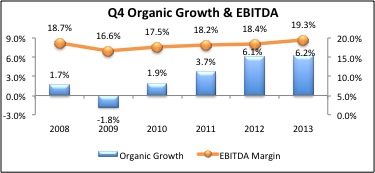

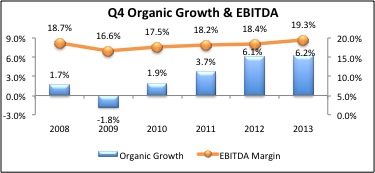

Large to midsize independent agencies and brokerages posted organic growth of 6.2% in 2013, narrowly outperforming 2012’s 6.1% growth, a report from management consultant Reagan Consulting found. Earnings before interest, taxes, depreciation and amortization (EBITDA) margins also saw an impressive jump—from 18.5% in 2012 to 19.3% in 2013.

In fact, median revenues for firms responding to Reagan's survey was $15mn last year. EBITDA margins represented a six-year high since Reagan began studying the organic growth and profitability of independent agencies in 2008, noted Kevin Stipe, president of Reagan Consulting.

“Broker performance has progressed significantly in the last five years,” Stipe said. “It wasn’t too long ago, in 2009, when brokers were shrinking organically (-1.9% median organic growth).”

Stipe attributed the sector’s success to independents’ ability to “capitalize on a firming market, a recovering economy and new business initiatives.”

“Agents and brokers have…made large strides forward in performance and shareholder returns,” he said.

Image source: Reagan Consulting

Image source: Reagan Consulting

However, Stipe cautioned that independents may not be able to keep up with their impressive rate of growth.

“We do not necessarily think that brokers will go backwards, but we are wondering if brokers can maintain their impressive run of consistently improving results,” Stipe said.

Reagan surveyed roughly 140 mid-size and large agencies and brokerages to complete the report, primarily specializing in the property/casualty market. About half of the industry’s 100 largest firms participated, the consultancy said.

In a separate conversation with

Insurance Business, Stipe added that growth in the firms' employee benefits markets (typically comprising 20% of revenue for those surveyed) has stagnated while brokers in the P/C space have experienced these impressive gains.

“Complexity [of the Affordable Care Act] and healthcare cost pressures have combined to scare folks and to limit the growth of the employee benefits line—5% annual growth over the last four years, which is way below what it was prior to that,” he said.

Stipe said he believes there will be growth opportunities for larger brokers in the employee benefits space, but “the under-50 life groups will dwindle.”