Americans have a nearly 70% chance of needing long-term care support and services after turning 65, the latest estimates from the Administration for Community Living (ACL) reveal. These services, however, don’t come cheap. And without proper coverage, such expenses can easily eat into your retirement savings.

This is where long-term care insurance comes in handy. This type of policy covers the cost of medical and non-medical services for seniors who have lost the ability to care for themselves. But how much do you expect to pay for this form of coverage?

This is exactly what Insurance Business will answer in this guide. We will look at the latest industry figures to give you an idea of the different pricing ranges. We will also give you a walkthrough of the factors affecting the cost of long-term care insurance.

If you’re planning for your own care or helping an older loved one secure suitable coverage, you’ve come to the right place. This article can help you gain a deeper understanding of the different costs associated with long-term care insurance.

Industry non-profit American Association for Long Term Care Insurance (AALTCI) has released its latest price index detailing how much policyholders can expect to pay in annual premiums.

The tables below sum up the cost of long-term care insurance policies worth $165,000 based on age, gender, and marital status. The index also calculated the cost of policies with inflation growth provisions.

|

Buyer |

Benefits |

Annual premiums |

|

Single male |

Level benefits |

$950 |

|

Benefits growing at 1% yearly |

$1,375 |

|

|

Benefits growing at 2% yearly |

$1,750 |

|

|

Benefits growing at 3% yearly |

$2,220 |

|

|

Benefits growing at 5% yearly |

$3,685 |

|

|

Single female |

Level benefits |

$1,500 |

|

Benefits growing at 1% yearly |

$2,150 |

|

|

Benefits growing at 2% yearly |

$2,815 |

|

|

Benefits growing at 3% yearly |

$3,700 |

|

|

Benefits growing at 5% yearly |

$6,400 |

|

|

Married couple |

Level benefits |

$2,080 combined |

|

Benefits growing at 1% yearly |

$3,000 combined |

|

|

Benefits growing at 2% yearly |

$3,870 combined |

|

|

Benefits growing at 3% yearly |

$5,025 combined |

|

|

Benefits growing at 5% yearly |

$8,575 combined |

According to the price index, the value of this long-term care insurance policy can increase to $222,400 once the policyholder reaches 85 years old for plans with 1% inflation growth provisions. For those with 2% provisions, the value can top $298,900 and $400,500 for policies with 3% inflation benefit.

|

Buyer |

Benefits |

Annual premiums |

|

Single male |

Level benefits |

$1,175 |

|

Benefits growing at 1% yearly |

$1,600 |

|

|

Benefits growing at 2% yearly |

$2,000 |

|

|

Benefits growing at 3% yearly |

$2,525 |

|

|

Benefits growing at 5% yearly |

$3,800 |

|

|

Single female |

Level benefits |

$1,900 |

|

Benefits growing at 1% yearly |

$2,550 |

|

|

Benefits growing at 2% yearly |

$3,300 |

|

|

Benefits growing at 3% yearly |

$4,300 |

|

|

Benefits growing at 5% yearly |

$6,600 |

|

|

Married couple |

Level benefits |

$2,600 combined |

|

Benefits growing at 1% yearly |

$3,525 combined |

|

|

Benefits growing at 2% yearly |

$4,525 combined |

|

|

Benefits growing at 3% yearly |

$5,800 combined |

|

|

Benefits growing at 5% yearly |

$8,750 combined |

Policies can be valued at $211,600 on the policyholder’s 85th birthday if their long-term care insurance plan has 1% inflation growth provision. The value increases to $270,700, $345,500, and $588,750 for policies with 2%, 3% and 5% inflation benefits, respectively.

|

Buyer |

Benefits |

Annual premiums |

|

Single male |

Level benefits |

$1,700 |

|

Benefits growing at 1% yearly |

$2,165 |

|

|

Benefits growing at 2% yearly |

$2,600 |

|

|

Benefits growing at 3% yearly |

$3,135 |

|

|

Benefits growing at 5% yearly |

$4,200 |

|

|

Single female |

Level benefits |

$2,700 |

|

Benefits growing at 1% yearly |

$3,400 |

|

|

Benefits growing at 2% yearly |

$4,230 |

|

|

Benefits growing at 3% yearly |

$5,265 |

|

|

Benefits growing at 5% yearly |

$7,225 |

|

|

Married couple |

Level benefits |

$3,750 combined |

|

Benefits growing at 1% yearly |

$4,735 combined |

|

|

Benefits growing at 2% yearly |

$5,815 combined |

|

|

Benefits growing at 3% yearly |

$7,150 combined |

|

|

Benefits growing at 5% yearly |

$7,150 combined |

Long-term care insurance plans with 1% inflation growth provisions can be worth $201,300 after the policyholder turns 85. The policies can be valued at $245,000, $298,500, and $437,800 if they have respective inflation benefits of 2%, 3%, and 5%.

AALTCI also notes that the rates above are for “Select” long-term care insurance policies, which are more expensive than “Preferred” plans. The organization adds that these rates are for policyholders in Illinois. Your premiums can be higher or lower, depending on a range of factors, including where you live.

The cost of long-term care insurance policies varies depending on a range of factors. These include:

Long-term care insurance pays for the cost of medical and non-medical support and services for seniors who can no longer care for themselves due to age-related impairments. This type of care can be provided at home or in nursing homes, adult day care centers, and assisted living facilities.

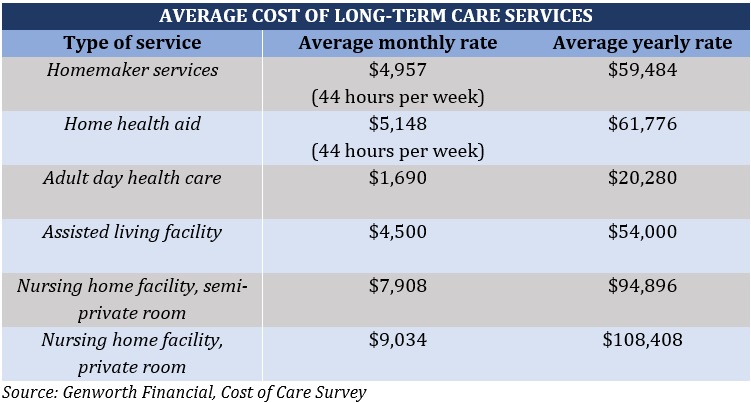

The cost of long-term care services, however, can be very expensive. To give you an idea of how much care costs in the venues above, here’s a summary from Genworth’s latest cost of care survey.

Cost of long-term care insurance – average cost of long-term care services (Table 4)

As you can see, the cost of long-term care services can deplete your retirement savings very quickly. To protect your retirement funds, it pays to have proper coverage in the form of a long-term care policy, sometimes referred to as extended care insurance.

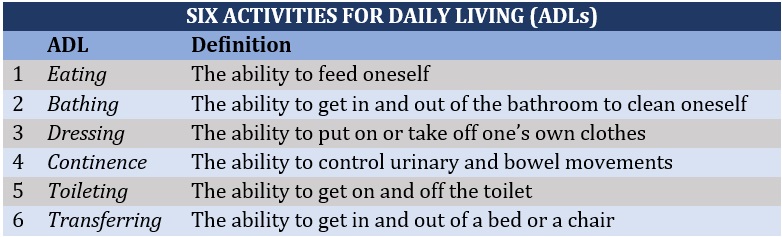

Each state implements its own requirements on who can access long-term care benefits under their policies. But generally, you’ll need certification from a reliable health services provider stating that you can no longer perform at least two of the six activities for daily living (ADLs). These ADLs, also called benefit triggers, are listed in the table below.

Cost of long-term care insurance – six activities for daily living (Table 5)

You may also qualify for long-term care coverage if you suffer from a debilitating condition. These include:

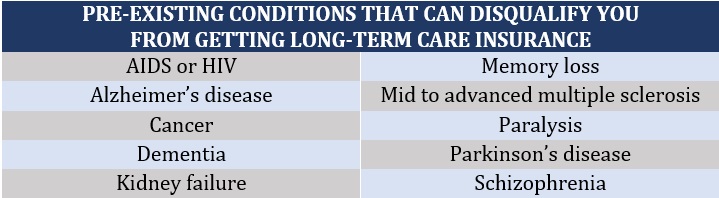

If you put off buying long-term care insurance until you already have health issues, there’s a big chance that you will be denied. Getting coverage will be difficult if you fit these criteria:

Here are some examples of pre-existing conditions that can prevent you from getting long-term care insurance:

Cost of long-term care insurance – pre-existing conditions that can disqualify you from coverage (Table 6)

If you have a pre-existing medical issue, the best way to get coverage is to take out health insurance. You can check out the different affordable health insurance options available. Your health insurance plan, however, doesn’t usually cover long-term care services.

The American Association of Retired Persons (AARP) recommends getting long-term care insurance in your early to mid-60s. If you’re married, the best time to take out coverage, along with your spouse, is at the age of 55.

The cost of long-term care insurance may be higher than if you get coverage in your late 40s to early 50s, but you’ll pay less premiums overall until you reach 80 years old. Remember, the main disadvantage of getting long-term care insurance early is that while the premiums are lower, you also commit to paying longer.

Read more about the break down of long-term care insurance costs by age here.

Long-term care coverage may be a costly expense depending on your health condition and personal situation. But there are several ways for you to cut the cost of long-term care insurance:

The best way to know if you’re getting the best deal possible is to compare quotes and policy features from different providers. The magic number is at least three insurers, then you can pick the one that you feel offers the best value for your money.

The younger you purchase long-term care insurance, the lower your premiums are. But there’s a caveat – you’ll also be paying premiums for a longer period.

Industry experts recommend taking out coverage between 60 and 65 if you’re single and at around 55 years old for married couples.

While you’ll be paying more than if you bought coverage in your 40s and early 50s, you could save more in overall premiums.

This allows you to split the premiums with your spouse. In addition, a joint plan lets couples share the total coverage amount. It also allows you to draw from each other’s pool of benefits once one of the spouses reaches their policy’s limit.

In most instances, you will be required to pay for the cost of long-term care services out of pocket for a certain timeframe called the elimination period. This often lasts between 30 and 90 days, after which your insurer starts the reimbursements. Policies with longer elimination periods typically cost less as the insurer also bears less risk.

While your life insurance offers several options for long-term care coverage, this can cost you more in the long run.

A hybrid life insurance policy, for example, allows you to access long-term care benefits while guaranteeing that your family receives a death benefit after you pass on. A long-term care insurance rider, meanwhile, gives you the benefit of tapping into your death benefit to pay for eligible long-term care costs. These features add to your life insurance premiums.

Taking a separate long-term insurance policy costs less than these options.

But life insurance comes with several unique benefits. If you want to learn more about how this type of policy works, you can check out our comprehensive guide to life insurance.

The data ACL gathered reveals a strong probability that you’ll be needing some form of long-term care support once you reach old age.

The figures also indicate that women require long-term care services for an average of 3.7 years, while men need them for around 2.2 years. A fifth of all seniors, regardless of their gender, also require care services for more than five years.

Without proper coverage, you’ll have to pay for these expenses yourself. If you don’t have enough financial resources, this can prove costly. That’s why it’s recommended to take out long-term care insurance if you can afford to, especially if you’re not extremely wealthy.

You can learn more about how long term-care insurance works and how it compares to other health-related coverage.

Do you think the cost of long-term care insurance is justifiable? Share your thoughts in the comments section below.