Top Insurance Employers

Jump to winners | Jump to methodology | View PDF

Top Insurance Employers: The Evolution of the Workplace

Meaningful work. Good pay. Great benefits. Plenty of PTO. Diversity, equity and inclusion (DE&I) programs. Career development paths. Mix all of these elements with some intangible factors, and you’ve got the recipe for a great work environment.

“Overall, today’s candidates desire a competitive salary, flexibility and clear development opportunities,” says Judy Busby, senior vice president of executive search and corporate strategy at The Jacobson Group, an insurance staffing agency. “Insurers need to take a fresh approach to their total rewards, seek feedback from current employees and continue to evolve their programs in order to recruit and retain top talent. Those who don’t will lose out to more employee-focused and progressive competitors.”

As someone with her finger on the pulse of the insurance industry labor market, Busby has witnessed an interesting rhythm over the past year and a half. Since the COVID-19 pandemic set in and sent employees around the world into remote working arrangements, The Jacobson Group has had to help its clients adapt to new demands, from shifting employee expectations to remote onboarding. In addition to coaching clients to interview and hire candidates without ever meeting them face-to-face, Busby has been educating clients on how these factors have led to a much different labor market today – one where there’s more movement and competition.

“The insurance industry remained relatively stable throughout the events of the past year – unemployment is low, and the industry added jobs in the midst of a pandemic,” Busby says. “Along with many industries, there’s a lot of movement within insurance right now. Employees who were holding out on making a career move in the earlier stages of the pandemic are reevaluating their options. In the next year, insurers will need to be much more intentional about how they retain talent than they have in the past. I’m encouraging leaders to be future-focused and have candid conversations with their employees to discuss their professional aspirations and be strategic in building and maintaining their loyalty.”

Employee development is a high priority at Brown & Riding (B&R), one of this year’s Top Insurance Employers.

“We pride ourselves on being the best company in the industry at developing people internally and encouraging people to advance in their career at B&R,” says president and CEO Jeff Rodriguez. “We promote from within, nurture new people and try very hard to make our culture very welcoming and encouraging. The overwhelming majority of our brokers, production team leads and administrative leadership are all homegrown from within the company, and we are very proud of that.”

Rodriguez believes the insurance labor market isn’t what it could be because carriers and brokers haven’t been investing in developing the next generation of employees.

“The industry is predominantly filling its ranks by hiring from competitors, which we also do, but many companies are not doing their part to bring new people into the industry, which is creating a long-term issue in the industry,” Rodriguez says. “People have a choice where they work, and we will always strive to be a top-choice employer by having a culture that attracts top industry talent, and we will also do our part by being a leading company in recruiting people from outside the industry and from risk management programs at the university level.”

Reaching across the generations

Unlike some in the labor market, Busby doesn’t place much value in labeling employees based on their generational affiliation, preferring to focus on the individual.

“It’s important to recognize that generalizations about the generations should serve as a rough guide and that they’re not going to ring true for all members of the cohort,” she says. “Instead, focus on individual employee motivators and finding creative ways to meet their preferred work and communication styles. Celebrate the different experiences and perspectives multigenerational teams have to offer and create a workplace that connects the generations by promoting knowledge sharing, team camaraderie and growth.”

In the face of new industry trends and labor conditions, Rodriguez says B&R is determined to create a culture that embraces growth and change to help empower career advancements. He’s concentrating on making ongoing education and professional development a universal organizational priority, along with multigenerational knowledge transfer.

“We are constantly striving to have an organizational mindset that we can – and must – all learn from each other so that people who have been around a long time are as interested and open to learning and being mentored by a brand-new employee as the junior employee is to learn and be mentored by a senior person,” Rodriguez says. “In a changing world, experience is not the be all, end all; sometimes new information is as important as years of knowledge. As an analogy, wouldn’t you like to be treated by a doctor with 30 years of experience, partnered with a recent medical school graduate who recently learned new information and techniques?”

That kind of approach will place employers in good standing as they enter a new era – one where traditional work practices are combined with virtual equivalents empowered by the latest technologies.

“As offices reopen, leaders should recognize that corporate culture is not dependent on all employees working on-site,” Busby says. “We’re all challenged to reassess when on-site team-building is truly beneficial versus when these connections can be built and strengthened virtually. This will take more effort, and managers will need to be more intentional about fostering relationships among team members. However, it is possible to provide the flexibility individual employees need while also cultivating a strong culture.”

The best versus the rest

To determine the Top Insurance Employers, IBA surveyed thousands of employees from companies across the country, asking them to weigh in on several aspects of their workplace, from compensation and benefits to employee development and culture. The majority of those surveyed were from relatively small companies – a total of 63% worked at organizations with 100 employees or fewer, while 21% hailed from firms with between 101 and 500 employees, and 16% worked at companies with more than 500 employees.

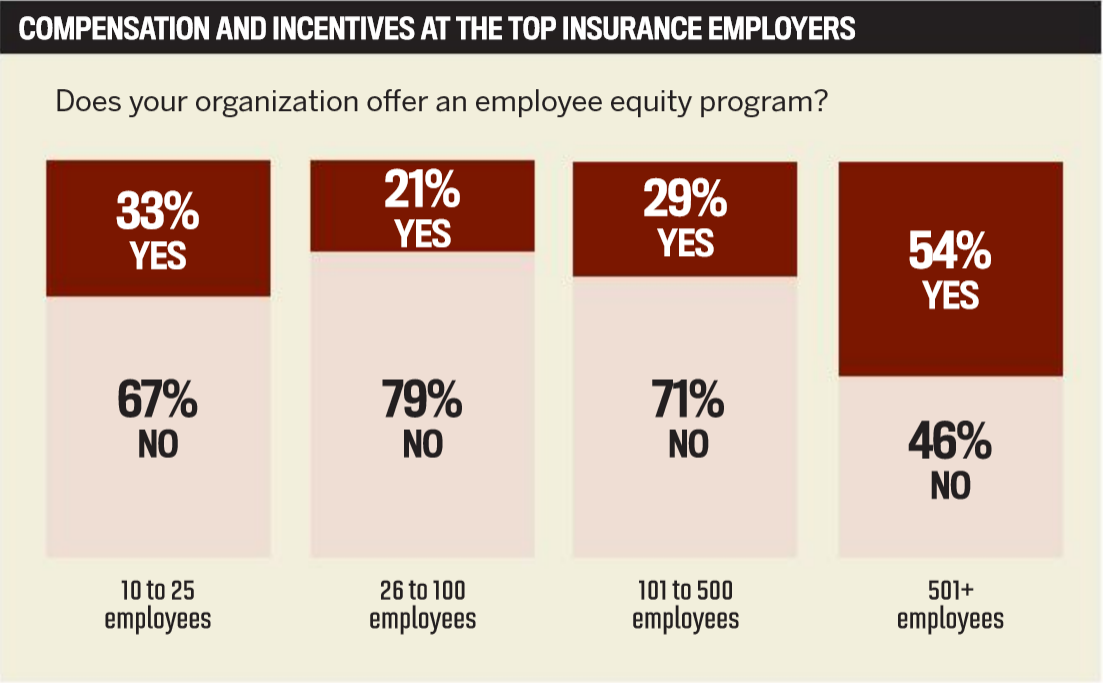

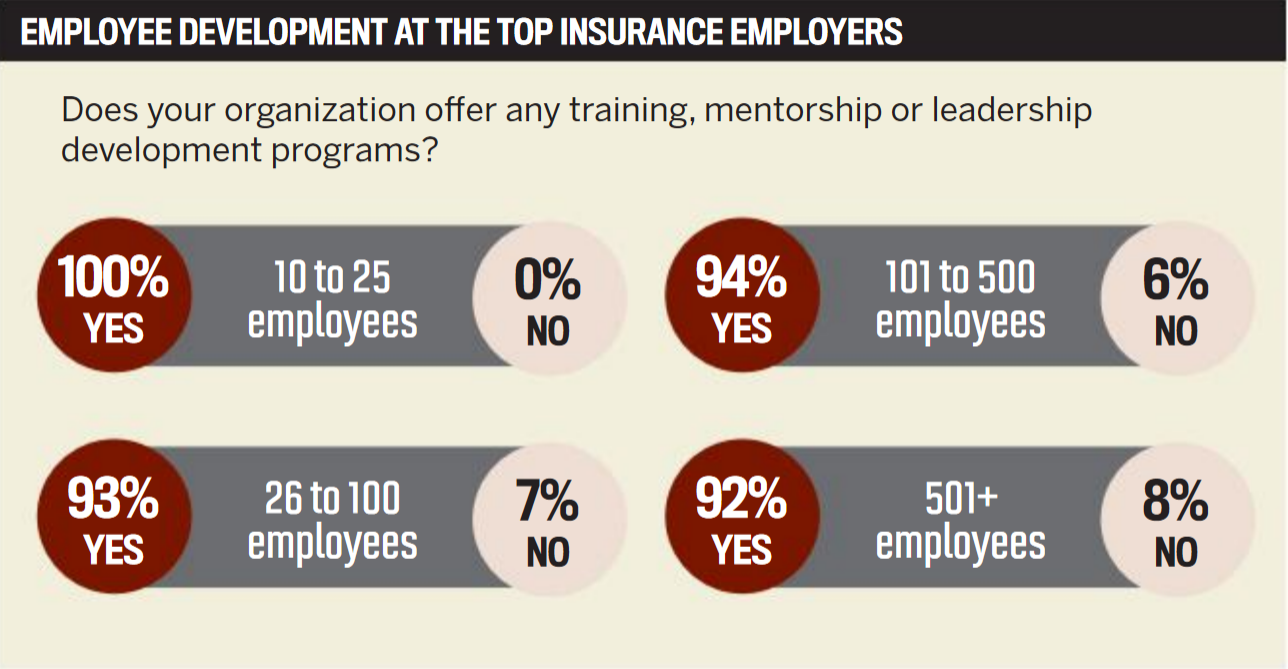

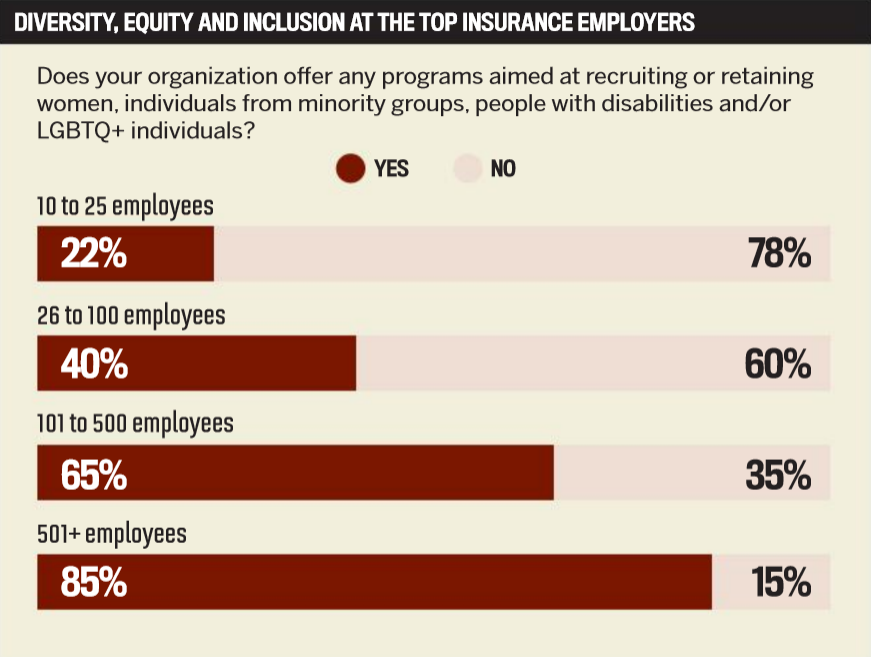

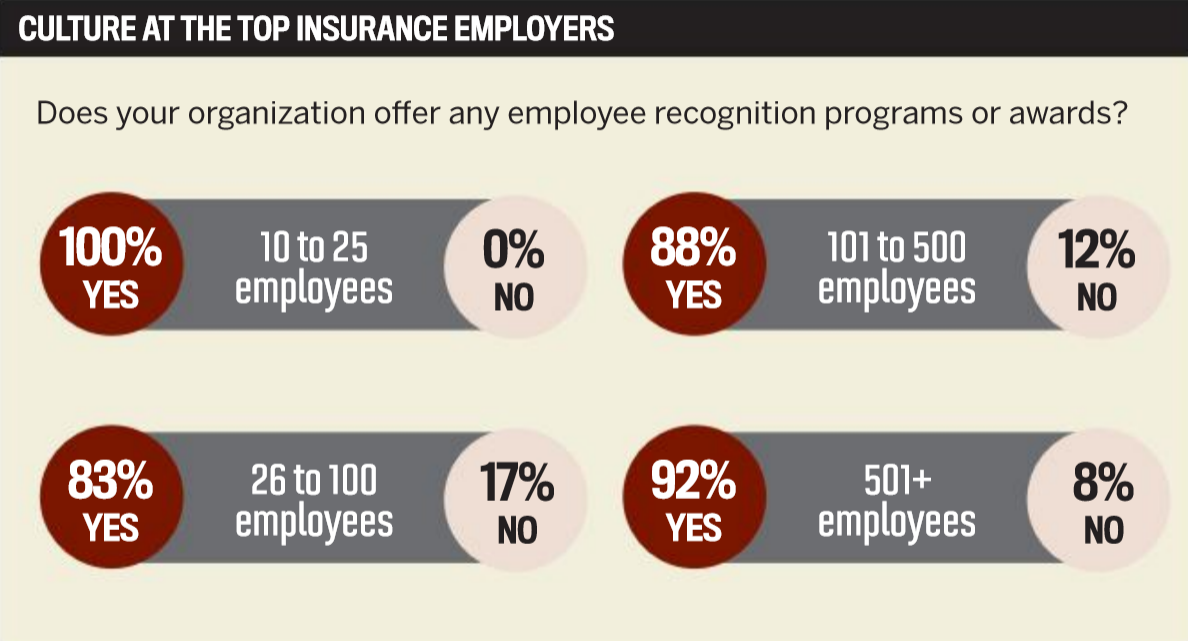

The size of the business didn’t seem to be a major factor in the quality of retirement programs, paid time off, education credits, career pathing and onboarding support. However, larger businesses were much more likely to have comprehensive benefits, along with robust DE&I programs.

As for what employees value most in their workplace, culture was one factor that came up again and again in the survey comments. One employee described their company’s culture as “second-to-none and a catalyst in the success that we have seen so far in 2021. Everyone feels included, and a certain ‘togetherness’ is promoted in order to make everyone feel comfortable.” Another respondent noted that “many companies try to form a culture and feel of ‘family’; in all my years of experience, this is the one that has done it.”

Transparency and communication were also mentioned frequently when employees were asked what their organizations are doing well. “The communication among employees and upper management is open, and that creates an atmosphere of camaraderie and rapport, which motivates employees to do their very best work all the time,” one respondent said of their employer. Another said their employer “does a great job in making sure that each employee has a voice and feels heard if/when there are concerns or just ideas for new projects. I have worked at many different organizations, and this is my first job in a decade-plus in which I feel truly valued and listened to.”

Along the same lines, many respondents lauded their companies for their response to the COVID-19 pandemic. Several said they appreciated their employers’ clear communication and transparency, while others praised their companies for facilitating a smooth transition to remote work and being supportive and flexible about childcare arrangements.

Some companies even sent their employees ‘survival kits’ or care packages to help them cope during the height of the pandemic.

Finally, employees made it clear that they value companies that are willing to invest in their development and growth. “I believe our organization does an amazing job hiring bright, intuitive and eager individuals directly from universities that help all of our teams grow and develop,” one respondent said. Another praised their company for “leadership and growth from within,” adding: “Young people often find true mentorship – both personal and professional – in our leaders, most of whom have grown in the organization themselves.”

Top Insurance Employers

10 TO 25 EMPLOYEES

- Continental Underwriters Inc.

- Miller-Schuring Agency

- Navion Insurance Associates

- RPR Insurance

- The Viti Companies

26 TO 100 EMPLOYEES

- Alkeme Insurance

- American Risk Management Resources Network

- Darr Schackow Insurance Agency

- Deland, Gibson Insurance

- Frank Winston Crum Insurance

- Glenwood Insurance Agency

- JAG Insurance Group

- Mahowald

- MountainOne Insurance Agency

- Peel & Holland

- Provident Insurance Programs

- Statewide Underwriting Services

- Synapse Services

- Tangram Insurance Services

- Teague Insurance Agency

- Texan Insurance

- TexCap Insurance

- The Starke Agency

- Topa Insurance Company

- VAST, an Acrisure Partner Agency

101 TO 500 EMPLOYEES

- Align Financial Holdings

- Brown & Riding

- Corvus Insurance

- HomeServices Insurance

- Reliance Partners

- Rich & Cartmill

- Shepherd Insurance

- The Liberty Company Insurance Brokers

- The Zebra

- Vermont Mutual Insurance Group

501+ EMPLOYEES

- Acentria Insurance

- Assurance Agency

- Sompo International

Methodology

To find and recognize the best employers in the insurance industry, IBA first invited organizations to participate by filling out an employer form, which asked companies to explain their various offerings and practices. Next, employees from nominated companies were asked to fill out an anonymous form evaluating their workplace on a number of metrics, including benefits, compensation, culture, employee development and commitment to diversity and inclusion.

To be considered, each organization had to reach a minimum number of employee responses based on overall size. Organizations that achieved an 80% or greater average satisfaction rating from employees were named a Top Insurance Employer for 2021.

Keep up with the latest news and events

Join our mailing list, it’s free!