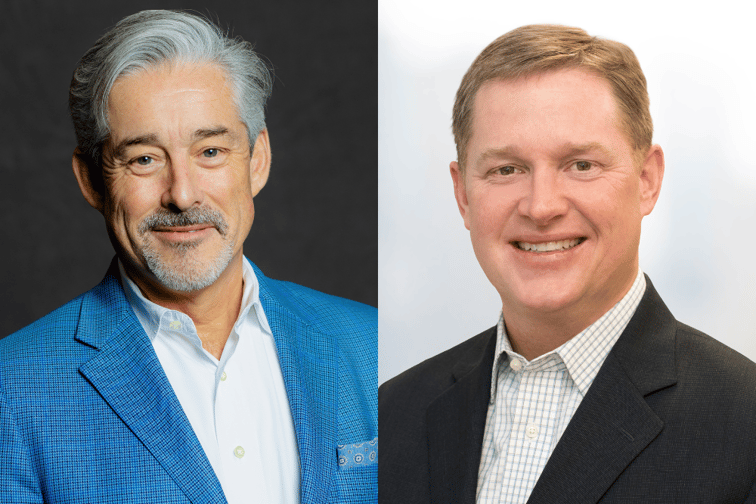

The constraints, challenges and exposures that persisted throughout the P&C market in 2023 will not be going anywhere in 2024, according to Amwins’ executive vice president, national property practice leader Harry Tucker, and Thomas Dillon, the company’s executive vice president – national casualty practice leader.

“The heavily cat exposed properties are going to be remain a problem, while any adversely affected business in any way, is going to be the toughest challenge for us,” Tucker said.

“In the casualty space, auto continues to be an area difficulty from a profitability perspective for carriers both within the primary and the excess space. It's not just trucking companies, it’s sales fleets, construction fleets and emergency medical,” Dillon added.

While a significant market softening is not expected to occur in 2024, both Tucker and Dillon believe that there is also a chance for carriers to tap into opportunities through specialization in uncertain times.

“The areas of dislocation, where the market is either going up or down, are also areas of opportunity,” the former said.

“We're highly focused on the cat-driven difficult property risks — that’s our forte.”

On the casualty side, Dillon is noticing that continued uncertainty in the standard markets is also going to provide more opportunity for the E&S space in 2024.

“You're seeing risks that have moved from the E&S space into the into the standard space that are not ready to come back based on performance, based on the performance of an industry segment or on an account-by-account basis,” he said.

Elsewhere, Tucker believes that growth and sidestepping market constraints is through insurance professionals seeking continued specialization when dealing with difficult accounts.

“Opportunity going into the future will be found in the continued investment in specialization and expertise in specific markets and industries,” he said.

In an interview with Insurance Business, Dillon spoke about why the middle market space will be the most competitive in 2024 while both spoke about why tort reform may be more difficult to pursue.

Within the Amwins state of the market for 2024 report that was released last month, middle market business, specifically insureds with premiums between $10,000 to $100,000, remained the most pursued class of business since carriers find it more profitable overall.

Dillon expected that this will continue to be the case in 2024, resulting in the segment becoming more competitive throughout the year.

“In the casualty space, insurance companies have historically performed better from a loss perspective on small middle market business,” he said.

“It's also much stickier business. If you have a $30,000 account, you get 10% increase, that’s $3000. It doesn't move from carrier to carrier as frequently as the as the larger business does. If a carrier loses money in one year, they know they have a couple years down the road to make it profitable, because the business will mostly likely stay with them, versus jump ship and go to another carrier.”

This is a result of business being more efficiently handled by insurance professionals, which Dillon expects to increase in the coming months due to more technological capabilities being introduced and refined.

“With the use of AI and technology, you can quote things quicker,” he said.

However, Dillon predicts that there will be more concerted efforts to increase the capabilities of this segment to make carriers even more competitive.

“They're developing teams and technologies within their underwriting group, just to focus on that business,” he said.

“They’re getting the Cadillac of products that have efficiency, quickness and fair pricing in mind.”

Elsewhere, as litigation funding and social inflation becomes more widespread, insurance professionals like Tucker and Dillon hoped that more government action will be taken to curb this widespread phenomenon.

“Hedge funds are aggressively going after that business right now. It's good money,” Tucker said.

“On the surface, it looks as if it's benefiting the consumer and the plaintiff. But it’s sort of a dichotomy or a paradox that these attorneys are saying, ‘we're going after the big bad insurance company, we want the big money,’ when it's actually big money that is funding these things.”

However, Dillon has noted that states have been noticing how these organizations and their tactics are affecting the judicial system.

“The more states that come in and maybe not alleviate or limit it, but at least expose this practice will be very helpful,” he said. “We can hope that from the front end, least, there's no Wizard of Oz behind the curtain, that's pulling all the strings that to give individuals the ability to bring frivolous lawsuits into the system.”

Dillon points to the recent passing of Florida’s House Bill 837, which is meant to help curb frivolous lawsuits, as a step in the right direction.

“But it takes a while for these things to work their way down the system,” he said.

“However, because of our political and election system, there may be a whole new legislator in office in three to five years once we begin to witness the true impacts of these reforms.”

Furthermore, plaintiff attorney political PACs also have a lot of power, with the ability to influence federal legislation.

“It’s very difficult for tort reform to pass because the plaintiff's attorney bar is such a strong lobby pack in Washington. It will have to be done on a sate-by-state basis,” Dillon said.