In a statement released by Americans for Tax Reform (ATR), a conservative advocacy group, significant concerns have been raised over the National Association of Insurance Commissioners’ (NAIC) latest regulatory actions. ATR claims that NAIC, a regulatory body made up of insurance regulators from all 50 states, the District of Columbia, and US territories, is imposing unnecessary regulations on life insurance companies that invest in certain types of asset-backed securities (ABS), such as collateralized loan obligations and securitizations of various loans.

These increased regulations, according to ATR, could potentially lead to a decrease in the attractiveness of defined contribution (DC) retirement plans, such as 401(k)s, for American workers, due to reduced returns from investments in residual ABS tranches.

ATR was reacting to minutes from an NAIC meeting of the Risk-Based Capital Investment Risk and Evaluation (E) Working Group just over a week ago in Phoenix, Arizona. It pointed to a recent Oliver Wyman report which suggests that the proposed increase in capital requirements for residual ABS tranches from 30% to 45% by NAIC is disproportionate to the actual risk these investments pose, especially when compared to the losses on common stock, which carries a capital charge of 30%. The NAIC has invited comment on the report. ATR advocates for the proposed regulations to be delayed by at least a year and calls for a comprehensive cost-benefit analysis before any increase is implemented.

ATR has also criticized the alignment of these rules with the international Basel III Endgame banking regulations, which they argue were established by unelected officials and should not influence US state-regulated insurance entities.

ATR also claims that unions and the Biden Administration are influencing these regulations to undermine DC plans and promote defined benefit plans, which they argue are often used to further left-wing political agendas through shareholder activism.

The statement also mentions the efforts of the hospitality union UNITE HERE against annuity products backed by private equity, as well as legal actions by unions against public companies shifting to DC plans. According to ATR, these movements stem from a desire to maintain control over corporate policies through environmental, social, and governance (ESG) agendas associated with defined benefit plans.

ATR warns that these regulatory changes will force annuity providers to hold more cash, limiting investment options for DC plans and potentially harming American workers’ retirement savings. It urges the NAIC to adhere to due process principles similar to the Administrative Procedure Act, and not to proceed without substantial evidence that increased capital charges would benefit the industry or its clients.

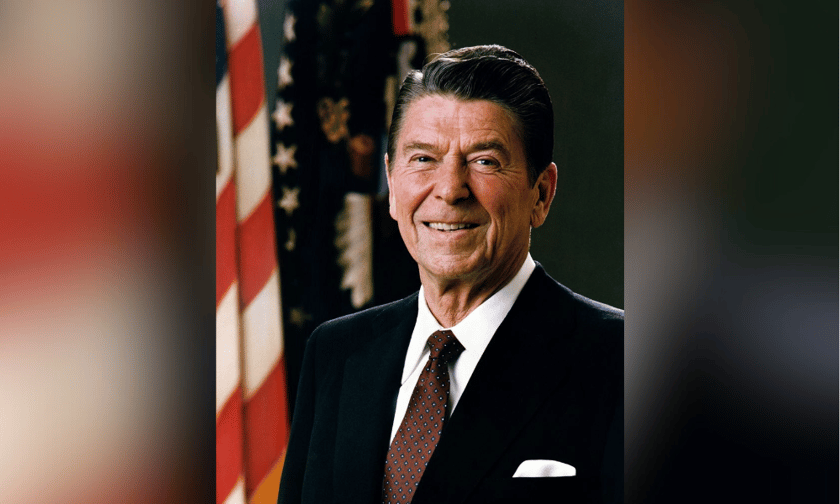

Americans for Tax Reform (ATR) is a politically conservative US advocacy group dedicated to reducing the size of government and opposing higher taxes at both the federal and state levels. Founded in 1985 by Grover Norquist at the request of President Ronald Reagan, ATR is best known for urging politicians to sign the Taxpayer Protection Pledge, a commitment not to increase taxes.

Over the years, ATR has been active in a variety of tax-related issues, including opposition to income tax increases, advocating for simpler tax codes, and reducing government spending. The organization also plays a significant role in tax reform debates, providing analysis and arguments against tax hikes and for tax reductions. Beyond taxation, ATR engages in broader economic issues and regulatory matters, emphasizing the principles of free market and limited government.

ATR’s influence extends into numerous policy areas, including healthcare, energy, and technology, where it advocates for policies that promote economic freedom and individual liberty. Its activities range from lobbying and legislative analysis to organizing grassroots campaigns and educating the public and policymakers on fiscal policies.

Over the years, investigations and reports by media and watchdog groups have suggested that ATR’s funding has included contributions from the tobacco industry, the alcohol industry, and other business interests that benefit from the group’s tax policy positions. Additionally, ATR has been linked to broader networks of conservative donors and organizations, such as those associated with the Koch brothers, who are known for supporting libertarian and conservative causes in the United States.

It’s important to note that the specifics of ATR’s funding, including the identities of its donors and the exact amounts contributed, remain largely confidential due to the organization’s status and the current regulations governing such entities in the US.

Have something to say about this story? Let us know in the comments below.