Renters' insurance is a crucial form of financial protection easily accessible to the UK’s massive renting population, but one misconception is preventing many from taking out coverage – that their landlord’s insurance policy already protects their belongings.

The truth is, however, unless it is explicitly stated in the tenancy agreement, landlord insurance covers only, as the name suggests, anything that belongs to the landlord. And often, the only way for tenants to ensure that they do not end up footing the bill when an accident or disaster damages or destroys their possessions is to purchase renters insurance.

But how does this type of coverage work? Is it a legal requirement? What does it cover and how much coverage do you need? Insurance Business answers these questions and more in this article. If you’re a tenant trying to work out if this is the kind of protection you need, this guide can help you in your decision. For the insurance professionals who frequently visit our website, this is an excellent article to pass along to a client who has questions about renters insurance in the UK.

Simply put, renters insurance pays out the cost to repair or replace your personal belongings if they are damaged or stolen from the property you are renting. It works the same as home contents coverage in a homeowners insurance policy. That is why it is sometimes called contents insurance. Some insurers also refer to it as tenants’ insurance.

Renters' insurance is not mandatory in the UK, meaning you have no legal obligation to take out coverage. Your landlord likewise cannot require you to purchase renters insurance as part of your tenancy agreement. What they can do, however, is encourage you to get one and remind you of the financial protection such policies provide if an unexpected accident or disaster strikes the rental property.

Renters insurance is also transferrable, meaning you can take the policy with you when you move to another rental property or even if you have bought your own home.

This type of coverage is different from landlord insurance, which covers the things your landlord owns, including:

Landlord insurance does not cover anything that belongs to you as a tenant.

Renters insurance provides coverage if your personal belongings are lost, damaged, or destroyed due to:

The list of items typically covered by renters insurance includes:

Most renters insurance policies also provide tenants’ liability coverage, which pays out the repair and replacement costs if you unintentionally damage fixtures, fittings, and other items that your landlord owns in the rental property. This also serves to minimize end-of-tenancy deductions that cover the cost of fixing accidental damage.

Some policies also cover the cost of replacing the following:

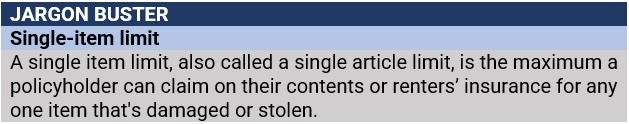

One thing to take note of is that renters insurance policies have a single-item limit, which is the most the insurer will pay for certain items. So, you may need to declare some of your more expensive possessions separately to have them properly insured.

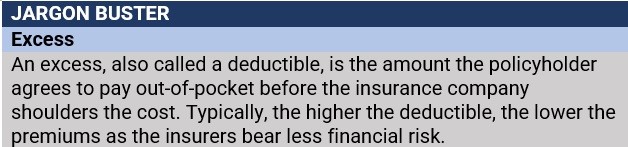

You will also need to pay an excess. Also called the deductible, this is the maximum amount you need to pay before renters insurance coverage kicks in. Learn everything you need to know about insurance deductibles in this handy guide.

Confused with all the insurance jargon? Check out our glossary of insurance terms for the meaning behind common industry buzzwords.

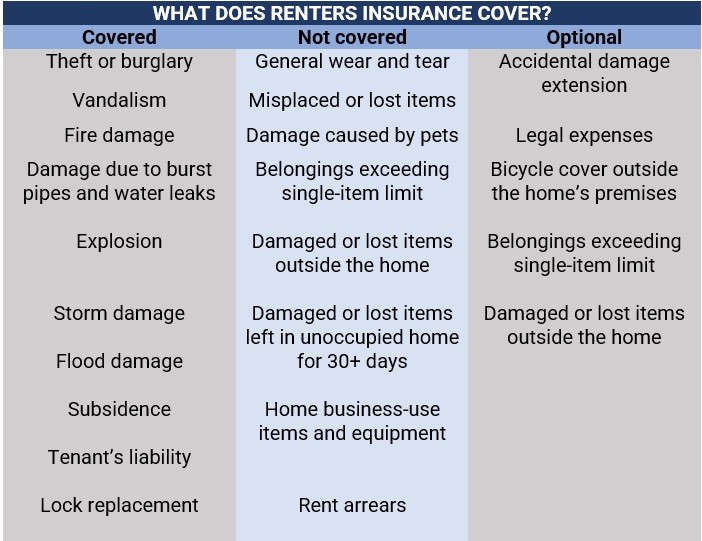

Not all losses or damages to your belongings, however, are covered by renters insurance. Policies typically exclude the following:

One benefit of renters’ insurance policies is that it provides flexible cover that can be tailored to suit the varying needs of tenants. If standard renters insurance coverage is not enough to meet your needs, there are a range of optional extras you can use to extend protection. These include:

The table below provides a summary of what is covered under your renters' insurance policy, what is not, and what optional extras are available.

Renters insurance is one of the most affordable types of policies that one can use. And just like in other types of insurance plans, several factors impact the price of premiums. These include:

Based on the research Insurance Business conducted, UK renters can take out contents-only coverage of a home insurance policy, which cost between £59 and £132 annually. This works out at about £4 to £11 monthly. Given the low cost, tenant insurance is worth having unless a person’s possessions are really limited.

Ever wondered how insurance companies come up with premiums? Find out how and everything else about insurance premiums in this comprehensive guide.

Each tenant’s situation is unique, so there is no one-size-fits-all coverage that suits every need. The answer to how much renters insurance coverage is needed is entirely up to you. The coverage amount should be enough to pay for the cost of repairing and replacing all your possessions should an unexpected incident occur.

It is important, however, to come up with an accurate estimation of how much your belongings are worth:

Most home insurers allow homeowners and renters to access personal property calculators to help customers work out the amount. An experienced insurance agent or broker can also help you find out how much coverage you will need.

Although it is not often that accidents and disasters happen, it still pays to be prepared. One of the most important benefits that renters insurance provides is the peace of mind in knowing that if an unexpected incident occurs, you have the proper financial protection to help you recover quickly.

Not all tenants, however, need renters insurance. If you have very few possessions, then this type of coverage is unnecessary. But if you own and store expensive belongings in the place you rent, then it pays to have this kind of protection. Renters insurance also suits those living in areas with high incidents of theft or those prone to flooding and other natural disasters. All told, renters insurance is a relatively cheap expense given the type of protection it provides.

Moving outside the UK? Find out how tenant insurance works in other parts of the world in our global renters' insurance guide.

Do you think renters insurance is a worthwhile investment? Tell us why or why not in the comment section below.