Construction projects face a lot of risks. From natural calamities such as hail and storm to man-made hazards like vandalism and theft, disasters strike when you least expect them. That’s why having home builders insurance is crucial for property owners and contractors involved in the construction.

This client education article discusses everything you need to know about this type of insurance. This piece will explain how the policy works, what it covers, and who should take out coverage.

Whether you’re a construction company or real estate developer working on a huge project or a homeowner renovating your property, this guide can help. Insurance professionals can also share this article with their clients to help them understand this essential form of coverage. Read on and find out how home builders insurance can protect you.

Home builders insurance protects against financial losses arising from a construction project. Coverage includes the building and anything that will become a permanent part of the structure throughout the project’s duration. That’s why it’s also called course of construction insurance. More on policy inclusions later.

Another popular name for the policy is builder’s risk insurance. While the names vary, the purpose remains the same. Home builders coverage is designed to protect both the property in development and those involved in the project financially when an unforeseen incident happens.

Generally, home builders insurance pays out the repair and replacement costs incurred from damages caused by covered events. The policy is designed to protect the builders’ investments. It also helps ensure that the construction project gets completed without major financial setbacks and delays.

This form of coverage is often needed for:

Everyone involved in a construction project needs the proper protection in case an unexpected disaster occurs. While not legally required, home builders insurance is often imposed as a condition in a construction contract.

Depending on the insurer and the agreement, either the contractor or the property owner can purchase builder’s risk insurance. It’s important to confirm who will be responsible for taking out coverage when finalizing the details of the contract.

Home builders insurance pays for the cost of:

Different insurers provide varying levels of protection, but a standard builder’s risk policy covers losses or damage caused by:

Some insurance companies offer coverage for water damage up to the limits specified in the policy. Standard policies don’t typically cover damage caused by overland flooding, sewer backup, and earthquakes. To get coverage for these types of perils, you must purchase an add-on or rider.

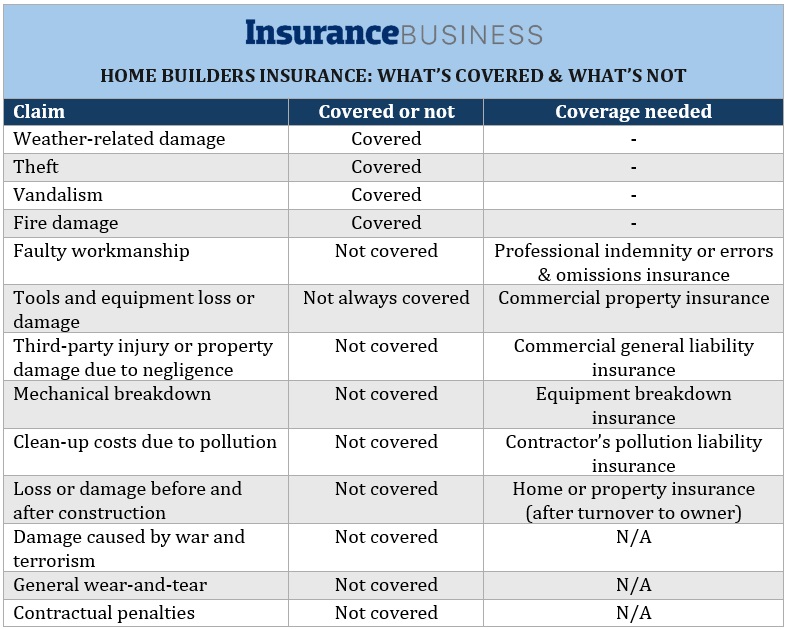

There are certain instances that home builders insurance won’t cover. For the situations below, you may need to get a different type of insurance policy:

Here’s a summary of what home builders insurance covers, what it doesn’t, and what types of policies can provide coverage.

Property insurance, also called home insurance, covers losses or damage to the completed structure after it has been turned over to the owner. This policy may also cover the contents inside the property.

Contractor’s insurance is a collective term given to a range of policies that construction companies need to get optimal coverage for a construction project. This includes home builders insurance, also known as builder’s risk insurance. Getting a complete range of contractor’s insurance is a part of a broader risk management strategy that construction businesses must employ.

Homeowners who are renovating or expanding their homes need builder’s risk insurance to protect their investment. It covers them financially if an unexpected disaster occurs during renovation. This includes a storm damaging the property or thieves stealing tools and equipment left within the premises.

A builder’s warranty and a home warranty are the same. Both serve as a guarantee from the builder that the home will be free of defects for a specified period after construction or renovation. Builders initially get the warranty, which the homeowner inherits once they take possession of the property.

Find out what types of policies construction businesses need to be fully protected in this guide to insurance for contractors.

The cost of home builders insurance is influenced by a range of factors, including:

In Canada, contractors and property owners pay between 1% and 4% of the total construction costs for home builders insurance. This means that premiums for a $500,000 residential project will cost around $5,000 to $20,000.

Unlike most types of policies in which costs are calculated for the year, premiums for builders insurance are based on the estimated completion of the project.

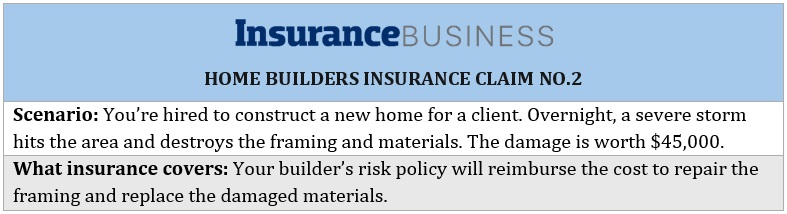

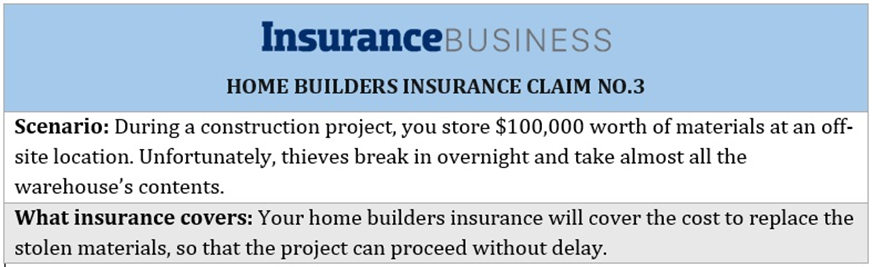

Construction projects are exposed to a range of risks. These can cost builders and property owners a huge sum of money. Home builders insurance can help protect you and your business financially once unforeseen disasters strike. Consider these scenarios:

Home builders insurance Canada claims scenario 1

Home builders insurance Canada claims scenario 2

Home builders insurance Canada claims scenario 3

These situations show the important role home builders insurance plays in ensuring that construction projects are completed on time.

Home builders insurance is essential for anyone who could suffer financial losses if something goes wrong in a construction project. These include:

Construction businesses bear the brunt of the financial losses as they often shoulder the project expenses until construction is finished. A home builders policy provides financial protection from additional costs caused by unexpected damage.

Builder’s risk insurance is a crucial part of any property owner or developer’s risk management plan. This policy transfers the potential financial risks from losses and damage from the owners to the insurance providers.

Canadian homeowners who are renovating or expanding their properties must take out home builders insurance. The policy protects them financially if an unforeseen disaster strikes during renovation. Without coverage, they will need to cover the repair and replacement costs out of pocket.

No two construction projects are the same. Each comes with its own set of risks. That’s why there isn’t a single policy that fits every need. Before purchasing the right coverage, it’s important to consider these factors:

If you’re searching for home builders insurance providers in Canada that offer the best coverage, our Best in Insurance Special Reports page is the place to go. In this section, we feature only insurers and insurance professionals who are recognized as dependable and respected leaders of the industry.

Recently, Insurance Business unveiled our five-star awardees for the Best Insurance Companies for Construction in Canada. By partnering with these insurers, you can be sure that your construction project will be protected and proceed as planned.

How important is having home builders insurance for your construction project? Do you have experience where this type of policy saved you? We’d love to see your story below.