Travel insurance does not typically cover claims related to pre-existing medical conditions. The good news is there are some policies that give you the option to waive this exclusion as long as you meet certain eligibility requirements.

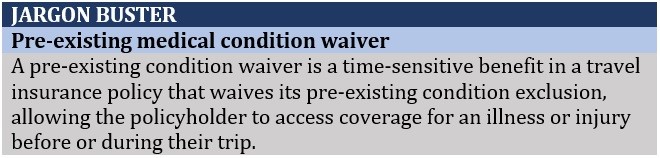

This feature, aptly called the pre-existing medical condition waiver, acts like travel insurance for pre-existing conditions, covering you for financial losses resulting from an illness or injury that you may already have before your trip. And what’s even better is that it comes at no additional charge.

If you’re wondering if you can access coverage for a pre-existing medical condition, then this article can help answer many of your pressing questions. Read on and find out how this additional benefit works in this comprehensive guide to travel insurance for pre-existing conditions.

There is no standalone travel insurance policy that covers pre-existing medical conditions. Unless your plan specifically states that it covers such issues, then it’s safe to assume that the expenses you incur before or during your trip because of a pre-existing illness or injury are likewise excluded from coverage.

Eligible travelers can obtain a pre-existing condition exclusion waiver to trigger coverage. This means that your insurer will foot the bill if a pre-existing condition causes you to cut short, postpone, or cancel your trip.

To qualify for a waiver, you must meet all three of the following criteria:

You can qualify for a pre-existing condition waiver if you are physically fit to travel at the time you purchase insurance. You will need to provide a letter from your doctor clearing you for travel as proof. Your condition must also be stable, meaning there have been no changes – minor or major – within a certain timeframe, usually between 60 and 180 days prior to taking out insurance. This requirement extends to everyone listed in your policy.

If you were not medically cleared when you bought travel insurance but expect to be fit at the time of your departure, you would not be able to obtain a waiver. The same is true if you have medical treatment or surgery scheduled in the future as these are considered “foreseen” events.

Being a time-sensitive benefit, the pre-existing condition waiver can only be attached to your travel insurance policy if you purchase the plan within a certain timeframe. Depending on the insurer, this coverage window usually lasts 14 to 21 days after you have made your initial trip deposit, which can include hotel accommodations, airline tickets, and tour bookings. Waiting until the last minute before purchasing travel insurance can void your eligibility for a waiver.

In addition, many travel insurers require that the initial deposit be the “first-and-only booking” for a particular destination and travel date. This prevents travelers from cancelling and rebooking their trips to qualify for a pre-existing condition waiver.

Finally, you can access a waiver if the amount of your coverage is equivalent to the total pre-paid, non-refundable cost of your trip. This is the money you are set to lose if your trip was cancelled. If you’re having a tough time determining the full cost, you can use an online trip cost calculator to get an estimate.

One thing to note is that age is not a factor when determining your eligibility for a pre-existing condition waiver. Anyone who meets the requirements above qualifies for coverage, regardless of how old they are. Some plans also extend coverage to non-traveling family members.

One prominent feature of a pre-existing condition waiver is that it “waives” your travel insurance company’s ability to use your recent medical history when processing your claim. Without the waiver, your insurer can dig into your recent medical records to find information that can result in your claim being denied.

In a way, the waiver also functions as a form of travel insurance for pre-existing conditions. Let’s say that during your trip, you needed to get treatment for a health issue that was stable recently. The waiver will remove the pre-existing condition exclusion from your policy to allow coverage to kick in. This means your insurer will shoulder any costs that you will incur.

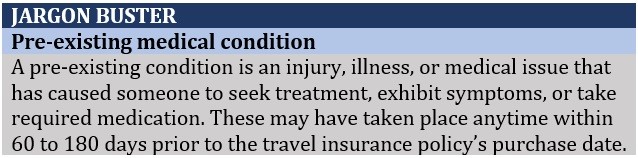

Now, the question is how far back will insurers check your medical records to ensure that coverage applies? Travel insurance companies impose a “look-back period,” which is a specific time frame when a pre-existing condition is considered stable, usually between 60 and 180 days. To qualify for a waiver, your condition must be stable within this period, meaning it has not changed or worsened. There must also be no new treatments, medications, or diagnoses, or any scheduled treatments, lab tests, or medical procedures.

For comprehensive travel insurance plans, the pre-existing conditions waiver extends to your traveling companions and immediate family members. Some policies even cover trip cancellations and interruptions stemming from medical issues of a non-traveling family member.

Waivers for travel medical insurance, meanwhile, cover only the policyholder and have a look-back period as far as three years.

If you want to find out how travel medical policies differ from comprehensive plans, you can check out our comprehensive guide to travel medical insurance.

In travel insurance parlance, a pre-existing condition is an injury, illness, or medical issue that a policyholder has experienced symptoms of, prompting them to seek treatment and take medication before purchasing coverage. These instances should fall within an insurer’s look-back period for a condition to be considered pre-existing.

Another important thing to remember is that you don’t even need an official diagnosis from a medical professional for an illness or injury to be considered a pre-existing condition by your travel insurer.

Although many travel insurance plans provide a broad range of coverage, there are certain health-related issues that these policies will not cover even if you meet all the criteria for a pre-existing medical condition waiver. These include:

Some expensive trips, or those worth more than $10,000, may also not qualify for a pre-existing condition waiver.

Exclusion waivers are also not available in annual or multi-trip travel insurance plans. To access this benefit, you must purchase a single-trip policy and meet all the eligibility requirements.

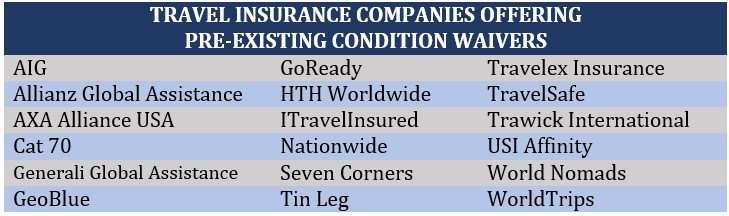

Not all companies, however, offer policies with exclusion waivers that often act as travel insurance for pre-existing conditions. The table below lists down some of the top travel insurers in the country that offer such benefits.

If you want to find out which insurers in the country offer the best coverage, you can check out our latest ranking of the top travel insurance companies in the US.

One of the most common misconceptions that has prevented American travelers from taking out travel insurance is that coverage is just an unnecessary expense, especially if they already have health insurance.

But the truth is your health plans, including Medicare, will most likely offer little to no coverage if you’re traveling outside the US. So, if you fall ill or suffer an injury during your overseas trips, you will probably be on the hook for your medical bills, including emergency medical transportation, which can be financially devastating if you don’t have coverage.

You can learn more about how healthcare coverage works in the US and other regions by accessing our global health insurance primer.

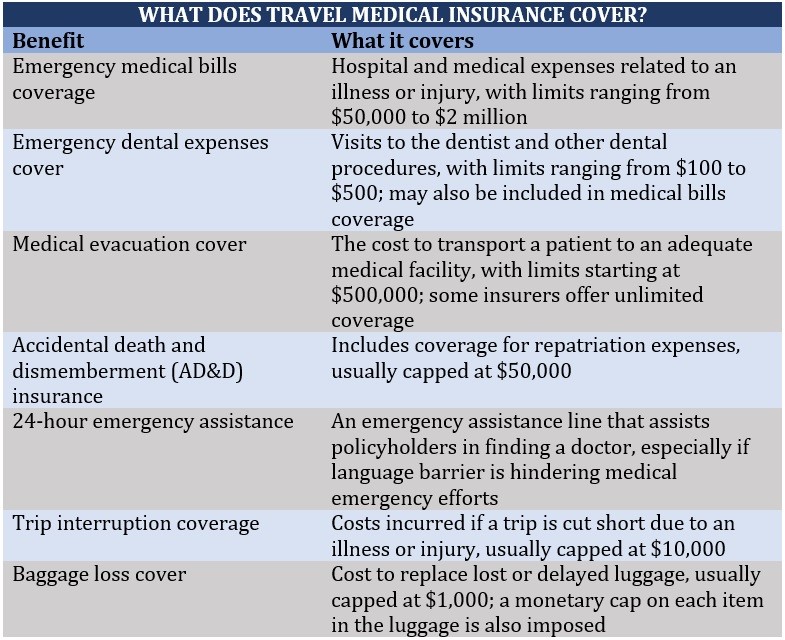

Travel insurance provides a range of medical-related benefits to keep you financially protected if an illness or injury disrupts your travel plans. Policies often follow a reimbursement-based system and offer coverage up to the plan limits. But apart from medical coverage, travel insurance delivers a slew of other benefits. Generally, a standard travel medical insurance plan covers the following:

Even if your medical issues have been stable for some time, there’s no way of predicting when these may flare up. Postponing, cancelling, or cutting your trip because of an injury or illness can have huge financial consequences, especially if you don’t have proper coverage.

Most travel insurance policies don’t cover pre-existing conditions, but qualifying for an exclusion waiver can provide you with the necessary protection when the need arises. And unlike other additional benefits that can raise your premiums, a pre-existing condition waiver is free of charge. However, these waivers are also considered in the industry as a “benefit of good faith.” This means that the only time you will know whether you have qualified for coverage is when you have filed a claim.

A pre-existing conditions waiver also works on cruises. If you’re planning on boarding a cruise ship and wondering if taking out coverage is a worthwhile investment, our comprehensive guide to cruise travel insurance can help you make an informed decision.

Do you think obtaining travel insurance for pre-existing conditions is worth it? Is traveling uninsured a risk you’re willing to take? Share your thoughts in the comments section below.