Structuring your business as a limited liability company, or LLC, allows you to protect your personal belongings by separating them from your business assets. This means a third party cannot go after your personal possessions if your business gets sued or files for bankruptcy.

But how do you protect your business assets? This is where liability insurance for LLC plays an important role. This type of coverage, however, comes in many forms. To get the policy that matches the needs of your business, you must also understand the kind of protection each one provides.

Insurance Business will help you achieve that by giving you a walkthrough of the different liability insurance policies LLCs can access. We will explain how each policy works and how it can protect your business assets. Read on and find out if liability insurance for LLC is a worthwhile investment for your business.

As an LLC, your business needs liability insurance to protect it financially against claims of property damage, bodily injury, and reputational harm caused by your day-to-day operations. It covers medical payments and legal and settlement costs resulting from lawsuits.

Liability insurance for LLC comes in several types, with each providing different levels of protection. Here are some of the most essential coverages that an LLC needs to protect its business assets.

General liability insurance protects your LLC from claims of physical injury or property damage stemming from your business activities. It also covers lawsuits arising from copyright infringement and reputational harm such as libel, slander, false arrest, and malicious prosecution.

Some policies provide coverage for product liability as well. This protects your business against claims of bodily harm or financial losses caused by a product you design, manufacture, or sell.

You can purchase general liability insurance together with commercial property insurance and business interruption coverage in a business owner’s policy (BOP). Taking out these types of business insurance as a package allows you to slash a significant amount from your premiums than when buying them separately. BOPs, however, are only available to LLCs with fewer than 100 employees and revenues not exceeding $1 million.

General liability insurance is not mandatory for LLCs, but other businesses and some clients may make it a condition before working with you. The cost depends on a range of factors, including the industry you’re in, number of your employees, and where you operate. If you want to learn more about how general liability insurance cost is calculated, you can click on the link to access our guide.

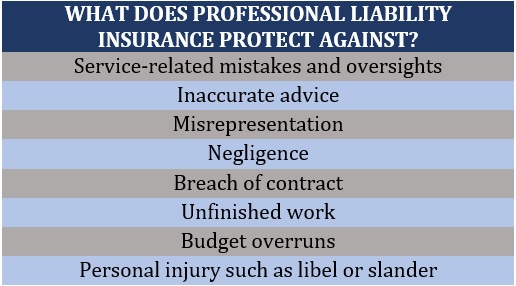

If your LLC provides a professional service, then you may be required either by law or industry standards to take out professional liability insurance. This covers your business against claims of financial losses resulting from the services it offers. This policy pays out legal and settlement costs stemming from the following:

Professional liability insurance is mandatory for some occupations. Depending on the industry, it may also be referred to as errors and omissions (E&O) or malpractice insurance. Here are some of the professions where coverage is required:

You can learn more about how this type of coverage can protect your LLC in our comprehensive guide to professional liability insurance.

If your business handles and stores sensitive customer data, then cyber insurance is a type of liability insurance for LLC that you should have. It protects your company from lawsuits filed by clients, vendors, and even employees for damages caused by a cyber incident. The policy covers court fees, settlement costs, and regulatory fines.

Cyber insurance also pays out for the financial losses your business incurs due to a cyberattack. These include:

A cyber incident can prove costly to your business, especially if you don’t have the proper coverage. If you want to know how much damage a single attack can cost a business, you can check out our latest cyber crime report.

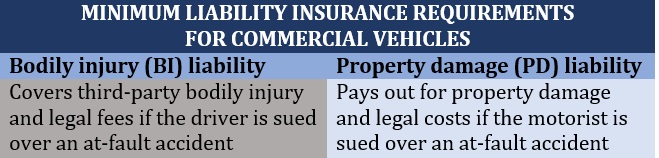

Just like private motorists, all drivers of commercial vehicles need to carry insurance to be able to operate on US roads. Depending on the state, commercial vehicle drivers are often required to take out minimum liability insurance coverage under commercial auto insurance. This consists of:

Product liability insurance may be worth considering if your LLC manufactures, designs, or sells products. This type of coverage protects your business against lawsuits from clients claiming injuries or losses because of your product. It pays out legal defense costs, as well as third-party compensation if your company is found to be at fault.

Liability insurance for LLC, however, is not the only form of coverage businesses need. If you’re a small business owner working out what types of policies can keep your company protected, our comprehensive guide to small business insurance can help.

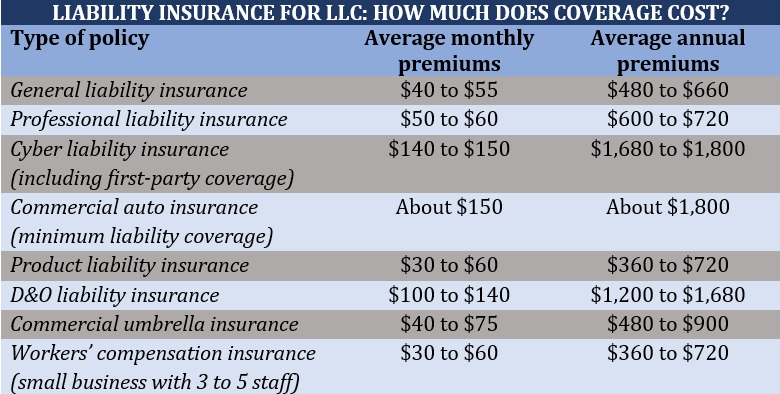

Liability insurance coverage consists of a range of policies that provide varying levels of protection. That’s why it is hard to come up with a one-size-fits-all estimate of how much coverage costs. The table below breaks down how premiums cost for the different types of liability insurance for LLC based on the various price comparison and insurer websites Insurance Business checked out.

The cost of liability insurance for LLC is also influenced by several other factors. These include:

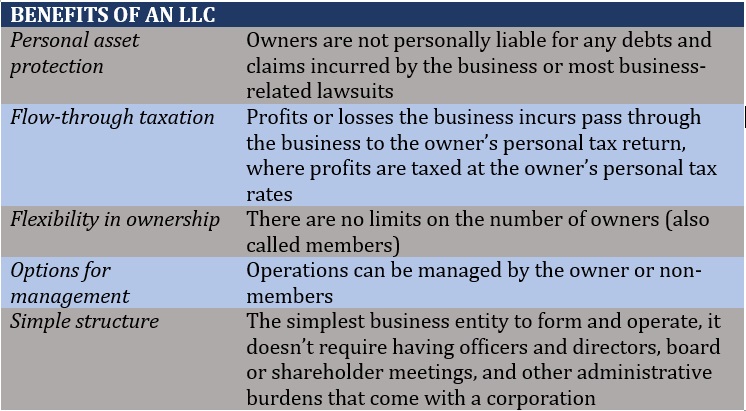

LLC stands for limited liability company. This type of business structure protects the owners from personal liability for the company’s debts and claims. This means that if the business is sued or cannot pay its debts, the owner’s personal possessions – including their home and vehicle – cannot be legally pursued. This kind of protection is what makes an LLC a popular business structure for startups and small enterprises.

An LLC can have one or more owners, also referred to as members. LLC members typically share the responsibility of managing the business in a system called member-managed. This is unless they bring in someone from outside to handle the daily aspects of running the business – manager-managed.

In terms of taxes, however, an LLC is not considered separate from its owners. Instead, it acts as what the Internal Revenue Service (IRS) calls a “flow-through entity,” just like a sole proprietorship and a partnership. In this type of entity, business income flows through the business to the LLC members, who then report their share of profits or losses on their individual income tax returns.

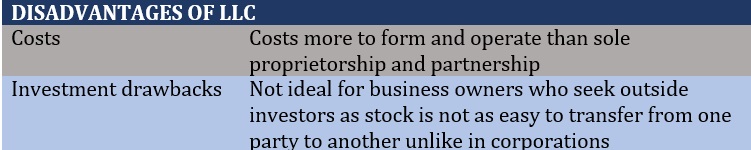

The tables below sum up the benefits and drawbacks of an LLC.

Regardless of the structure, no business is entirely immune from lawsuits. Even with all the necessary risk management strategies and safety precautions in place, mistakes and accidents can occur in your day-to-day operations. And depending on the severity of the damage, a single lawsuit can have massive financial consequences for your company. This is especially true for the many small businesses and startups comprising the LLC population across the country.

This highlights the importance of liability insurance for LLC. This group of policies provides your business assets protection against claims of injuries and property damage that your company is legally liable for.

While many types of coverage are not compulsory, it pays to have some level of protection if unexpected events happen. Some policies may cost more than others. But considering the kind of protection they offer, the coverage you pay may spell the difference between keeping your business or ceasing operations.

Liability insurance is one of the most popular policies that businesses take out because of the protection it provides, but there are many types of coverages available. Find out how other forms of business insurance can help you navigate difficult times in this comprehensive business insurance guide.

Do you think liability insurance for LLC is a worthwhile investment? Can LLCs survive without one? Share your thoughts in the comments section below.