This article was produced in partnership with Amwins.

The cannabis industry in the United States is abuzz with activity. Combined medical and recreational cannabis sales are projected to reach around $33 billion by the end of 2022, according to MJBizDaily’s US Cannabis Retail Sales Estimate: 2015-26, thanks to more states passing positive legislation.

In 2022, Mississippi became the 37th state to legalize medical marijuana, and Rhode Island, Maryland, Missouri all approved recreational adult-use. On November 23, US Congress also passed the first ever bipartisan cannabis bill, known as the Medical Marijuana and Cannabidiol Research Expansion Act, which will enable researchers to fully study the health benefits of cannabis, and could potentially lead to more federal regulation.

In tandem with the regulated marijuana industry, the hemp CBD industry is now reaping the benefits of the 2018 Farm Bill, which removed hemp and derivatives of cannabis with very low concentrations of the psychoactive compound delta-9-tetrahydrocannabinol (THC) (no more than 0.3% THC on a dry weight basis), from the definition of marijuana in the Controlled Substances Act (CSA).

This new-found legality of hemp CBD opened doors to financing, insurance, and paved the way for more cannabis product development in the medical, health and wellness space. Unlike hemp CBD, marijuana remains a Schedule 1 drug under the CSA, which has really prohibited insurance carriers and financial markets from supporting the cannabis industry.

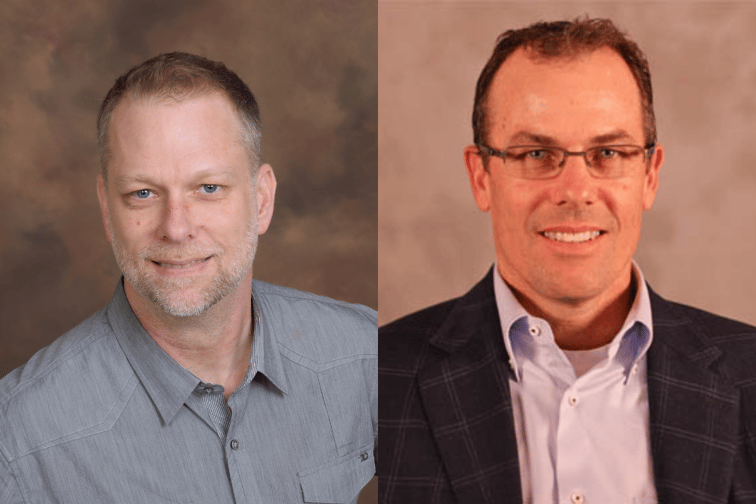

“Regulated marijuana for medical and/or recreational use, and hemp CBD are two distinct risk profiles,” said Norman Ives (pictured, left), cannabis specialist with Amwins Brokerage in Los Angeles, CA. “A regulated marijuana business will have different insurance needs and different insurance available to it than a hemp CBD risk. Insurance carriers are generally more comfortable with the federal position around hemp CBD.”

Morgan Moore (pictured, right), EVP with Amwins Brokerage in Los Angeles, CA, said the regulated marijuana industry is still largely “underserved” by the insurance markets, with only a few “robust coverage” options available. This could become problematic as the industry grows, and more states legalize recreational adult-use cannabis.

Western states pioneered the legalization of adult-use marijuana, with Washington and Colorado coming online in 2012, followed by Oregon in 2014 and California in 2016. While these states paved the way for the recreational cannabis industry, cracks are now showing in their foundations.

“In mature markets, the wholesale price of cannabis has dropped significantly,” said Ives. “In some cases, it's actually selling for less than the cost of production, which is putting a tremendous amount of pressure on the producer and/or processors, particularly those in the middle or bottom end of the revenue model. If they're not producing a high quantity of cannabis, they're struggling to compete with the big players in the mature markets.”

Eastern states have generally been slower to legalize cannabis. New York approved adult-use in 2021, and has now started granting cultivator licenses, with the aim of having dispensaries up and running by the end of the year. However, delays are expected as the state is currently engaged in a legal battle over its licensing criteria.

As more states legalize adult-use marijuana, cultivators, producers, processors, and distributors are looking to the mature markets in the Western states to understand their business models, and see how they incorporate technology and innovation. They’re also focused on how to address social equity issues associated with the prior illegality of cannabis operations. But the mature markets are far from perfect role models.

“Financially, many cannabis operators are not in a great place. There’s a ton of debt in the cannabis industry, which is going to create a lot of enforcement activity,” said Moore. “In addition to that, more states are coming online and they’re throwing out licenses, so we have this combination of people just getting started in the industry in certain states, and other states now reaching 5+ years in maturity and struggling financially.”

Cannabis has been cultivated and used for both medical and recreational purposes for centuries. While regulated marijuana is still ‘an emerging market,’ many consumers are already familiar with the product. Therefore, cannabis companies have the challenge of keeping traditional users interested in legal products, while also attracting non-traditional users with innovative offerings like gummies, drinks, and health and wellness solutions.

“Research and development of cannabis products has been very delayed, and there are so many unknowns as to how far the product can go. The passage of some of these laws [like the Medical Marijuana and Cannabidiol Research Expansion Act] is opening up other ways to research,” said Moore.

Ives said he’s seeing “a continued push into minor cannabinoids,” which are naturally occurring compounds found in cannabis plants, often believed to have therapeutic and medicinal effects.

The two most common cannabinoids are cannabidiol (CBD) and tetrahydrocannabinol (THC), both of which are commonly highlighted on regulated products on the market today. But now companies are trying to find ways to produce and market other cannabinoids, including cannabinol (CBN) which is believed to help with sleep, and non-psychotropic substances (meaning they won’t induce a “high”) like cannabigerol (CBG).

This can create insurance challenges, especially if the cannabinoid is synthetic, meaning it is a chemically engineered analog. CBN, for example, is the product of oxidization and can be manufactured from the exposure of THC to heat and light. To create CBN, producers may be tempted to buy Farm Bill-approved hemp, which they can convert into their desired cannabinoid. However, Ives urged caution for those tempted to supplement their regulated THC or CBD products in this way.

“Many cannabis carriers exclude coverage for manufactured cannabinoids,” he told Insurance Business. “If you're extracting a cannabinoid from a raw cannabis plant, that's not a problem at all. But if you're buying Farm Bill-approved hemp and converting it to another cannabinoid, you may not have insurance coverage. If your policy has an exclusion for analogs or synthetic cannabis, you could very well be adding an ingredient that makes your product uninsurable.”

The regulated cannabis industry is always evolving. Companies are trying to innovate and capture new clientele with fresh products, while navigating a complex regulatory minefield.

“The cannabis market is growing. It’s an emerging industry, and we’ve got this amazing amount of technology and evolution that’s happening over a short period of time,” said Ives. “I would encourage agents and brokers to work with a specialist in the space. Don't shop for a policy, shop for a broker who knows what they're doing, and can help you understand the different carriers’ appetites and intent with their coverage.”