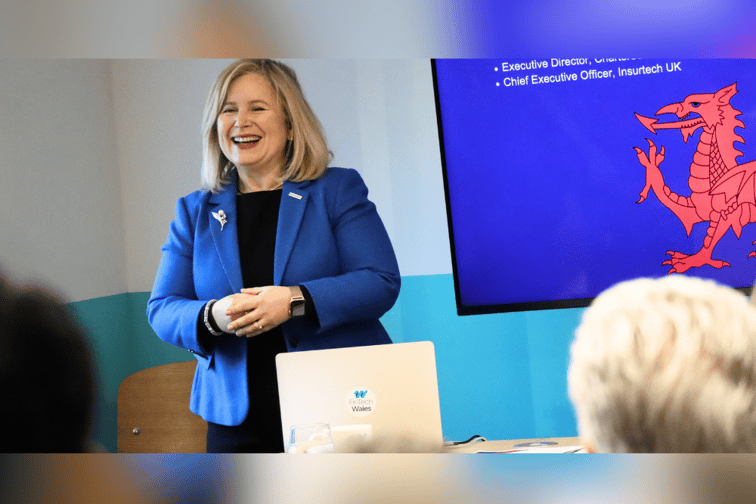

If the UK is the global nexus of insurtech, then how would you describe the insurtech scene in Wales? I had the great pleasure of meeting representatives of the Welsh insurtech community in Cardiff last week, and I think the dragon analogy is an apt one.

There is an active Welsh insurtech scene centred around Cardiff which builds on the strong insurance heritage existing in South Wales, as well as the growing fintech sector in the region. Which is why we decided to co-host a Welsh insurtech roundtable event with Fintech Wales, as part of Insurtech UK’s mission to engage with the insurtechs across all of the regions of the UK.

What I found there is a close-knit, collaborative community, where in the words of one attendee, “Everyone knows everybody else.” This was borne out during the networking drinks afterwards where I noticed most were greeting each other warmly, like old friends.

After sharing some of the key figures on the state of the UK insurtech market from the McKinsey report, The United Kingdom: the Nexus of Insurtech, jointly produced with Insurtech UK, we discussed the differences between the Welsh and the wider UK insurtech scene. The Welsh insurtech community was well represented with attendees from Driverly, PureCyber, Ogi, Go Compare, Aquis, Broker Insights, Dynamo Cover, as well as Browne Jacobson, Capital Law, Lewis Silkin, PwC, Sicsic Advisory and Sonr amongst others.

Whilst there were similar challenges with access to funding and capacity raised, there was also a sense of community spirit, with ex-employees from locally based companies like Admiral setting up startups to do business with their former employers. It was commented that it was easier to do business with people you know than to have to make new connections and build trust in larger cities like London where investors were receiving hundreds of approaches from unknown startups.

The smaller ecosystem made for a more conducive environment for collaboration, with Fintech Wales CEO, Sarah Williams-Gardener, commenting on the strong links between insurance employers and local universities and higher educational institutions. This meant that there was a continual pipeline of talent to support the growth of the sector.

Also the compact size of the market meant the relationships between the service providers like law, accountancy and consultancy firms and the insurtech and insurance companies were underpinned by social and civic connections gained through working in the same community over many years.

In these ways, Cardiff shared similarities with the Hartford insurtech sector in Connecticut, where Insurtech UK was involved in creating a UK-Connecticut insurtech corridor to enable UK insurtech firms to have a ‘soft-landing’ when establishing themselves for the first time in the US. Like Cardiff, Hartford also is home to several major insurance corporations, and yet has a smaller but more closely connected ecosystem – with universities, professional services firms, regulators, and associations all on first-name terms – than other bigger insurance cities such as New York or Chicago.

Hartford describes itself as the “Insurance Capital of the US”, and whilst Cardiff might not be so boastful, it is a major insurance centre for the UK and attracts companies wanting a lower cost-base than cities such as London or even Bristol. It also attracts people wanting more affordable housing and a better quality of life (with close proximity to the countryside and the coast), especially post-pandemic when it is less imperative to commute every day into a big city office.

I was pleasantly surprised to find that it took less than two hours to travel from London Paddington to Cardiff Central, and the city centre (and rugby stadium) only five minutes’ walk from the station.

Overall, I was impressed by the energy of the Welsh insurtech scene, with roundtable participants largely positive about the opportunities for growth and willingness to engage with new entrants. Most attendees believed there would be more insurtechs in Wales this time next year. For me, that conjures up an image of a Welsh insurtech dragon spreading its wings, ready to seize new opportunities!