Selling life insurance from home can be an enticing option for agents and brokers who want to maintain independence and flexibility in their professional careers. But doing business in a remote setup is a complex process, requiring hard work and dedication to succeed.

In this article, Insurance Business discusses the benefits and drawbacks of selling life insurance remotely. We will also give a step-by-step walkthrough of the process and explain what it takes to generate more sales.

Whether you’re starting a career as a life insurance agent or a sales veteran trying to work out if a remote setup suits you, this guide can help. Read on and learn more about the basics of how to sell life insurance from home.

A career as a life insurance sales professional can be challenging. The competition is fierce, and you may experience a lot of rejection before a successful sale. Conducting business in the comforts of your home isn’t any different. You should be willing to put in the effort for your venture to grow.

Fortunately, there are certain steps you can follow on how to start selling life insurance from home. Here’s a step-by-step guide:

If you’re just starting out in the industry, you will need to comply with the licensing requirements of the state where you plan on selling life insurance. However, before you can obtain a license, there are certain steps you need to follow:

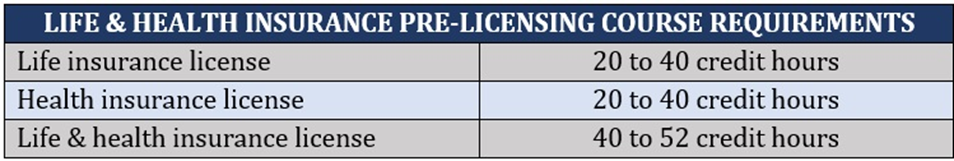

You’re required to complete a specific number of hours of coursework covering policy types, industry regulations, insurance principles, and ethics. The required credit hours vary by state but often ranges from:

You must pass the life and health licensure examination administered by your state’s insurance regulatory department. The test is designed to assess your knowledge of the different life and health insurance concepts, laws, and regulations. The passing score is usually between 60% and 70% depending on where you take the exam.

Some states will require you to undergo a criminal background check before issuing your life and health insurance agent license.

Once you have your license, it’s time to pick a niche.

Life insurance policies come in different forms. These include term, whole, and universal life insurance plans. There are also hybrid life insurance policies that combine a death benefit with an annuity and long-term care coverage.

You can choose to offer different types of plans or specialize in certain areas. Some life insurance agents and brokers even branch out to health insurance policies.

When deciding on which types of policies to sell, it’s important to develop your expertise. Standing out as an expert in your niche can enable you to build your brand, making it easier to sell life insurance from home.

This comprehensive guide on how life insurance works can help you understand more about this crucial type of coverage.

Having the right setup plays an important role in helping you succeed while selling life insurance from home. Equipment-wise, you will need to invest in:

Since you’ll be spending a great chunk of your time selling insurance, it can also help if you have a quiet space in your home where you can set up a workstation.

It’s also advisable to check with your area’s business department to find out if there are certain business licenses that you need to obtain. Some states may require certain permits if you plan on meeting clients in your residence.

Most insurance companies are doing away with paper applications. That’s why it’s important, especially if you’re selling life insurance remotely, to get familiar with how e-applications work.

Many life insurers are also automating key processes, including quoting and underwriting, so it’s important that you understand how these systems work.

You may also consider investing in customer relationship management (CRM) software to keep your client records organized.

Finding good leads is the lifeline of a career in insurance sales. But in a highly saturated market such as life insurance, it is also the biggest challenge. Life insurance agents often compete for a few qualified prospects. That’s why it’s crucial that you have a sound strategy on how to catch the attention of potential buyers before your competition does.

You can find great ideas on how to generate life insurance leads in this comprehensive guide.

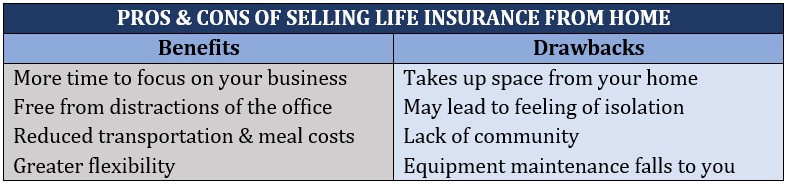

These are some of the benefits that make selling life insurance from home an attractive option:

On the flipside, there are also disadvantages of selling life insurance from home, including:

Here’s a summary of the pros and cons of selling life insurance from home:

Just like in any profession, choosing a career as a life insurance agent or broker has its share of advantages and challenges. To find out if a role in insurance sales is a good fit for you, you must first weigh these pros and cons:

As mentioned, if you intend to start a career selling life insurance, you must first comply with licensing requirements, which vary in each state. But apart from this, there are very few entry barriers for those wanting to pursue this career.

While some life insurance companies prefer candidates with a college degree, sales roles don’t necessarily require one. To help new hires prepare for their jobs, most insurers implement mentorship and training programs.

Insurance sales roles offer opportunities to earn higher income that has strong potential for growth. And with earnings mostly commission-based, a great work ethic and willingness to place yourself out there to establish relationships with clients are often rewarded.

Life policies are among the most in demand insurance products. And with the large number of people seeking coverage, this also means that there are plenty of opportunities to work in the sector.

If you choose to sell life insurance from home, you can enjoy the freedom of setting your own work schedule. However, there will be instances that will require you to meet with clients in-person outside your residence.

Life insurance plays an essential role in providing families with a financial cushion after the death of a loved one. With the right policy, this type of coverage can help families pay off debts and meet daily living expenses. This is just one of the reasons why a career in life insurance sales can be fulfilling.

High-pressure work environment

Many life insurance agents and brokers work long hours under tremendous pressure to meet different targets and quotas. This highly competitive work environment often leads to stress and burnout.

Since insurance sales are a commission-based role, predicting your next paycheck can be difficult. Your income will depend on the number of successful sales. This means that for you to earn more, you also need to push yourself harder.

Life insurance agents are often responsible for finding customer leads on their own. Although there are some insurers that provide staff with leads, there’s a strong likelihood that these may have already been contacted by several other insurance agents.

You also have the option to pay for exclusive leads. But these can be extremely expensive. If you choose to go this route, you may need to have a very high close rate just to break even.

If you’re working as an independent agent, you don’t have access to a full range of employee benefits. This means you have limited paid time off. Taking time off can also cost you part of your earnings as it takes time away from building client relationships and looking for leads.

During the course of your work, you will eventually meet people who treat insurance agents with disrespect or disdain. You may also receive a lot of no’s before getting a yes, so having excellent people skills and a resilient nature are necessary to thrive in this career.

As a life insurance agent or broker, the most common way for you to earn an income is through commissions. Generally, you can receive front-loaded commissions of 40% to up to 115% of the policy’s first-year premiums.

The rates for renewals, however, fall steeply to about 1% or 2%. You may also stop receiving commissions after the policy’s third year.

The type of insurance policy you sell also has an impact on your commission rates:

Term life insurance plans pay the lowest commissions ranging from 30% to 80% of the policy’s annual premiums.

Whole life insurance policies yield the highest commissions, often exceeding 100% of the total premiums for the policy’s first year. The exact percentage depends on the age of the policyholder.

Commission rates for universal life insurance policies are at least 100% of the premiums the policyholder pays in the first year up to the amount of the target premium. But the rate decreases for any premiums the insured pays above the target level in the first year.

If you want to know how much you can earn by selling life policies, you can find the answer in this guide to life insurance agent salaries.

Your success as a life insurance sales professional depends largely on the kind of relationship you build with your customers. Here are some practical strategies to help you establish a strong professional relationship with your clients.

The key to building and maintaining trust with a client is excellent customer service. To be successful, you must have the ability to understand each potential client’s unique needs and consistently provide quality service.

When it comes to life insurance, people often already know that they need coverage. However, they may not necessarily comprehend the types of policies to address their needs. The best life insurance agents have the empathy to identify the right form of coverage every client needs.

Trying hard to sell policies right away is a sure-fire way to ruin clients’ trust. That’s why you should focus on establishing good relationships instead. By being patient, you’re more likely to secure a long-term customer who may be willing to refer you to other potential clients.

If you want to be taken seriously in the industry, you must learn how to dress and communicate professionally. Sometimes, selling life insurance from home involves working outside a professional setting, but this doesn’t mean that professionalism goes out the window.

Part of establishing a successful career in life insurance is keeping abreast of the latest developments in the sector. Our Life & Health Insurance News section helps you do just that. Be sure to visit and bookmark this page regularly to access breaking news and the latest industry updates.

Do you think selling life insurance from home can be a worthwhile career? Feel free to comment below.