How much do life insurance agents make? Do life insurance agents have the highest-paying sales job in the industry? Is being a life insurance agent a good career path? These are just some of the topics Insurance Business will discuss in this article.

Apart from pay, we will delve deeper into what it takes to be successful in the profession, along with the benefits and drawbacks. If you’re considering being a life insurance agent as a potential career, then this piece can serve as a helpful guide. For those already in the profession, this article can give you an idea of how much your counterparts across the country are earning. Read on and learn more about a life insurance agent’s earning potential.

The average annual salary of life insurance agents ranges from $62,000 to $76,000. These figures are based on the estimates of several employment websites Insurance Business used for research. The Bureau of Labor Statistics (BLS) has also released its latest occupational employment and wage statistics (OEWS), estimating the yearly average to be almost $77,000, although this figure pertains to all types of insurance agents.

For this piece, we will refer to the data compiled by this website, which ranks the states and major cities according to the average salary. You can also check out BLS’ OEWS projections for additional information. The table below reveals the percentile wage estimates for life insurance agents across the country.

|

PERCENTILE WAGE ESTIMATES (LIFE INSURANCE AGENTS) |

|||

|---|---|---|---|

|

Percentile |

Annual wage |

Monthly wage |

Hourly wage |

|

10th |

$39,000 |

$3,250 |

$19 |

|

25th |

$49,000 |

$4,083 |

$24 |

|

50th (Median) |

$62,552 |

$5,213 |

$30 |

|

75th |

$79,000 |

$6,583 |

$38 |

|

90th |

$99,000 |

$8,250 |

$48 |

|

WAGE ESTIMATES PER EXPERIENCE LEVEL (LIFE INSURANCE AGENTS) |

|||

|---|---|---|---|

|

Experience level |

Annual wage |

Monthly wage |

Hourly wage |

|

Entry |

$37,500 |

$3,125 |

$18.03 |

|

Mid |

$64,100 |

$5,342 |

$30.84 |

|

Senior |

$73,100 |

$6,092 |

$35.12 |

You also can view the wage estimates for insurance agents in general, along with the highest- and lowest-paying states and regions in the US, in this guide on how much insurance agents make.

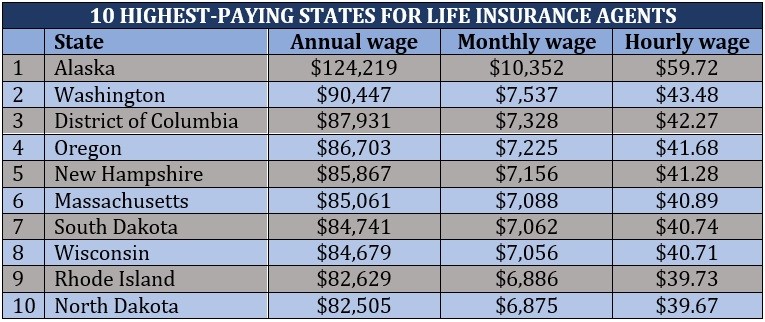

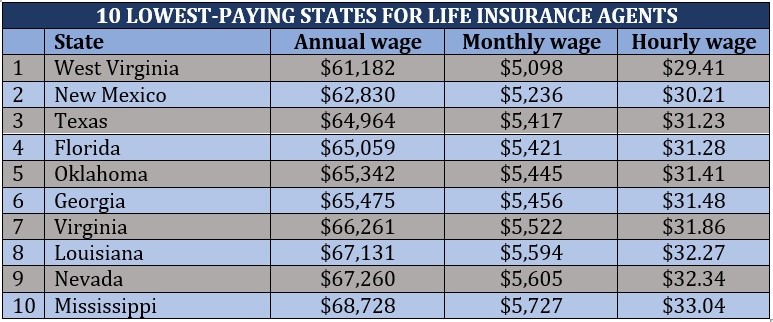

There are several factors that impact how much life insurance agents make – and among these is location. Because each state implements different rules on how insurance products are sold and who sells them, including licensing requirements, the average pay agents receive also varies. Here are the top- and least-paying states for life insurance agents ranked.

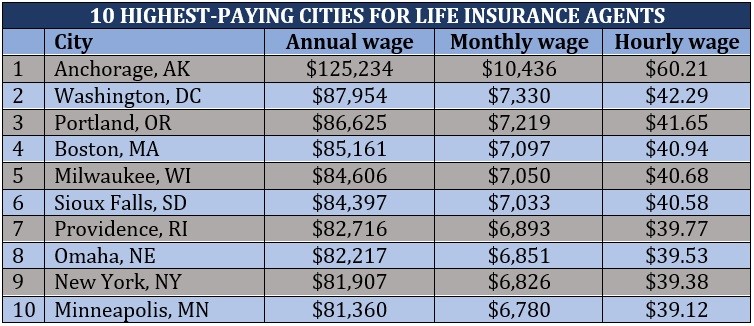

These are the highest-paying cities in the US when it comes to life insurance agent salaries.

The most common way life insurance agents make money is through commissions. Generally, agents receive front-loaded commissions of 40% to up to 115% of the policy’s first-year premiums, although the figure for renewals falls steeply to about 1% or 2%. Some agents stop receiving commissions after the third year of the policy.

Commission rates, however, are also dependent on the type of life insurance policies sold.

Insurance agents receive the highest commission rates for whole life insurance plans, often more than 100% of the total premiums for the policy’s first year. The exact percentage depends on the age of the policyholder.

Agents typically receive a commission equivalent to at least 100% of the premiums the policyholder pays in the first year up to the amount of the target premium for universal life insurance plans. However, the rate decreases for any premiums the insured pays above the target level in the first year.

Term life insurance plans pay the lowest commissions, often a percentage of the annual premiums ranging from between 30% and 80%.

Life insurance plays a crucial role in providing families with a certain level of financial security after the death of a loved one. With the right policy, this type of coverage can help families pay off loans and debts and meet daily living expenses. You can learn more about how this form of protection works by checking out our comprehensive guide to life insurance.

Life insurance agents can also be salaried employees of an insurance agency. These agents receive a base salary and employee benefits but are often required to meet a monthly sales quota.

There are three main variables that impact how much life insurance agents make. These are:

Captive life insurance agents, which work exclusively with one insurance carrier, typically earn lower commissions than independent life insurance agents, who represent several insurance companies. The catch is independent agents are often responsible for their own business expenses like rent, office supplies, and advertising costs.

Commission rates for whole and universal life insurance plans are often significantly higher than those for term life policies. Agents, however, must ensure that their clients are able to meet premium payments. If the policyholder stops paying and lets their policies lapse within the first few years, insurers may require agents to pay back some of the money they earned in commissions.

Each state has different requirements and regulations for those who want to sell life insurance policies, and these can affect how much agents earn in that state. In addition, a large city with a bigger population offers more opportunities for life insurance agents to sell policies compared to a small town with fewer residents.

Read next: How can you sell life insurance from home?

Choosing to pursue a career as a life insurance agent has its own share of pros and cons. Here are some of the advantages and disadvantages:

Minimal entry barriers

While there are some insurance companies and agencies that prefer candidates with a college degree, being a life insurance agent doesn’t necessarily require one. Most employers have training programs in place for new agents to prepare them for their jobs. All insurance agents, however, are required to obtain licenses to sell insurance products.

Multiple job opportunities

Do a quick online search for insurance jobs and websites will yield hundreds, if not thousands, of vacancies for life insurance agents. Agencies will always look to hire new people as long as there is demand for policies that can provide families with financial protection.

Strong earning potential

Because life insurance agents are paid mostly through commissions, those who have a great work ethic and are willing to go above and beyond to establish relationships with clients are presented with more opportunities to earn a higher income.

Opportunity to make a positive impact

Losing a loved one is never a pleasant experience, and it can be satisfying to know that you have played a key role in helping ease the financial burden on families while they grieve.

Chance to work with the biggest names

By pursuing a career as a life insurance agent, you can also have the opportunity to work with some of the country’s most prominent brands. You can check out our latest rankings of the largest life insurance companies in the US to find out the biggest names in the industry.

Commission-based earnings

This can either be a benefit or a drawback depending on a person’s situation. Life insurance agents who have an established client base and years of industry experience have more opportunities to close more sales, resulting in higher income. Industry novices, meanwhile, may struggle to find clients in a fiercely competitive market despite working long hours.

Sales challenges

Life insurance is not a particularly easy product to sell. Most people don’t like to acknowledge their own mortality, so talking about life insurance and what it covers can be a difficult task. Add this to the fact that such policies do not provide immediate gratification, unlike car insurance for example, and you have a product that can be challenging to sell.

Limited paid time off

Independent life insurance agents do not often have access to a full range of employee benefits, meaning they also have limited paid time off. Additionally, taking time off means they will have to spend time away from building client relationships and looking for leads, which can cost them part of their income.

Rejection and disrespect

Being a life insurance agent is not for the faint of heart and thin-skinned. During the course of their jobs, insurance agents will encounter people who will treat them with disdain and disrespect. They may also experience a lot of rejections before they can sell one policy. That is why having strong people skills and an impervious nature are crucial to achieving success in this field.

Your success as a life insurance agent is highly dependent on the type of relationship you build with potential clients. Here are some strategies from industry experts that can help you establish a good professional relationship with customers.

Life insurance is a dynamic field, with changes that occur in a snap. If you want to keep abreast of the latest happenings and developments, be sure to visit and bookmark our Life and Health news section, where you can find breaking news and industry updates. Also, don’t forget to subscribe to our newsletters to get fresh updates from the entire insurance industry as you develop your career.

Becoming a life insurance agent offers a host of advantages:

Becoming a life insurance agent is more than a job; it's a journey filled with financial rewards, personal fulfillment, and the power to secure people's financial well-being. This career merges financial acumen, interpersonal finesse, and the satisfaction of shaping clients' lives for the better.

Purchasing life insurance from an agent offers distinct advantages.

Agents provide personalized guidance tailored to your specific needs and financial goals. They have in-depth knowledge about various insurance products and can help you choose the right coverage.

They also offer a human touch, explaining policy details in detail and addressing any queries you may have.

Agents can look at your situation and recommend suitable policies to ensure complete coverage that aligns with your family's requirements. They simplify the selection process by presenting you with options that best match your circumstances and budget.

As your life changes, agents also help with policy updates so that your coverage remains relevant over time.

An agent's expertise extends to post-purchase support. They can help with claim filings and policy modifications. Their ongoing assistance fosters a long-term relationship built on trust and reliability.

While purchasing life insurance directly is an option, an agent's personalized guidance, product knowledge, and continued support make them a valuable resource throughout your insurance journey.

Explore the benefits of working with an agent to make an informed decision that secures your family's financial future effectively.

Several factors contribute to the high attrition rate among life insurance agents. The demanding nature of the job, characterized by commission-based income and prospecting challenges, often leads to discouragement. Many agents struggle to establish a steady client base and face rejection frequently, impacting their motivation.

The initial training and licensing requirements can be rigorous and time-consuming, dissuading those who seek quicker career paths.

The commission structure, while potentially lucrative, requires consistent effort to earn a good income. This leads agents to reevaluate their career choices.

A lack of proper mentorship and support from agencies can also lead to agent attrition. Without guidance and encouragement, new agents may feel overwhelmed and undervalued. Burnout can result from the pressure to meet sales targets and maintain client relationships, causing agents to seek alternative career paths.

Inadequate work-life balance is another prevalent reason for agent turnover. The demanding schedules, including evenings and weekends, can strain personal and family life. This work intensity often prompts agents to seek professions offering more predictable hours.

The challenges posed by the insurance industry, combined with the pressure to build a client base and maintain consistent sales, contribute to the high turnover of life insurance agents.

Addressing issues related to training, support, work-life balance, and income stability can potentially mitigate agent attrition and create a more sustainable career path within the field.

Achieving success in selling life insurance involves a combination of key strategies and qualities.

First, building strong relationships with clients is paramount. Understanding their needs and goals enables you to recommend the most fitting coverage options.

Effective communication is essential. Clearly explaining policy details, benefits, and potential risks helps clients make informed decisions. Honing your active listening skills allows you to address their concerns and tailor your approach.

Continuous learning is crucial in staying ahead. Keeping up with industry trends, policy updates, and market shifts enhances your credibility and positions you as a knowledgeable resource.

Developing a robust prospecting system is vital for consistent leads. Utilize diverse methods such as referrals, networking, and online presence to expand your client base. Establishing a niche market can also differentiate you from competitors.

Learn some helpful insurance prospecting tips to help you build your book of business here.

Resilience is key, as rejection is inevitable in sales. Maintaining a positive attitude, learning from setbacks, and adapting your strategies will contribute to long-term success.

Embracing technology helps, too. Use digital tools for client management, outreach, and online consultations to streamline processes and reach a wider audience.

Lastly, integrity is the foundation of trust. Prioritizing your clients' best interests over immediate gains fosters long-lasting relationships and referrals.

Success in selling life insurance demands a blend of interpersonal skills, industry expertise, adaptability, and ethical conduct. By focusing on client needs, staying informed, and refining your approach, you can establish a thriving and fulfilling career in the insurance industry.

Were you surprised to find out how much life insurance agents make? Do you agree with the figures above or not? Type in what you think in the comments section below.