Workers’ compensation insurance is mandatory in almost every state, but the rules on coverage vary. In this article, Insurance Business will focus on how this form of coverage works in Florida. We will give you a walkthrough of the different requirements and benefits covered, who can be exempted, and the other unique aspects of workers’ compensation laws in the state.

Whether you’re running a business or employed by one, this piece can serve as a handy guide. Read on and find out how workers comp insurance in Florida can keep you financially protected when unexpected accidents occur in your workplace.

Most employers operating in Florida are required to provide workers’ compensation insurance to their staff. The coverage requirements vary depending on three main factors:

The table below shows the coverage requirements for different types of businesses.

|

Industry |

Requirements |

|---|---|

|

Construction |

Coverage required for businesses with at least one employee – regardless of whether they are full-time or contractual – including corporate officers and limited liability company (LLC) members |

|

Non-construction |

Coverage required for businesses with at least four employees, including corporate officers and LLC members

*Sole proprietors and partners in a partnership business are not considered employees and are, therefore, not required to carry coverage unless they want to. If they do, they need to fill in a DWC-251 form – also called notice of election of coverage – and submit this to the Division of Workers’ Compensation. |

|

Agriculture |

Coverage required for businesses with six full-time employees or 12 seasonal staff who work more than 30 days in a season but no more than 45 days in a calendar year |

Contractors must also ensure that all subcontractors carry the necessary coverage before agreeing to do business with them. Once a project begins, subcontractors are considered the contractor’s employees. This means that if a work-related accident occurs, the contractor will be responsible for paying out the benefits if the subcontractors do not have workers comp insurance.

Businesses can only purchase coverage through private carriers licensed by the Office of Insurance Regulation (FLOIR). According to the agency, there are more than 250 providers of workers comp insurance in Florida.

Businesses that have obtained workers comp insurance in Florida are given the “Broken Arm” poster, which they are required to display. The poster contains the name and contact number of their insurance provider.

Out-of-state businesses with employees working in the state are also required to take out coverage from state-approved providers. Some states have an extraterritorial reciprocity workers comp agreement with Florida. This allows employers there to use their home state’s coverage for staff working in Florida.

The table below lists the states where Florida has extraterritorial agreements with.

Corporate officers and LLC members can apply for an exemption from workers comp coverage online through the Division of Workers’ Compensation website of the Florida Department of Financial Services (Florida CFO).

For non-construction LLCs, applicants must have at least 10% ownership of the company. No more than 10 members can also be granted an exemption for each LLC. There are no such restrictions for corporations as long as the applicants are listed as officers in the records of the Division of Corporations of the Florida Department of State. Application for non-construction businesses is free of charge.

The requirements are almost the same for construction businesses. The main differences are the $50 application fee per LLC member and three-person limit per LLC.

It’s important to note that exemptions are granted to individual officers or members and not to the business. If an officer or LLC member wants to be exempt from multiple entities, they must file a separate application for each. Exemptions are valid for two years, after which they must be renewed.

Workers’ compensation pays out the cost of medical care and a portion of lost income of employees who become injured or ill while doing their jobs. In Florida, the benefits that workers receive are grouped into three categories. Let’s go through each of them.

Workers compensation insurance covers all “medically necessary” treatments and procedures authorized by a primary doctor or specialist. These include:

Policies also provide mileage reimbursements if an employee needs to travel to and from the doctor and pharmacy.

The Florida CFO also shared helpful tips to ensure that employees receive the right coverage. Here are some of them:

If an employee is unable to work due to a job-related illness or injury, they may receive any of the three types of disability benefits. These are:

In the unfortunate scenario that an employee dies within a year after the accident or five years of continuous disability, their beneficiaries may receive the following benefits:

Workers comp insurance in Florida covers all types of injuries and illnesses that employees sustain if these were a direct result of performing their jobs. To work out how much compensation an employee is entitled to, employers and insurance providers use a workers comp settlement chart. You can access our comprehensive guide to this industry tool by clicking the link.

Not every illness or injury that occurs in the workplace is covered under workers comp insurance in Florida. Some instances that workers compensation does not cover include:

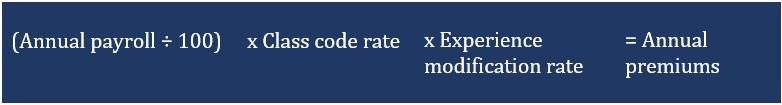

Just like in other states, the cost of workers comp insurance in Florida is calculated using this standard formula:

As you can see, there are three variables that play a crucial role in determining how much a business will pay for yearly premiums. These are:

If you want to dig deeper into the math behind these metrics, you can check out our guide to how workers comp is calculated.

Employers, however, can access discounts to reduce their workers’ comp premiums. Businesses that implement a workplace safety program can slash their annual premiums by 2%.

To help small businesses establish their own safety plan, the University of South Florida offers the Safety Florida Consultation Program. The program includes free consultation and access to employee safety training videos. You can find out how workers comp insurance for small businesses work in this guide.

Businesses with a drug-free workplace program are also eligible for a 5% discount on premiums.

Participation in both programs must be renewed every year for employers to continue receiving reduced premiums.

Since workers comp insurance is compulsory for all businesses operating in the state, getting caught without one can have serious legal and financial ramifications.

Businesses found to be lacking in coverage are often issued a stop-work order. This requires them to shut down operations until they can take out insurance and pay a fine. The penalty is equal to twice the amount the employer would have paid in annual premiums for the period they were without coverage. A $5,000 fine is also assessed for each employee who was falsely declared as an independent contractor.

A stop-work order may likewise be issued if a business tries to avoid paying the right premium amount by giving false information when purchasing workers comp coverage.

Apart from working without proper coverage, the Florida CFO reminds businesses that the following instances are against the law and may result in criminal charges from the Division of Investigative & Forensic Services (DIFS).

Denying an employee the right benefits can result in costly settlements. You can check out the most expensive workers comp settlement cases in the US that we compiled by clicking the link.

Apart from being mandatory coverage, workers compensation insurance frees businesses from the financial liability of shouldering the cost of medical care and treatment for an employee injured at work.

While most workplace accidents lead to minor injuries without a long-term impact on workers’ lives, you can never predict when something catastrophic will happen. And when they do, such incidents not only prove costly to the injured employee – without proper coverage, they can cost you your business as well.

This situation is what exactly workers compensation insurance protects you against. You can learn more about how this type of coverage works by accessing our comprehensive guide.

Check out our full report for the Top Workers’ Compensation Insurance Companies in the USA 2023 here.

What do you think about workers comp insurance in Florida? Does it provide businesses with adequate protection? Share your thoughts in the comments section below.