If you plan on launching your own insurance business in California, getting the proper licenses is one of the first and most important steps you need to take. Getting the right licenses, however, isn’t as simple as it sounds.

To help you sort things out, Insurance Business will give you a walkthrough of the different licenses you need to run an insurance agency in the Golden State. We will also give you a rundown of how much each license costs and what can disqualify you from getting one. Read on and find out what it takes to get a California insurance agency license.

All businesses and professionals involved in selling insurance policies in California need to have the proper licenses to operate legally. There are two general types of insurance agency licenses:

If your business is based in California, this allows you to operate within state lines. It works just like a standard insurance agent license, but on a business level.

For insurance agencies outside the state, a non-resident license is required. The good news is that California has reciprocity agreements with other states. This lets out-of-state insurance agencies and agents apply for licenses without taking California’s state licensure exams.

Insurance agencies can also pick different insurance lines to specialize in. If you plan on selling policies in more than one line, then you need to get a license for each. These licenses come with corresponding fees and requirements.

Here are the most common types of California insurance agency licenses. The definitions are based on the California Insurance Department’s (CDI) website.

This license type allows agencies and agents to sell insurance policies for sickness, bodily injury, and accidental death. They may also offer disability benefits.

This license lets your business sell life insurance policies. Coverage includes annuities and endowments, and accidental dismemberment and disability benefits. Most life insurance agencies also offer accident and health insurance.

Often taken together with a casualty license, a property license allows you to sell policies covering any “direct or consequential” loss or damage to property.

This type of California insurance agency license lets you sell coverage against legal liability. This includes any action that results in death, injury, disability, and property damage.

A business with a personal lines license is authorized to sell car insurance, watercraft insurance, and residential property insurance. The last includes earthquake and flood coverage. This license type also allows you to offer umbrella or excess liability insurance for auto and home policies.

This allows your business to sell and negotiate coverage on behalf of an appointing motor club.

This type of license enables brokers to place the following risks with non-admitted insurers:

This license allows brokers to place insurance with non-admitted insurers to cover risks other than aircraft and certain marine and transportation risks.

This license type lets your business sell credit insurance and receive a commission without having to get a life or P&C insurance license.

Your business needs a cargo insurance license if it’s involved in helping cargo owners and shippers get coverage for the goods they’re carrying.

This type of license is required for insurance agencies that employ analysts who offer advice on life and disability insurance contracts.

If you want to start an insurance business in the Lone Star State, find out what licenses you need in this guide to Texas insurance agency license.

You can apply for a California insurance agency license by logging on to Sircon’s website. You will need to register if you don’t have an account yet. Sircon is CDI’s partner software solutions provider.

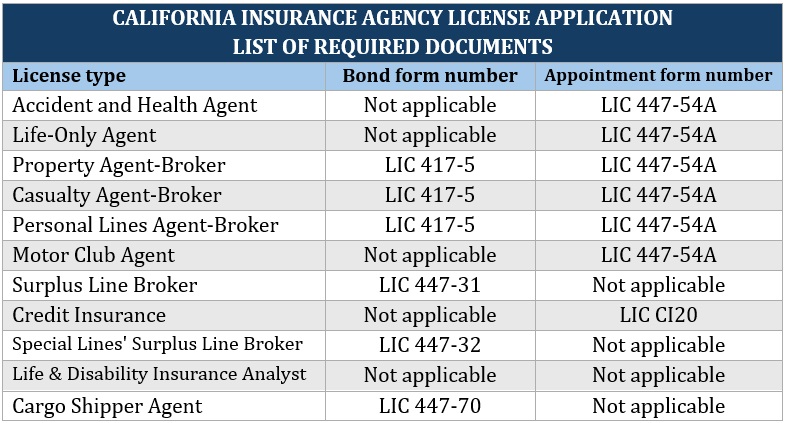

After signing in, you will be asked to submit an LIC 441-11 form, also called the business entity application form for insurance license, along with other documents. The requirements vary depending on the type of license you’re applying for. The table below lists the documents you must submit along with the LIC 441-11 form.

Here’s what the form numbers in the table are for:

Also called the Action Notice of Appointment form, the LIC 447-54A form lists all the licensed insurance agents employed by your business. This also lists the insurance lines each agent or broker is licensed for.

The LIC CI20, also known as Credit Insurance Agent Notice of Appointment, designates a credit insurance agent acting on the company’s behalf. Unlike the previous document, you’re only allowed to appoint one agent per form.

All P&C and personal lines agents and brokers are required to file a $10,000 Bond of Insurance Broker by submitting an LIC 417-5 form. This is meant to prove their financial responsibility.

The LIC 447-31 form is required for surplus lines brokers. Just like form LIC 417-5, it is designed to show financial responsibility. The bond amount is $50,000.

Like the two previous documents, the LIC 447-32 form proves the financial responsibility of special lines’ surplus lines broker. You will need to file a $10,000 bond for this.

This shows the financial responsibility of cargo insurance agents. The bond amount is $10,000.

You may also be required to show these documents:

This document is submitted when filing a bond. It serves as an authorization from the surety company that an individual assumes the responsibility of signing and delivering bonds.

This must be submitted with the power of attorney. A jurat states that the bond was executed in California.

Also called a 1033 consent waiver, this is required for anyone convicted of a felony involving interstate commerce crime looking for a job in the insurance industry. The answers to this form must be typewritten. The document is submitted along with a 2x2 picture of the applicant, and all court documents related to the conviction.

Your insurance agency must also already have a business name. You can find the rules on what terms are allowed in CDI’s name approval criteria page.

Unlicensed employees will be asked to submit fingerprints. All documents are forwarded directly to the Producer Licensing Bureau for review and approval.

Do you want to know what types of licenses you need if you want to start an insurance agency? This guide walks you through each one.

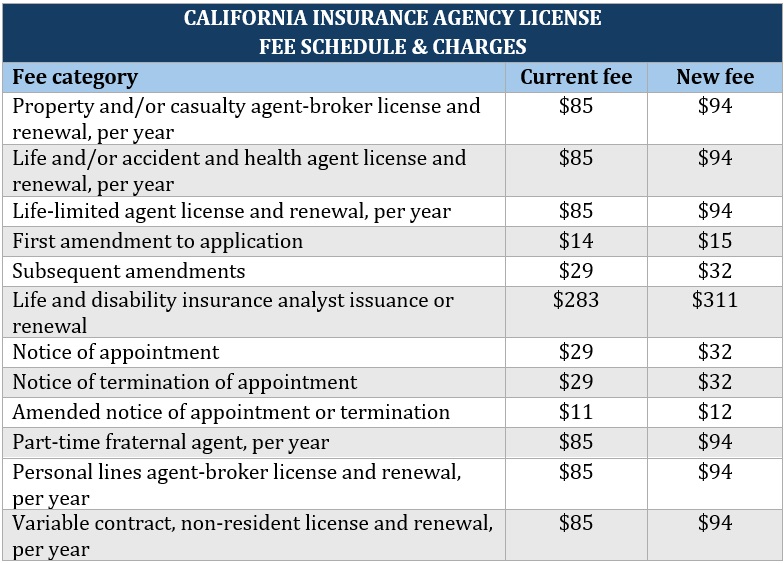

The fees you need to pay for a California insurance agency license vary, depending on the line you’re specializing in. Here’s CDI’s latest fee schedule for insurance businesses.

You can find the full fee schedule along with a downloadable PDF on CDI’s fee charges and schedule guide.

Insurance licenses in California are valid for two years. The term begins on the date the license was issued and ends on the last day of the same calendar month two years later. Any additional licenses issued after this will have the same expiration date as the first license.

Expiration dates are shown on the front of the licenses. The CDI sends out an e-mail notice, reminding you to renew your license about 90 days before it expires.

If you fail to renew your California insurance agency license by the expiration date, you’re given a one-year grace period to meet renewal requirements. During this time, however, your business is barred from making any transactions. You will also need to pay the 50% reinstatement fee.

If you’re still unable to renew your business license during the reinstatement period, you must apply for a new license. This means you need to submit all necessary documents again to the CDI.

Find out what licenses you need to run an insurance business in the Sunshine State in this guide to getting a Florida insurance agency license.

The CDI does detailed background checks on all license applications. That’s why it’s important for applicants to answer the screenings completely and truthfully.

Among the background information you must provide are:

Failure to disclose any of the items above can be viewed as an attempt to get a license by fraud or misrepresentation. This could result in the application being denied.

The CDI advises, “when in doubt, disclose.” List all convictions no matter how long ago they happened or if they were dismissed.

Keep in mind that license approval or refusal still depends on the nature or severity of the crime committed. This is regardless of how well you follow instructions in the application process or how truthfully you answer the background questions.

Apart from insurance licenses, you may need to get business licenses and permits to operate your insurance agency in California. The requirements vary depending on the county or city.

The most basic license you will need to run your insurance agency is called a business or general license. This usually includes a business tax certificate. All businesses operating in the state need this type of license.

If you have an office space, you may also be required to take out a zoning clearance, fire inspection certificate, and business property statement. You may be asked to provide workers’ compensation information for your employees as well.

You can check the state’s CalGold website to find out what types of business licenses you need for your insurance agency.

California law requires all businesses involved in selling insurance to have the right licenses. Doing so without the necessary licenses can lead to a felony charge. If your business is caught, you can face serious penalties, including monetary fines and blocked commissions. Your business license may also be suspended or revoked.

The CDI may also issue cease-and-desist orders to prevent your insurance agency from operating. If this happens, you may be required to pay any unsettled insurance claims.

Getting a license is often the first step in launching an insurance business. If you want to know what comes next after getting your insurance agency license, this guide on how to start your own insurance company can help.

Did you find this guide on getting a California insurance agency license helpful? Let us know in the comments section below.