Leading Insurance Professionals in the USA | Hot 100 2024

Jump to winners | Jump to methodology

Heavy hitters

Going the extra mile and making the difference is the calling card for Insurance Business America’s Hot 100

of 2024.

This century of insurance professionals represents a collection of pioneers shaping the future of the

industry with their innovation and excellence.

IB America features three individuals on the list, who are changing the face of insurance in their own distinctive ways.

Jacey Norberg, Risk Placement Services, area president

Dax Craig, Pie Insurance Services, co-founder and president

Chad Hall, RT Specialty, president

Secrets of success

Norberg is riding high as the past 12 months have seen the culmination of exacting standards and devising a strategy of how to achieve them. She took on the role of area president for the RPS office in Eau Claire, WI; Waukesha, WI; and Omaha, NE.

“It had been struggling for quite some time but since I took over, we just kept getting better and better. It was about continuing to develop our young talent and some of our existing talent.”

Under her direction, in the past year the branch has recorded growth levels of:

-

19 percent revenue

-

26 percent premiums

-

15 percent new business

Over the entire four years, the corresponding figures are:

-

47 percent revenue

-

70 percent premiums

-

223 percent new business

The key for Norberg was changing the mindset.

“We are such a big, diverse company and the legacy staff had come from a very small mom-and-pop shop. So, I’ve been teaching them about the pieces of RPS and how to access those, and what they can use them for.”

Norberg also encouraged staff to shadow her dealings with clients to learn firsthand. She explains, “I wanted to add customer value, trying to get service up to a higher standard and almost a white glove service. As soon as they were able to see it, they realized it was completely achievable. I don’t want to say it was easy. But the key was to bring everyone in on creating our vision of service. Then, it was an easier path for everyone to work together to achieve it.”

Mirroring this trajectory is Craig, who also credits his success as the culmination of a team effort.

Pie is the fastest-growing workers’ compensation insurer in the US, and is active in 38 states and Washington, DC. Over the past 12 months, the firm has:

-

grown its partner agent network by almost 30 percent

-

announced a $315-million Series D round of funding, making it the largest round of financing for any US-based P&C insurtech company in 2022

Dax also spearheaded a partnership with Ford Motor Credit Company to launch Ford Pro Insure, a new commercial auto insurance product powered by Pie, that delivers customized commercial auto coverage and services to small businesses with the goal of helping them reduce overall fleet costs.

“Throughout a challenging economic landscape, especially within the commercial insurance industry, the past 12 months were undeniably demanding yet equally rewarding. Looking back, I feel incredibly proud of my accomplishments as a leader,” Craig says.

And he adds, “The past 12 months were a mix of planned strategies and unexpected challenges. While we anticipated growth and innovation, the industry faced shifts in economic conditions that were challenging for me, our team, customers, and partners.”

Keeping a laser-like focus on performance is why Hall has delivered impressive results for his team of 30 brokers and 150 staff.

In the past year, he has:

-

created the BOR Tour, an educational and networking series of events where insurance agents and underwriters can come together to learn about construction insurance-related topics

-

launched Labor Guard Online, an online insurance pre-qualification and risk management service to manage risk transfer for construction projects and large builders and general contractors across the country

-

produced a personal book of business with $450+ million in premium and 300+ projects in 2022, bringing a total 12-year career with RT Specialty of over 19,000 construction policies

He also stresses the importance of leading with a collective excellence mindset.

“I’m in a constant state of reflection about the performance of my team, but I’m not as concerned about the performance of the past 12 months as I am about the performance of 30-, 60-, and 90-day periods. I break it down to smaller increments and look for trends in weekly and monthly data. “

Hall utilizes data analyses to track:

-

productivity

-

deal flow

-

submission-quote-bind conversion rates

-

quality of relationship vs. quantity

“I look for trends while tinkering with the team to find the optimal balance to yield the greatest result for our clients. Spending too little time gets you beat and spending too much time makes you inefficient and hard to scale. It takes experience to learn the art, but the indicators are in the metrics if you look closely for them.”

Jacey NorbergRisk Placement Services

Key to being a Top 100 Insurance Professional

A strategy Hall has explored is time management. As his team and responsibility has grown, he has had to delegate to maintain quality. To do this, he placed an emphasis on honing his ability to assemble a team.

“A high-performing team is built by providing enough support and coaching opportunities that allows your team to continue in developing their skill set. Scaling your team too fast can diminish its value to your client and is a serious concern if you don’t have a solid foundation in place first to build from,” he explains.

“It is a fine balance and requires developing strong best practices that set expectations that are measurable and hold your team accountable when they don’t meet expectations and reward them when they do.”

For Craig, the target over the last 12 months was adopting the mantra of the need to remain fluid.

“Working by the same playbook as I did a year ago, or even six months ago, wasn’t going to cut it. The world is changing rapidly around us and requires a more flexible approach.”

In practice, this manifested as a test-and-learn mindset.

He says, “My role is to guide and encourage our teams to try new things without fear of failure. To move fast and meet the demands of our customers and partners, continual learning, and the ability to pivot when something wasn’t working became a critical lesson.”

Enabling him to offer his team a wider insight, Craig undertakes a series of additional industry roles:

-

serves on the board of advisors for Kovrr, an Israeli company that enables reinsurers to predict and price cyber risk, transparently utilizing advanced artificial intelligence and data

-

founding member of the Colorado Inclusive Economy, a statewide movement of design, intent, and action led by local CEOs and leaders

-

advisory board member for the Collins College of Business at the University of Tulsa

-

member of the Young Presidents’ Organization, which connects 21,000 business leaders in more than 125 countries around a shared mission: Better Leaders Through Education

While Norberg’s biggest takeaway was how best to create a team ethic. It was about setting benchmarks that different members would respond to.

“When you’re in sixth grade and everybody asks what you want to be when you grow up, nobody says insurance. I always wanted to be a teacher. I now get the best of both worlds because my job is writing business, but I also get to mentor people.”

She has also used a variety of bonding activities, such as a Winnebago trip to a winery and ATV rides, resulting in 97 percent employee retention. Some members of her team have been working in the office for 30 to 40 years, and she is attuned to what motivates each of them.

“It is about sitting down with every individual person, even the new employees, so everybody knows who comes in. I take the time to get to know them and try to figure out what makes them tick. Every new person that I bring in or if I see someone struggling, my reward is seeing them all become successful," he says.

Dax CraigPie Insurance Services

Top 100 Insurance Professionals look forward

RPS has tasked Norberg with spreading her genius, as she is now going to oversee the firm’s North Barrington office. She will use her special ability to identify talent and hone it.

One of her top performers was a former Harley-Davidson salesman.

“I knew he had the drive but just needed to add the industry knowledge as he was great with clients, so could add customer value. When I’m looking for new recruits, it’s not necessarily somebody who really knows insurance.”

In addition to scouring the market for talent, she also inspires others with additional roles:

-

instructor for the Wholesale & Specialty Insurance Association

-

founding member of the RPS Women’s Network

-

active within the Wisconsin chapters of the Independent Insurance Agents & Brokers of America and Professional Insurance Agents

At RT Specialty, Hall has weathered a tough time to come through stronger. By the end of the third quarter of 2022, fewer projects were being green lit.

“That led to greater competition for deals by insurance agents and brokers. To find growth you needed to outthink, outwork, and outexecute the competition. This can equate to putting in longer hours, more marketing, diversifying into new products, and creative thinking that would set you apart from everyone else to win you the business,” he says.

And he revealed how he drove his team to never take the small details for granted.

“A hard market will challenge a broker, but a hard market with fewer deals will really challenge a broker to bring their A-game. As you get further along in your career and have cast a wider and wider net, you can get spread too thin quickly. You must stay disciplined, keep your head down, grind, continue to learn and keep developing fresh strategy, products, and solutions.”

Holding a long-term mindset has also set Craig up for repeat success. He has made sure there has been no tradeoff between revenue and standards.

“I’ve made it a priority to guarantee that Pie’s expansion doesn’t come at the expense of delivering exceptional service. This will remain at the forefront of my decision-making next year as we double down on our commitment to both sustainable growth and innovative solutions that elevate the experiences of our small business customers and partners who serve them.”

He continues, “This mindset is not just a current focus but a guiding principle I intend to carry forward throughout my career.”

Chad HallRT Specialty

Leading Insurance Professionals in the USA | Hot 100 2024

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Richard Soo Hoo

Chief Operating Officer and Co-Founder

Sterling Insurance Group of Martha's Vineyard

-

-

-

-

-

- Akhil Chopra

Managing Director and Cyber Brokerage Leader

Lockton Financial Services - Alexandra Glickman

Area Vice Chairman and Senior Managing Director, Global Practice Leader – Real Estate and Hospitality Practice

Gallagher - Alka Manaktala

Managing Partner

IOA Insurance - Amy Shore

EVP, Chief Customer Officer

Nationwide - Anthony Dagostino

Global cyber chief underwriting officer for commercial lines

AXA XL - Bill Creedon

Global Head of Construction

Willis Towers Watson - Brad Nevins

President and Founding Partner

FastrackCE, a Direct Connection Advertising and Marketing Company - Carolyn Toomey

Senior Vice President and Chief Underwriting Officer, Arch Healthcare

Arch Insurance - Casey Hartley

SVP, Head of E&S Wholesale Casualty and Environmental

Everest Insurance - Charles Williamson

CEO

Victor Insurance - Chase Johnson

Senior Vice President, Construction and Design Team Leader

Lockton Financial Services - Chaya Cooperberg

EVP, Chief People and Communications Officer

AmTrust Financial - Cory Friedman

Managing Director, Veterinary Division

Alera Group - Danette Beck

National Construction Practice Leader

USI Insurance Services - Daniel Ginden

Managing Director

Novatae Risk Group - Danielle Elizabeth Lenzi

Head of Risk Management/Risk Executive

Rudin Management - Dawn D’Onofrio

Chief Executive Officer

WKFC, AgRisk, and Ryan Specialty National Programs - Deborah Fox

Vice President

NFP - Denise Campbell

Senior Vice President, Client Executive

Marsh - Dwight Williams

National Account Director, Management Liability Practice

Risk Strategies Company - Eileen Frank

President and CEO

JP West - Fela Abioye

Managing Director

The Hartford - Garrett Droege

Director of Innovation and Digital Risk Practice Leader

IMA Financial Group - George Woods

Head of US P&C Broker Sales Management

Swiss Re - Jack Ramsey

VP, Agency Channel

Next Insurance - Jacqueline A. Waters

Managing Partner and Practice Leader - Financial Services, Legal and Claims, Commercial Risk Solutions

Aon - Jacqueline Roth

President of Employee Benefits

IMA Financial Group - Jeff Breskin

Senior Vice President, Risk Management

The J. Morey Company - Jeff Lamb

Executive Director, Programs and Alliances

Markel Specialty - Jen Jacobson

Head of North America, Professional Lines

AXIS Capital - Jen Tadin

MD, Global Small Business and President of Gallagher Agency Alliance

Gallagher - Jennifer Hammersley

Senior Vice President, Head of Financial Lines Underwriting

Swiss Re - Jennifer Wilson

Senior Vice President, National Cyber Practice Lead

Newfront - John Chu

Founder and CEO

Bamboo Insurance - Katie Davies

CEO and President of JEM Underwriting Managers and CEO of Technical Risk Underwriters

Ryan Specialty - Ken Leibow

Chief Executive Officer

InsurTech Express - Kent Hamilton

President /Insurance Broker/Producer

Front Row Insurance Brokers LLC - Kimberly George

Global Head, Innovation & Product Development

Sedgwick - Kristen D. Peed

Corporate Director, Risk Management and Insurance

Sequoia Consulting Group - Kristin Kraeger

Chief Executive Officer, Professional Services

Aon - Lael Chappell

Chief Marketing and Business Development Officer

Desq - Larry Fine

Management Liability Coverage Leader, FINEX North America

Willis Towers Watson - Leanne Berry

Vice President, Distribution

Vantage Risk Companies - Mary Pat Joyce

Managing Executive, Carrier Alliance

Markel Specialty - Matthew McLellan

Managing Director

Marsh - Michael J. Sicard

Chairman and Chief Executive Officer

USI Insurance Services - Michele G. Centeno

Senior Vice President

Lockton Financial Services - Michelle Chia

Head of Professional Liability and Cyber

Zurich North America - Michelle Lopilato

Head of Distribution and Founding Member

Converge - Nadia N. Hoyte

Executive and Professional Risk Solutions

USI Insurance Services - Noah Bank

Vice President

HUB International - Patricia Kocsondy

Head of US Cyber and Technology

Beazley - Paul H. Flowers Jr.

Regional Director of Broker and Sales Development

Fountain Health Insurance - Peter R. Taffae

Chief Executive Officer

ExecutivePerils - Pilar Summerville

Senior Vice President

RT Specialty - Quinn Shepherd

CEO and Managing Partner

Sheperd Insurance - Rachel Miller

Vice President, Management Liability

Woodruff Sawyer - Rachel Perry

Chief Innovation Officer, Commercial Risk North America

Aon - Ronald Keller

Senior Underwriter, E&S Casualty

Ascot Group US - Rusty Reid

Chief Executive Officer

Higginbotham - Sabrina Hart

President and CEO

Munich Re Specialty Insurance - Sanjay Mehta

Executive Vice President, Chief Market Officer

The Liberty Company Insurance Brokers - Scott Hudson

President and CEO

Gallagher Bassett - Senan O’Loughlin

Executive Vice President, Head of US Mortality Markets

RGA - Shevawn Barder

Founder and CEO

AM Specialty Insurance Company - Steve Love

Founder and CEO

Solero - Susan Rivera

CEO and Co-Founder

Tokio Marine HCC - Tammy Kocher

Assistant Vice President, Cyber Underwriting

BCS Financial - Teaqoshawn Nelson

Senior Product Marketing Manager

Duck Creek Technologies - Theresa Le

Chief Claims Officer

Cowbell - Thomas Elfert

Senior Vice President

Arthur J. Gallagher & Co. - Tom Reagan

Cyber Practice Leader, FINPRO Practice

Marsh - Tony McIntosh

President and Partner

Aura Risk Management & Insurance Services, The Liberty Company Insurance Brokers - Tracey Sharis

President, Global Risk Solutions, North America Programs

Liberty Mutual - Trent Cooksley

Co-Founder and COO

Cowbell - Trish Buckhardt

Executive Vice President, Chief Operating Officer

Nautilus Insurance Group - Valerie Taylor

Producer, Vice President (National Cannabis Practice Leader)

The Liberty Company Insurance Brokers - Yiana Stavrakis

President

Monarch E&S Insurance Services

Methodology

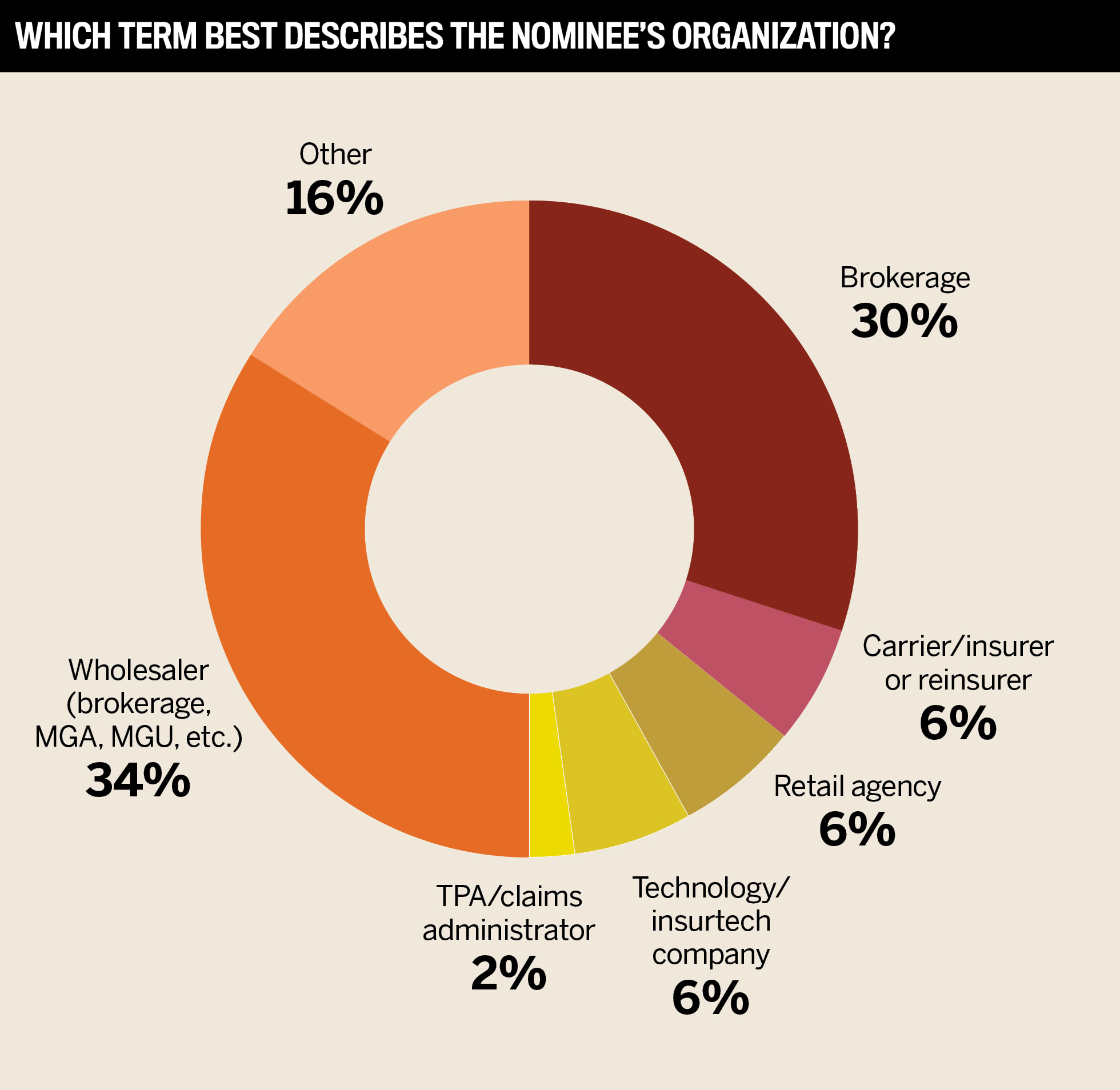

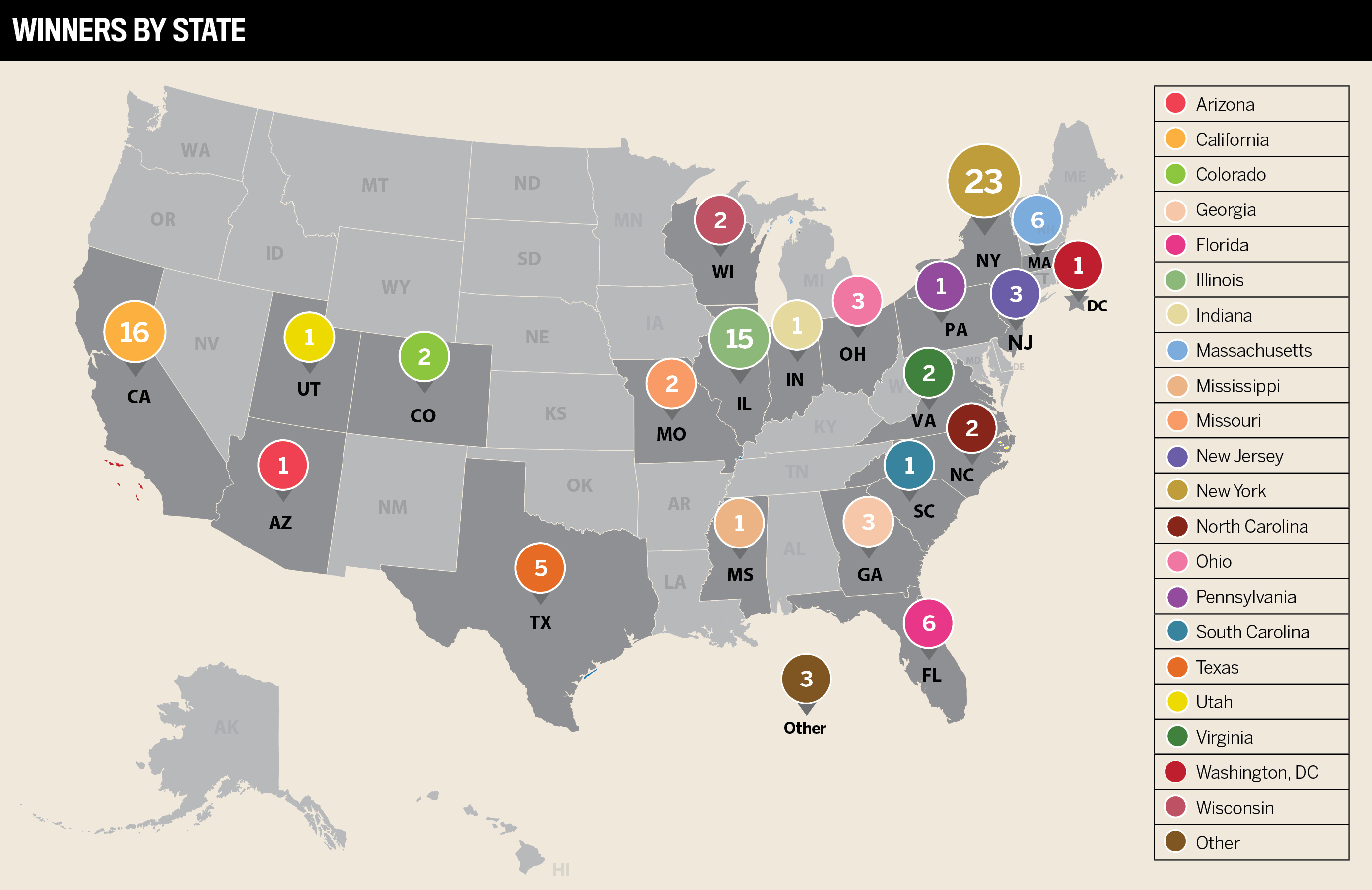

Starting in August 2023, Insurance Business America invited insurance professionals from across the country to nominate their most exceptional leaders for the ninth annual Hot 100 list. After receiving hundreds of nominations, IB America narrowed the list down to 100 movers and shakers whose contributions have helped shape the insurance industry over the past 12 months. From innovators at the forefront of change to leaders who are transforming the way the industry does business, this year’s Hot 100 list represents the best the industry has to offer.

This report is proudly supported by the Association for Cooperative Operations Research and Development (ACORD).

About the supporting association

Association for Cooperative Operations Research and Development (ACORD)

ACORD is a non-profit, industry-owned organization. For 50 years, ACORD has enabled the success of the global insurance industry by facilitating the flow of data and information across all insurance stakeholders through relevant and timely data standards.

ACORD moves the global insurance industry forward by encouraging and facilitating global information, enabling improved efficiency, and implementing effective, strategic positioning.

Keep up with the latest news and events

Join our mailing list, it’s free!