Let’s say your construction company was hired to work on a large-scale project. During the construction phase, a massive fire broke out resulting in extensive damage to the property, materials, and equipment. An investigation revealed that the losses easily reached hundreds of thousands of dollars. Without coverage, you’re on the hook for the cost of repairs.

The situation shows how important it is for construction businesses to have builder’s risk insurance.

In this guide, Insurance Business will explain how this type of insurance works and how it can protect your business. We will also give you a checklist of what to look for when choosing the right policy. Read on and find out the answers to the most common questions about builder’s risk coverage.

Construction projects are exposed to a wide range of risks. From natural calamities to man-made hazards, disasters often strike unexpectedly. Builder’s risk insurance protects property owners and construction companies against financial losses resulting from these incidents.

The policy pays for the cost to repair or rebuild the damaged structure and replace lost materials and equipment. This helps ensure that the construction project goes as planned without major financial setbacks and delays.

Coverage kicks in when the first shovel hits the ground and lasts until the project is completed. This is why the policy is also called course of construction insurance.

If your business is involved in the construction of residential and commercial establishments, builder’s risk insurance is important. Homeowners doing major renovations and expansions can also benefit from this type of coverage.

There are no laws in Canada requiring construction companies to take out a builder’s risk policy. Most clients, however, choose to only work with businesses that carry insurance.

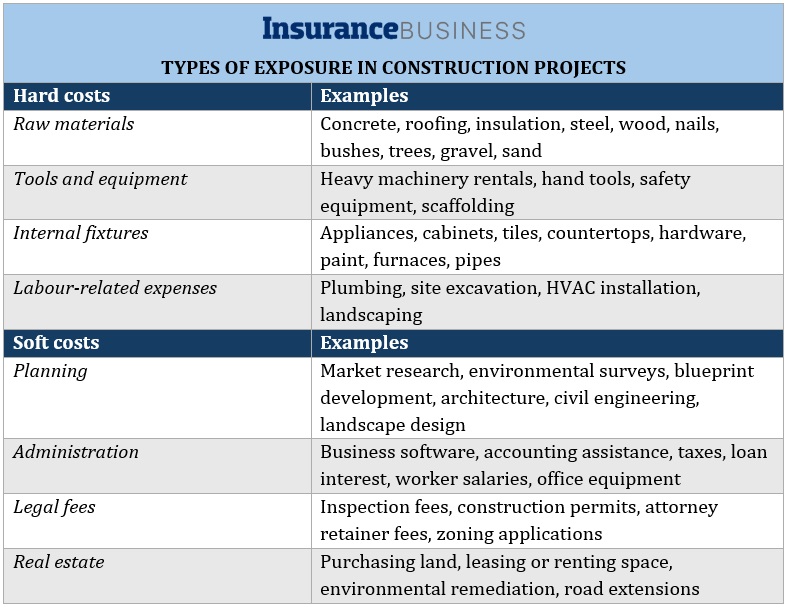

Builder’s risk insurance covers two types of exposures:

Hard costs come from tangible assets associated with a construction project. These include the physical structure, materials, supplies, and labour-related expenses. Compared to soft costs, hard costs are easier to determine because they are used to make visible improvements.

In its most basic form, builder’s risk insurance is designed to cover only hard costs.

When a disaster happens, losses and damage onsite can result in project delays that can lead to additional expenses. These are considered soft costs. These include architectural and design fees, loan interests, and advertising and PR expenses. Mostly, soft costs wouldn’t have been incurred if there were no delays in the construction project.

Here are some examples of hard and soft costs in a construction project:

A builder’s risk policy reimburses the hard and soft costs incurred if the loss or damage is caused by covered events, including:

Standard policies don’t usually cover overland flooding and earthquakes, although you can add these events by purchasing an endorsement. Water damage is often covered only up to a specified limit. Some insurance providers will also allow you to include coverage for pollution clean-up, molding, sewer backup, and business interruption.

Increasing your policy’s level of coverage has a corresponding effect on your premiums.

Builder’s risk insurance doesn’t cover every exposure. Some instances that the policy excludes are:

If you’re searching for coverage for these incidents, it may be better if you look at other types of construction insurance. This guide on insurance for contractors will give you a rundown of the different types of coverage your construction business needs.

To give you an idea of how builder’s risk insurance can benefit construction companies in Canada, we will give you a few scenarios:

Scenario: Your construction business is working on a huge shopping complex worth millions of dollars. During construction, faulty electrical wiring causes a massive fire resulting in extensive damage to the property, materials, and equipment. Worse, the incident has delayed the project’s completion.

What builder’s risk insurance covers: Your policy can help pay for the costs of the fire damage. These include repair and reconstruction of the affected areas and purchasing of new materials and equipment. Your insurance, however, may not reimburse the costs to replace and re-install the faulty electrical system that caused the fire.

Scenario: Your construction company is building a commercial establishment in a prominent suburban location. With the project nearing completion, a severe storm rips through the area. This caused major structural damage to the building and delayed the project's progress.

What builder’s risk insurance covers: Your policy will cover the cost of repair, debris removal, and replacement of lost and damaged equipment. The exact cost, however, will depend on the limits specified on your policy document.

Scenario: You leave some materials and tools in a locked storage onsite overnight, thinking it would be secure. You come back the next day to find out that the construction site has been broken into, and the essential supplies have been stolen. Without these supplies, the project will be delayed.

What builder’s risk insurance covers: Construction sites are among the favourite targets of thieves because of the expensive materials and equipment often stored in them. Fortunately, your builder’s risk policy covers the cost of replacing the stolen property to ensure that the project can proceed without further interruptions. But there’s a condition: the property must have been stored in a secure location at the job site.

Scenario: You’re restoring an abandoned house in a popular tourist location so it can be used as a vacation rental. One night, the property was broken into and vandalized, causing significant damage to the property.

What builder’s risk insurance covers: Your policy will pay for the cost to repair the damage. If there are materials and equipment that were stolen, these will also be covered up to the policy’s limit.

Find out the current trends on Canada’s construction insurance market straight from the experts in this episode of Insurance Business TV.

Depending on the agreement, either the project owner or the construction company can get builder’s risk insurance. This is why it’s important that you confirm who will be responsible for purchasing coverage when finalizing the details of the construction contract.

Regardless of who took out insurance, coverage can be extended to everyone who is involved in the project. This can be done through an additional insured endorsement. Those who can be added as named insureds include:

Homeowners renovating or expanding their properties can also benefit from getting builder’s risk insurance. Being the rightful owners of the property, they will be responsible for shouldering the cost of any damage without proper coverage.

Construction companies and property owners can expect to pay anywhere from 1% to 4% of the overall project costs for builder’s risk coverage. This means that the premiums for contractors working on a $500,000 residential project will be significantly lower than those constructing a $5 million commercial complex.

For these examples, the premiums can range from $5,000 to $20,000 and $50,000 to $200,000, respectively.

Apart from the total cost of the project, there are several factors that can influence premiums. These include:

Premiums for builder’s risk insurance, however, are calculated differently than other types of insurance policies. Unlike home and auto policies, in which the costs are calculated per year, construction insurance premiums are based on the expected completion of the project.

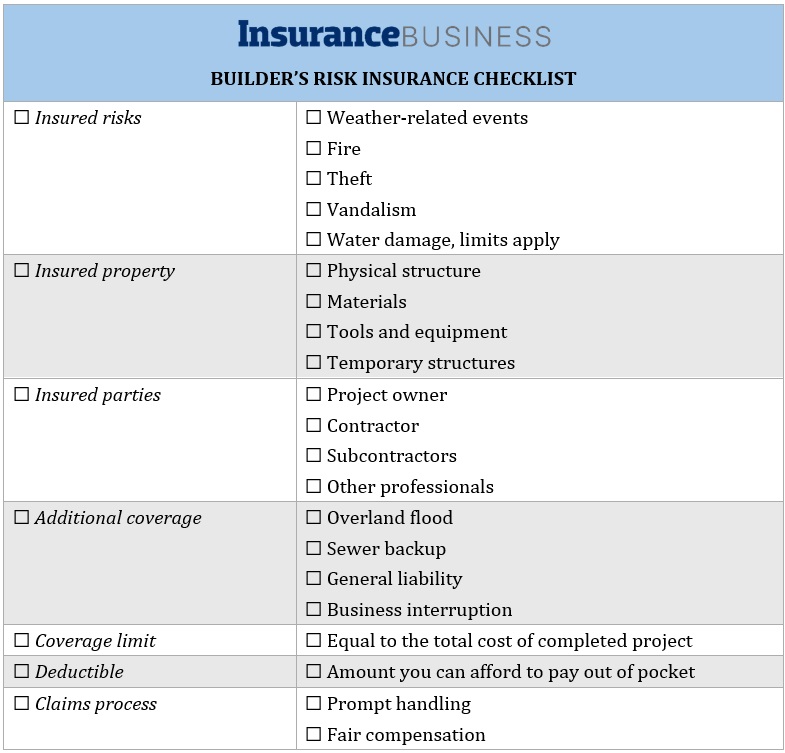

Each construction project comes with its unique share of risks. Because of this, there is no one-size-fits-all builder’s risk insurance policy that can cater to every need. To find the right coverage that matches your business’ needs, there are several factors you need to consider:

Here’s a checklist of what you need to consider to find the policy that best suits your needs. You can download the file and print it for easy access.

Another important factor that you should consider is the insurer’s reputation. If you’re looking for a builder’s risk insurance provider that offers top-notch coverage, our Best in Insurance Special Reports page is the place to visit. Here, we only feature insurance companies and professionals who are vetted by our panel of experts as respected and reliable industry leaders.

Recently, we revealed our five-star winners of the Best Insurance Companies for Construction in Canada awards. By choosing to partner with these insurers, you can be sure that your construction project will be protected from start to finish.

Do you think getting builder’s risk insurance is important for construction businesses? Have you experienced the benefits of having coverage? Feel free to share your story in the comments.