The CEOs of the nation’s largest insurance companies rake in millions of dollars each year as part of their jobs of leading their firms to profitability. But how much do these executives make exactly?

Insurance Business crunches the numbers from the previous financial years to give you an idea of how much the top insurance CEOs earn in salaries and other compensation. We will also make a side-by-side comparison to find out where their earnings rank among their industry peers.

If you’re wondering how much the industry’s top executives make and whether they’re deserving of the pay, you’ve come to the right place. Gain a deeper understanding of the numbers behind insurance CEO salary and compensation in this guide.

Data gathered by the Consumer Federation of America (CFA) reveals that the CEOs of the 10 largest personal lines insurance companies earned a combined $130.6 million in compensation in the latest financial year. The figure is up from around $122.9 million in 2021.

The table below from the consumer advocacy and education non-profit breaks down the total pay of the chief executives of these companies in the last two financial years. The group obtained the data from the Nebraska Department of Insurance. The department legally requires insurers to provide information about the salaries, bonuses, and other compensation of their top officials.

Insurance Business rearranged the list from the highest to the lowest earning CEO in 2022.

|

Insurer |

CEO |

2022 compensation |

2021 compensation |

|

Michael Tipsord |

$24.4 million |

$24.5 million |

|

|

Allan Schnitzer |

$20.8 million |

$19.1 million |

|

|

Thomas Wilson |

$18.9 million |

$18.4 million |

|

|

David Long |

$15.4 million |

$12.2 million |

|

|

Tom Combs |

$13.6 million |

$13.6 million |

|

|

Progressive |

Susan Patricia Griffith |

$12.7 million |

$14.5 million |

|

Jeffrey Dailey |

$9.7 million |

$7.9 million |

|

|

American Family |

Jack Salzwedel |

$6.7 million |

$6.8 million |

|

USAA |

Steven Wayne Peacock |

$4.8 million |

$1.9 million |

|

Kirt Walker |

$3.5 million |

$3.9 million |

|

|

Combined |

|

$130.6 million |

$122.9 million |

The list is split evenly between the CEOs whose pay increased and those whose compensation dropped. For the latter group, most executives experienced just marginal decreases in earnings.

Progessive’s Griffith suffered the biggest pay cut at around $1.8 million. Although his earnings dipped slightly, State Farm CEO Tipsord earned the biggest paycheck among all executives in the list.

On the flipside, Liberty Mutual’s Long and USAA’s Peacock received the highest pay raise at $3.2 million and $2.9 million, respectively.

CFA noted, however, that the data reported to the department may exclude compensation paid by affiliated companies, so it’s possible that the figures above are underrepresented.

The group’s list also doesn’t include insurance CEO salary and compensation for the country’s top multiline insurers and health insurance specialists, some of which are substantially higher than those in the table.

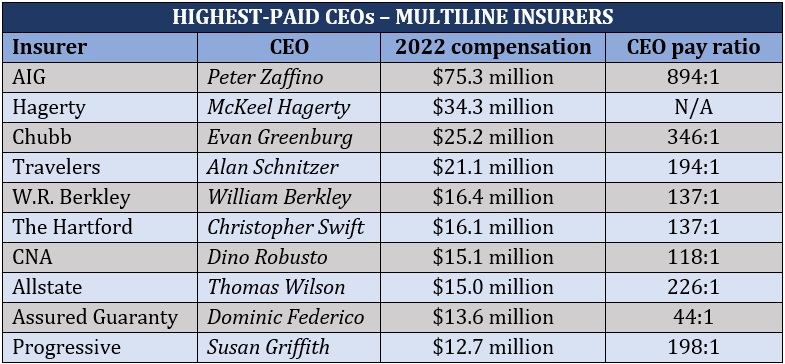

The table below shows the 10 highest-paid CEOs of the country’s top P&C and multiline insurers, according to data obtained by the market intelligence firm S&P Global.

AIG’s Peter Zaffino has the highest compensation among all insurance CEOs on the list, earning 894 times more compared to that of the firm’s average employee. Hagerty of his family’s eponymous company and Chubb’s Greenburg round up the top three. Greenburg made 346 times more than Chubb’s average worker.

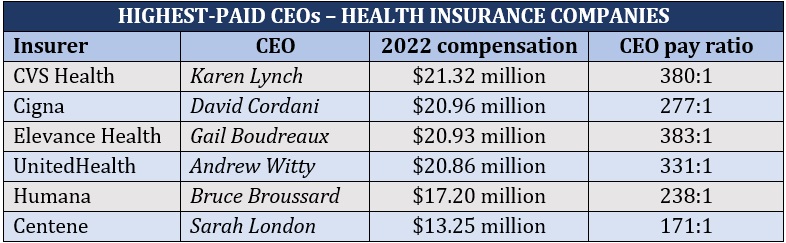

The CEOs of the six largest health insurance companies in the US earned a combined $114.5 million in salaries and other compensation in 2022. This is according to the Securities and Exchange Commission (SEC) proxy filings obtained by the industry news outlet Fierce Healthcare. Here’s the list arranged from the highest to the lowest earners.

There’s a little bit more parity in the pay of the CEOs of the top health insurance companies in the US. The figures above show that the salaries and compensation of the top four executives are separated by a few hundred thousand dollars. Their earnings, however, are between 270 and 380 times higher than those of their companies’ average employees.

Just like regular employees, the chief executives of insurance companies get an annual salary. They are also entitled to employee benefits such as paid vacations and group insurance. However, CEO compensation is more complicated and involves a range of other factors that go beyond just their reported salaries and benefits.

Among these factors are performance rewards. Insurance CEOs often earn bonuses depending on the company’s overall performance, growth, and profitability, as well as shareholder value. This is why CEO compensation is sometimes described as “pay-for-performance.”

Here’s a list of the common elements that go into a CEO compensation package:

Most insurance CEOs earn substantial base salaries, which depend on a range of factors, including job performance and years of experience. An executive compensation committee formed by the board of directors typically sets the annual figure. The CEO then gets paid in cash either monthly or biweekly.

Performance-based incentives form a significant part of insurance CEO compensation. These can come in the form of short-term rewards for achieving certain revenue- or operation-based goals. They can also be long-term incentives that focus on goals that can be achieved in more than a year.

Short-term incentives are typically given as cash rewards, while long-term incentives are often structured as stock-based compensation. CEOs usually receive compensation for long-term incentives at the end of their stated performance periods.

Just like salaried workers, insurance CEOs are entitled to several employee benefits, including:

CEOs can access additional benefits that aren’t available to other salaried employees, including:

These perks are designed to compensate CEOs for the extra demands on their time.

Insurance companies provide CEOs with severance pay in the event of voluntary or involuntary termination. Some packages include a change-in-control provision, also referred to as a “golden parachute.” This compensates chief executives if they lose their jobs because of a merger or an acquisition where the purchasing entity replaces them with their own leaders.

CEOs play a crucial role in the success or failure of a company, which makes their roles important. However, there’s still an ongoing debate on whether they deserve the compensation they receive.

Michael DeLong, research and advocacy associate at the Consumer Federation of America, says the organization understands the need for insurance companies to offer competitive salaries to attract talented leaders. The group’s concern, however, is how insurers obtain the funds to compensate their senior executives.

“While we think that current insurance CEO salaries are grossly excessive and undeserved, we are focused on the fact that these inflated salaries are generally paid by insurance company policyholders and not the shareholders,” he explains. “These massive salaries and bonuses came during a time when auto insurance rates rose, and the insurance companies claimed they had to raise rates in order to cover increasing costs.

“The insurers also claimed they were in financial trouble due to a variety of factors, so they needed to cut costs. They slashed advertising, increased premiums for ordinary people, and in some cases shut down buildings and laid off some of their employees. However, the insurance companies did not cut their CEO compensation at all. In fact, insurance CEOs are earning dramatically more now than they did prior to the pandemic.”

DeLong adds that the situation has reinforced the public’s negative perception of high insurance CEO salaries.

“CEO salaries are extremely high, often in the millions or tens of millions of dollars, and they are unconnected to performance,” he says. “At the same time, many Americans are living paycheck to paycheck and struggling to afford their insurance premiums.

“The problem with the mismatch between huge CEO compensation packages and the financial struggles of American consumers is particularly acute in insurance, since state laws require that we purchase insurance. Since we are forced to buy their products, it makes people very angry to learn that their high premium is, in part, covering the multi-million-dollar payday of the company executives.”

DeLong also calls on the insurance regulators to do their part in addressing the issue.

“Except in California, where consumer protection rules limit the amount of executive salary that can be passed along to policyholders, insurance regulators generally allow the costs of executive salaries to be built into the rates they charge their customers,” he notes.

“We would like to see regulators step in and protect consumers from having to bear the burden of wildly inflated executive salaries and bonuses.”

The SEC requires all publicly traded companies, including insurers, to disclose how much they pay their senior executives, how they determine the overall compensation, and who helped set the total package. This means you can get information on insurance CEO salaries through public filings with the SEC.

In addition, you can find data on CEO compensation in other documents, including:

You can also keep abreast of the latest industry developments, including senior leadership movements and salaries, by subscribing to our free newsletters. By signing up, you will be up to date with the latest breaking news, cutting-edge opinion, and expert analysis impacting the industry.

What is your opinion about the salary and compensation of CEOs in the insurance industry? Do you think it’s fair? Share your comments below.