An office space is a vital part of many businesses. It provides a venue for employees to work together, meet clients, or simply perform their jobs. But office spaces are also exposed to plenty of risks. The physical structure and all equipment inside it can be damaged in a fire. Or a client may slip on a wet spot and get injured. Such incidents highlight the importance of getting proper coverage.

Enter business office insurance. This type of policy is designed to protect your business financially if unexpected disasters happen in your office space.

Insurance Business delves deeper into business office insurance in this guide. We will discuss what’s covered and what’s not, and what businesses should be looking for in a policy. Read on and find out if business office insurance offers the protection that your business needs.

Business office insurance is a type of policy that covers office spaces and almost everything inside. The level of protection varies depending on the insurance company.

Most policies offer a combination of commercial property and liability insurance coverage, much like what a standard business owner’s policy provides.

Some policies also pay out for the income your business loses if it is forced to temporarily shut down.

Others provide protection for home-based businesses.

Overall, business office insurance is designed to minimize the disruption to your day-to-day operations by compensating for the losses and damage that occur in your office space. These include incidents affecting any equipment and technology your business uses, as well as the inventory of products and materials you store and sell.

Business office insurance policies are often customizable. This allows businesses to take out enough coverage for the different assets that are essential to their operations.

Insurance companies provide an array of coverage options to address the unique needs of different businesses. These include:

Business office insurance covers the physical building where your business operates. This is especially important if you own the property.

Policies also cover fixtures and equipment that are permanently attached to the structure, including electrical and plumbing systems.

Coverage may also include detached structures that your business uses or owns such as warehouses, sheds, and parking spaces.

Commercial property policies pay out the cost to repair or replace the damage caused by an insured peril. This includes man-made incidents like theft and arson, and natural catastrophes.

Business personal property (BPP) insurance covers your company’s physical assets kept inside the office building. This covers equipment, furniture, even your staff’s personal possessions.

This type of policy is essential if you are renting office space. Most commercial property owners also make personal property coverage a condition of the leasing agreement.

This section of a business office insurance policy functions much like renters’ insurance in home insurance policies. Like commercial property coverage, it pays out repair and replacement costs as long as these are caused by a named peril.

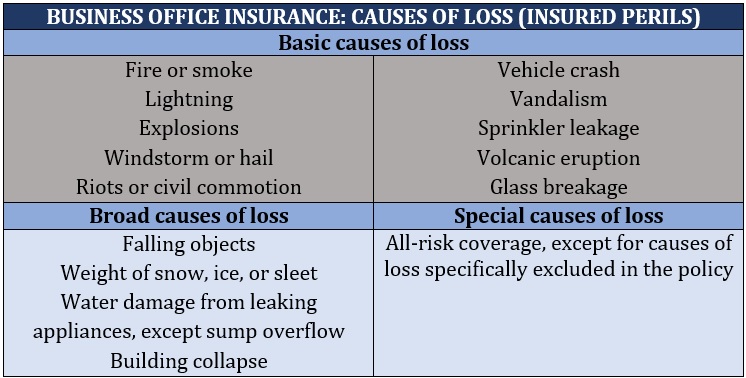

Most commercial property and business personal property policies classify insured perils into three groups. The table below lists these categories, along with examples.

Both kinds of policies also provide two types of coverages:

The general liability section of a business office insurance policy covers your business against claims of bodily injury and property damage that happen within the office premises. It pays out the legal and settlement costs arising from lawsuits, as well as medical expenses incurred due to the injury.

If your office space or business premises experience heavy foot traffic, this form of coverage may prove beneficial. You can learn more about this type of policy in our comprehensive guide to general liability insurance.

Business income insurance helps recover lost income if your business is unable to operate because of losses or damage to your office space if these are caused by insured perils. It may also pay for your operating expenses while your business temporarily shuts down. These expenses include:

Some business income policies provide coverage for additional expenses related to the closure. These include the costs of setting up in a temporary location or training employees to use new equipment.

This type of coverage is also called business interruption insurance, which is included in some business owner’s policies.

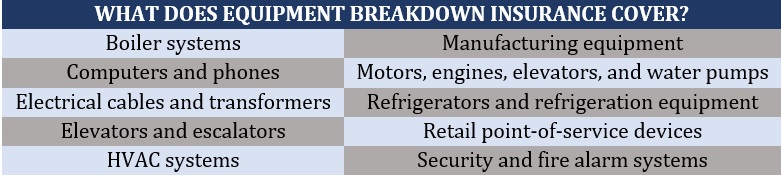

Equipment breakdown insurance reimburses the cost to repair or replace equipment that unexpectedly malfunctions due to electrical or mechanical failure, motor burnout, or power surges. The table below lists some common office equipment covered under this type of policy.

Equipment breakdown insurance must not be confused with tools and equipment insurance, which is an entirely different kind of policy. If you want to know the difference between these two types of coverage, you can check out our comprehensive guide to tool insurance.

Some business office insurance policies offer commercial crime coverage. This protects your business financially against business-related criminal acts. These include:

Commercial crime insurance covers criminal acts committed by third parties and employees. And given the rapid pace of digital transformation among businesses, it may also help to take out cyber insurance. This protects your company financially against the growing threat of cyberattacks like these incidents we covered in our latest cyber crime report.

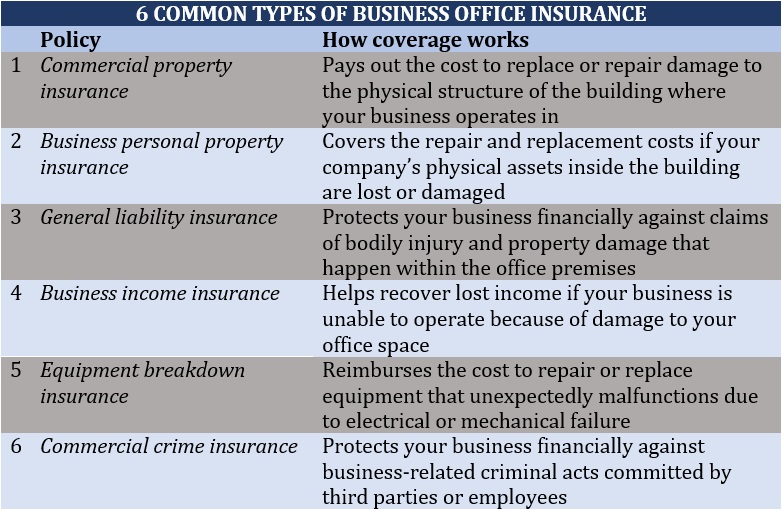

Here’s a summary of the different types of coverage commonly included in a business office insurance policy.

Regardless of whether you operate in an office space or not, there are certain forms of coverage that every business must consider. Find out what these are in our guide to the different types of business insurance policies.

Business office insurance typically covers property damage and liability claims that occur within the business premises. This type of policy doesn’t cover the following instances, which require separate forms of coverage:

Depending on the nature of your business, you may want to take out the abovementioned coverages. If you’re operating a limited liability company, our guide to liability insurance for LLC can give you an idea of some of the policies you may need.

Here’s a breakdown of how much average premiums cost for the different types of business office insurance policies. To come up with these estimates, we compiled data from different price comparison and insurer websites.

|

HOW MUCH DOES BUSINESS OFFICE INSURANCE COST? |

||

|---|---|---|

|

Type of policy |

Average monthly premiums |

Average annual premiums |

|

Commercial property insurance (Including business personal property coverage) |

$65 to $70 |

$780 to $840 |

|

General liability insurance |

$40 to $55 |

$480 to $660 |

|

Business income insurance |

$60 to $90 |

$720 to $1,080 |

|

Equipment breakdown insurance |

$25 to $40 |

$300 to $480 |

|

Commercial crime insurance |

$80 to $100 |

$960 to $1,200 |

Because these are just estimates, your actual premiums may be considerably lower or higher than these figures. The cost of your coverage depends on a range of factors, including:

If you own a small business and are wondering how much you need to spend on the different types of insurance policies, our guide to small business insurance cost can help.

Because of the crucial role business office insurance policies play in protecting your business, experts advise that you shop around and compare options. This is to ensure that you are getting the kind of coverage that matches your needs at the best possible price.

Here are some of the factors you need to consider before buying business office insurance:

Business office insurance is just one of the several types of coverage you can access to protect your assets and investments. If you want to learn about the different kinds of policies that can help you navigate challenging times, our comprehensive guide to business insurance can prove useful.

Is business office insurance a worthwhile investment? Have you ever experienced a situation where this type of coverage helped? Feel free to share your story below.