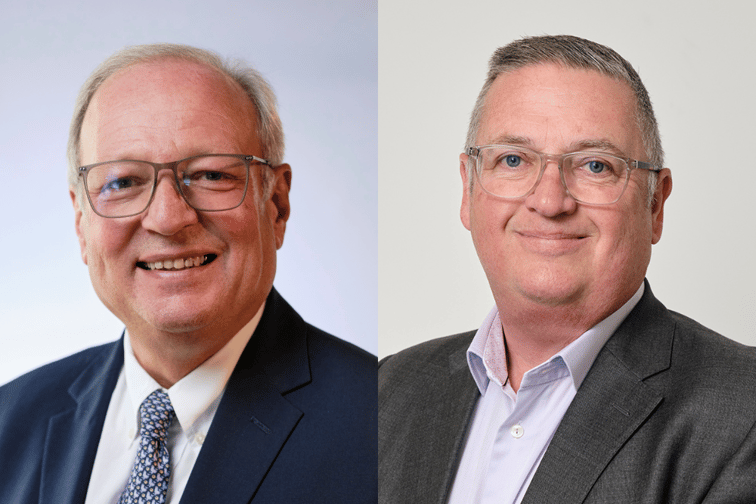

Looking back on the evolution of QuestGates over the last two decades, managing director Chris Hall (pictured left) noted that “it doesn’t feel like 20 years at all.” One of the original three founders of the specialist loss adjusting and claims handling company, Hall remembers the ‘have a go’ approach taken to building the business.

“Never in our wildest dreams, did we think we’d get to where we are,” he said. “And the pace of change in the last three years alone has been incredible. In three years, we have more than doubled the size of the business. It took us 17 years to get to £20 million and only another three years to get to £40 million. So obviously we were slacking in those early years!”

Several factors have underpinned this rapid growth, key among them the acquisition trail QuestGates has been blazing . Similar to the broking market, Hall said, the loss-adjusting sector has seen quite a bit of upheaval in recent years with owners approaching retirement age and looking for the right exit strategy. And COVID had quite a big impact on encouraging people to more actively think about and plan those exit strategies.

“I think COVID had a big impact on people’s attitudes,” he said. “A number of the businesses we’ve acquired or are acquiring, we’ve been talking to for quite a long time. One of the businesses we recently bought, I’d been talking to them for about 10 years. And the owner rang me and asked to go for a coffee, and told me that things had changed, that COVID had made him rethink things.”

Regulation and compliance are also critical factors behind this M&A activity. Hall noted that a number of the acquisitions made by QuestGates have actually been driven by insurers’ messaging around compliance standards. However, as part of the wider QuestGates group, these companies meet insurers’ IT, security and business continuity requirements.

“The final thing is that from day one we had two USPs,” he said. “We wanted to do specialist work – we didn’t want to do high-volume, low-margin type business. And we wanted to stay an owner-managing business, and we’re now the only owner-managed business of our size in the market, all the others have gone. I think that owner-managed piece is very attractive to business owners who want to sell their business but still want to carry on working.

“One of the things I’m most proud of is that we’ve done 14 acquisitions to date, with two or three more close to completion and we’ve brought those senior people with us. That goes back to when we started the business by buying QuestGates Partnership and we still have some of the original people from that team. So, our model is pretty unusual in that we keep the management teams of the businesses we buy and allow them to do the bits they love about running the business, without having to worry about compliance and all that other stuff.”

Hall noted that while it has taken 20 years to get to where QuestGates is today, he firmly believes that the firm is now “at the most exciting stage we’ve ever been.” There are so many opportunities present in the market, he said, and QuestGates is now of a size, scale and reputation that it is being actively approached by potential vendors and by insurers which previously considered the independently owned business too small to work with.

“In addition, we’ve developed so many new services and the people that go around them,” he said. “We’ve brought in engineers and surveyors and we’ve recruited accountants. The area where I think we’ve really surprised people is around major loss. Speaking with insurers and other adjusters, you hear that everyone’s worried about the ageing market and younger people not coming in. But we’ve taken a totally different attitude to major loss.

“Rather than focus on recruiting the guys that are 55-plus with great experience and expertise, but aren’t necessarily here for the long term, we’ve deliberately gone for people that are younger and mentored them and brought them through the sector. And now we’ve got a young, highly competent major loss team that work with the likes of Allianz and AXA and AIG - and it’s a team that’s potentially going to be with us for the next 20 years.”

For Alistair Steward (pictured right), director of business development at QuestGates, who has been with the business since its early years, one of the most instrumental changes he has seen is the evolution of how technology is used in loss adjusting and claims handling.

“In the loss adjusting sector, you often find that you’ve either got the technical expertise but not the tech support that you need, or you’re very driven by technology but you don’t have that technical expertise,” he said. “We’ve always taken the view, given the fact that we deal with large and complex claims on the whole, that you’ve got to have people dealing with the claim. And those people need to know what they’re talking about and be able to show empathy, but also be supported by some really good technology.”

That blend of people and tech is what it takes to deliver a client-centric proposition at a cost-effective price and Steward has been gratified to see how advancements in technology are enabling claims to be settled more quickly and in a way that supports the customer journey. QuestGates has done a good job of using technology as an enabler for the human at the front of the claim, he said, which has been ratified by the firm retaining its flagship Investor in Customers Gold award.

As for what’s next, Hall emphasised that QuestGates’ 20-year anniversary represents an opportunity to look back, not an excuse to stand still. The team is always reviewing everything it does, he said, and prides itself on being adaptable to new opportunities as and when they arise.

“We want to stay an owner-managed business and we will,” he said. “Whether we will look to take external investment in at some point in the future, that’s possible. We’ve always done acquisitions by retained money - but if the right option meant we had to borrow the money, then we would do so. In the same way, we may look to take on external investment, though there’s nothing on the cards from that perspective.”

Keeping the momentum of the business high is also critical to Hall’s growth agenda, and he highlighted QuestGates’ continued commitment to further diversification of its reach and proposition.

“The key for me is to carry on but not to lose our ambition or our enthusiasm,” he said. “Whenever I get asked when will I give this up, I say two things – “one, when I’m not enjoying it anymore and two, when it no longer annoys other people that I do it’. And as long as both those two reasons are still there, I’m carrying on.”

What are your thoughts on this story? Feel free to share them in the comment box below.