If you want to pursue a career as an insurance professional, there are several requirements that you must meet. Among these is obtaining the right licenses.

But how long does it take to get an insurance license? The answer depends on your chosen role and where you intend to practice.

Each state has varying licensure requirements, which can make the process a bit complicated. To shed light on the matter, Insurance Business will give you a walkthrough of the criteria for three of the most popular insurance jobs that require licensing. Find out what it takes to get an insurance license if you want to become an agent, broker, or claims adjuster.

All states require insurance agents and brokers to obtain a license before they can sell policies. Depending on your pace, the process can take between 2 and 8 weeks before your insurance license gets released.

You will be spending the bulk of this time completing your pre-licensing course, which requires attending 20 to 40 hours of classes, and studying for the licensure exam. The test is proctored and usually lasts between two and three hours.

Once you pass the exam, you can expect to wait a few days before your insurance license gets released. This is given that you passed the background check. If you need to take the licensure exam more than once or the background check yields issues, these will lengthen the process.

We will give a more detailed review of the licensing process for insurance agents and brokers in the succeeding sections.

Not all states require claims adjusters to obtain licenses, but most do. However, many independent adjusting firms in non-licensing states prefer licensed candidates, especially if the job involves being assigned to various locations across the country.

Similar to that of insurance sales professionals, getting an adjuster license can take a few to several weeks. You will also be required to finish a pre-licensing course, pass the licensure exam, and complete a background check.

Once you pass the test, you will need to formally submit your license application and pay the corresponding fees.

We will discuss the claims adjuster licensing requirements in more detail below.

All insurance agents and brokers must get a license from their state’s department of insurance regulation to be able to legally sell policies. To qualify, you must be at least 18 years old and successfully complete a background check.

States also require that you’re free of felony or fraud charges and not owe any federal or state income taxes. In some states, aspiring insurance agents and brokers must not have past-due child support.

Once you meet these criteria, you can then proceed with the next steps:

Those seeking an insurance agent or broker license are required to complete a pre-licensing course to prepare for the state licensure examinations. This involves picking an insurance line to specialize in, also called the line of authority. Among the most common specializations are:

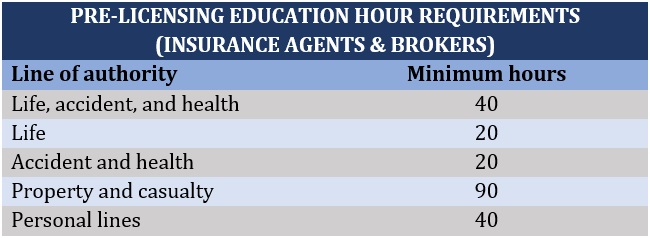

You can take pre-licensing courses online or in a classroom setting. The subjects come with mandatory minimum hours, which vary depending on the specialization. Here are the typical minimum requirements per line of authority:

But if you’re an industry veteran carrying certain industry designations, you can skip pre-licensing coursework and directly take the licensure exam.

After completing the pre-licensing coursework, you can now take the state licensure exam. The tests are divided into:

Each test consists of between 50 and 200 items and must be completed in two to three hours. If you wish to practice in both combined lines, then you must pass both exams. Otherwise, you’re only required to take the test for the line you plan on specializing in.

The exams are proctored, meaning you will be taking them in a classroom environment with someone – called a proctor – supervising the test.

The passing scores vary depending on the state. But typically, you must get at least 70% of your answers right to pass.

The test results are valid for two years. This means that you must apply for your insurance license within that timeframe. If you fail to do so, you will need to retake the licensure exam.

Each attempt of the insurance agent licensure exam can cost around $40 to $150, depending on where you’re taking it. You will also be asked to present one valid signature-bearing ID with your photo and the original copy of your pre-licensing education certificate before taking the test.

Here’s a list of what are considered valid identification documents:

If you’re unable to present any of these documents, then you will not be allowed to take the exam. This also means that your payment will be forfeited.

An insurance licensure exam is one of the most difficult tests to take because of the range of topics covered. Data gathered by professional licensing resource website State Requirement shows the passing rate to be around 60%.

Here’s a breakdown of the passing rates per line of authority from the National Association of Insurance Commissioners (NAIC):

License applications are submitted to your state’s insurance regulation department. However, you will need to wait at least 48 hours after passing the exam before applying to give the department enough time to process the results.

You can fill in the application form on the department’s website. Individual license fees vary by state. If you’re applying for insurance licenses for different specializations, you will need to pay separate fees.

The insurance regulation department reviews all license applications. There is no specific timetable for this as each application is treated differently. If something comes up from your background check, the department may contact you to provide clarity. This can slow down the process.

You can find out if your application has been approved or rejected through the department’s website as well. Once approved, you can request a PDF copy of your license. Some departments don’t mail printed licenses, so you may need to save and print your license yourself.

If you feel that there’s a delay and suspect an error, you can contact your state’s licensing department. To make the process easier for you, we have compiled the websites of each state’s insurance regulation department below:

|

INSURANCE AGENT LICENSING REQUIREMENTS BY STATE |

|||||

|

|

|

|

|

|

|

Once you have obtained an insurance license, most states require you to take a minimum of 24 hours of continuing education (CE) credits during a two-year term to maintain it. These include three hours of ethics training.

If you’re wondering how much you can make by becoming an insurance sales professional, you can check out our guide to insurance agent salaries and how much insurance brokers make.

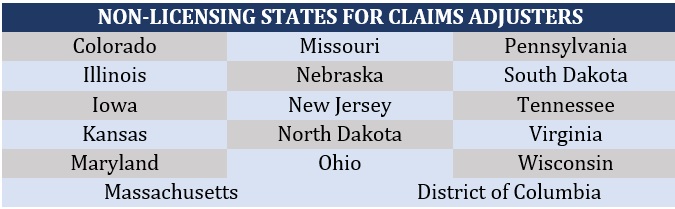

Insurance adjusters in 34 of the 50 states are required to obtain a license to be able to legally handle claims. If you plan to practice in the states below, you don’t have to get an insurance license. But you may want to consider obtaining one if you intend to handle claims in other states.

Some states have reciprocal agreements with others, allowing non-resident claims adjusters to practice in their jurisdictions.

Residents of the states above can get a non-resident designated home state (DHS) license. This allows you to choose which state will be considered as “home” and you can apply from there.

You can check out the requirements in each licensing state here:

|

INSURANCE ADJUSTER LICENSING REQUIREMENTS BY STATE |

|||||

|

|

|

|

|

|

|

As you may have noticed, insurance adjuster licensing requirements vary in each state, but there are certain similarities:

You must be at least 18 years old and pass a criminal background check. You must also have a valid driver’s license and maintain a good driving record.

You must complete 40 hours of pre-licensing coursework as preparation for the state licensure exam. This consists of a variety of subjects, including insurance products, regulations, laws, and ethics. You can take the course either online or through face-to-face classes.

You must score at least 70% in the state licensure exam to apply for an insurance adjuster license. The test typically consists of 150 items and lasts between two and three hours under the supervision of a proctor.

Once you pass the test, you can apply for a license at your state’s insurance regulation department. You will be asked to provide proof of pre-licensing education and pay a fee, which varies depending on the jurisdiction. Applications are typically processed within one business day, after which you can receive your license.

To maintain your license, you must complete 24 hours of CE for every two-year term. Continuing education courses consist of a range of topics, including industry trends, and new laws and regulations. These can be taken online or in-person.

If you’re curious about what insurance adjusters do and how much they earn, you can check out our guide to how much claims adjusters make.

Now that you know how long it takes to get an insurance license, head over to our Best in Insurance Special Reports page. It’s the place to go if you want to find the best companies to start your insurance career with. In this page, you can find companies that are nominated by their peers and vetted by our panel of experts as respectable and dependable market leaders.

Insurance Business has unveiled the list of the best insurance companies to work for in the US. These are the insurers that make each workday both challenging and rewarding. A positive work environment, competitive compensation, and an engaged workforce are just some of the attributes these insurance companies possess.

If you’re looking for an insurer that shares your values and provides the opportunity for professional growth, this list is a good place to begin your job search.

Do you think insurance is a good career path? Do you think it’s easy to get an insurance license? Feel free to comment below.