Five years ago, Fireman’s Fund Insurance Company began investigating infrared technology. With forward looking infrared (FLIR) cameras, the risk management division believed it could control water-related incidents—its biggest source of loss—beef up valued-added services and save money by identifying issues on a property before a loss event.

Today, each of the group’s 30 risk managers are equipped with FLIR cameras. Together, they conduct 7,000 inspections a year and this year, helped spot just shy of 100 issues before they led to a loss for the company.

The inclusion of these cameras and complimentary inspections has helped producers working with Fireman’s Fund retain clients and add the kind of value-added services that testify to the value of an independent agent, says Richard Standring, risk services manager for Fireman’s Fund.

“Our agents love it,” Standring told

Insurance Business America. “They’ve got clients who have got a house or another property with a history of water loss, and they say ‘Can you help us preserve this building?’ And they get to say, ‘Absolutely.’”

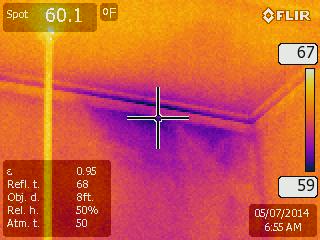

The FLIR cameras work by detecting “cold spots,” which usually indicate wetness. Risk managers then use a moisture meter to detect wetness, generally caused by a leaking pipe in a second-floor bathroom or laundry room.

The inspections have served both private residences as well as commercial properties, including the world-famous Newport Mansions. These kinds of clients particularly appreciate the addition of the FLIR cameras, Standtring said.

“It’s amazing how well the policyholders respond to this,” he said. “When you point out the problem to they and say, ‘Go have that fixed,’ they’re on the phone with their contractor before we’ve even left. A loss is a major inconvenience to these people and they really appreciate the service.”

Standring has taken the experience as an important message to the insurance industry in adopting emerging, yet expensive technology.

“You can never rest on your past success. There’s always some new technology out there, whether in hardware or software,” Standring said. “The profit margin in personal lines insurance in particular is so painfully thin that everything we can do in risk management helps that bottom line.”

The FLIR cameras work by detecting “cold spots,” which usually indicate wetness. Risk managers then use a moisture meter to detect wetness, generally caused by a leaking pipe in a second-floor bathroom or laundry room.

The FLIR cameras work by detecting “cold spots,” which usually indicate wetness. Risk managers then use a moisture meter to detect wetness, generally caused by a leaking pipe in a second-floor bathroom or laundry room.