IRS) allows qualified taxpayers to deduct a part of their long-term care insurance premiums on their tax returns as “unreimbursed medical expenses,” depending on their age. But they must itemize these deductions, which must also not exceed the adjusted gross income (AGI) threshold.

The table below shows the 2022 deduction limits set by the statutory body.

It is also important to note that LTCI plans come with tax-free benefits, meaning policyholders are not taxed from any benefits they receive.

There are going to be a variety of policies available from different companies in your country, but here are the common things to consider when choosing your policy:

Read more: Can you use life insurance to build wealth?

The best long-term care insurance providers are going to vary wildly depending on which country you are in. Head on over to our Best of Insurance page and click on your country along the top to look for insurance brokerages that will work for you. They are all vetted by their peers in a survey conducted by our staff.

What about you? Do you think long-term care insurance is worth considering? Share your thoughts in the comment section below.