With Canada's large renting population, you may surmise that a huge proportion of the country’s tenants have taken out tenant insurance to protect their belongings. In reality, however, there exists a huge coverage gap, which industry experts attribute to a lack of understanding of the true value tenant insurance brings.

In this article, Insurance Business cuts through the noise surrounding this type of coverage. We will discuss what kind of protection tenant insurance provides, how much premiums cost, and how much coverage tenants need. If you’re among the millions of Canadians residing in rental properties, this piece can help guide you to find the right policy. For the insurance professionals who typically read our site, this article can help your clients better understand how tenant insurance in Canada works.

Tenant insurance, also sometimes called renters insurance, is a type of policy that protects tenants and their personal belongings when disasters and accidents strike. It functions the same way as contents insurance in a homeowners insurance policy, but covers your possessions if you’re living in the following type of rental properties:

Tenant insurance is not legally required in Canada, although many landlords make it a condition of the rental agreement.

One of the biggest misconceptions preventing many from purchasing coverage is the belief that the renters’ personal belongings are already covered under their landlord’s policy. But that is simply not the case. While it is true that it is the landlord’s responsibility to obtain coverage for the rental property and its fixtures and fittings, this type of protection – aptly called landlord insurance – does not include the tenants’ possessions. For you to be protected, you must purchase a separate tenant insurance policy.

Tenant insurance pays out the cost to repair or replace your belongings should they be lost, damaged, or destroyed by a named peril.

There are two ways in which you are paid under a tenant insurance policy:

Named perils, ACV, replacement cost – find the meaning behind these and other common industry buzzwords in our glossary of insurance terms.

Standard Canadian tenant insurance provides three types of coverage. These are:

Depending on the policy, tenant insurance typically covers loss or damage to your personal possessions caused by the following perils:

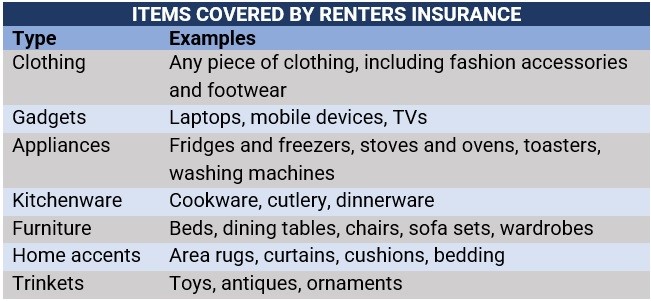

The table below details what items are covered by most tenant insurance policies.

Tenant insurance often imposes special limits on more expensive belongings, including jewelry, musical instruments, and artworks. You may need to purchase a rider to extend coverage to these items. Some policies cover spoiled food due to power interruption or if your refrigerator or freezer breaks down. Others cover lock replacement if your keys are lost or stolen.

Tenant insurance often imposes special limits on more expensive belongings, including jewelry, musical instruments, and artworks. You may need to purchase a rider to extend coverage to these items. Some policies cover spoiled food due to power interruption or if your refrigerator or freezer breaks down. Others cover lock replacement if your keys are lost or stolen.

Tenant insurance provides protection for a range of items you may never have thought of. Check out this list of unusual things your home insurance policy may cover.

Also called personal liability coverage, this part of a tenant insurance policy provides financial protection against:

Personal liability: Covers lawsuits and other legal expenses arising from injuries to other people while on the rental property, including those caused by dogs and other pets. Also covers damages to other people’s property that you, the tenant, is responsible for.

Medical payments: Pays out for hospital and treatment expenses incurred if a guest gets injured while on the property you are renting, regardless of who is at fault.

Also referred to as ALE, this is the part of a tenant's insurance policy that covers living expenses incurred if you need alternative accommodation because the rental property has become uninhabitable. Coverage typically includes the following, but is subject to limits:

Each policy provides different levels of coverage, so the terms and conditions also vary depending on the insurance provider. Tenant insurance in Canada typically has the following exclusions:

I know there’s obviously bigger things to worry about during the extreme cold warning.

— rob 🔨 (@rbngrhm) February 3, 2023

but if you’re a tenant and don’t have tenant insurance yet:

buy it NOW. A burst pipe WILL NOT BE GOOD.

Another misconception about tenant insurance is that it provides limited coverage, making purchasing such policies an unnecessary expense. The truth is, however, tenant insurance provides flexible coverage that can be tailored to suit each tenant’s unique needs. If a standard tenant insurance policy is not enough to meet your coverage requirements, there is an array of add-ons or endorsements you can use to extend protection. These include:

Based on the calculations of several price comparison websites Insurance Business reviewed, standard tenant insurance premiums in Canada go for between $15 to $40 per month, or $300 to $480 annually. If you want to know which insurers offer the best tenant insurance in Canada, you can view the list in our latest rankings.

However, because each renter comes with a different set of circumstances, tenant insurance does not have a fixed rate for everyone. Just like in other types of policies, tenant insurance premiums are influenced by a range of factors. These include:

The answer to this question is entirely up to you. Because each tenant’s situation is unique, there is no one-size-fits-all amount that can cover every need. The amount of tenant insurance you should take out should be enough to pay for the repair and replacement expenses if an unexpected accident or disaster damages or destroys your belongings.

Coming up with a precise estimate of the cost of your possessions, therefore, is crucial:

The internet is replete with personal property calculators from insurance companies and price comparison websites that you can easily access to get an accurate estimation. You can also consult an experienced insurance agent or broker to help you work out the true amount.

Tenant insurance is among the most affordable types of policies you can take out, but that does not mean you cannot save on premiums. Here are some practical strategies you can use to slash tenant insurance costs.

While accidents and calamities are not regular occurrences, it is still important to get protected. These events happen when you least expect them and tenant insurance gives you the peace of mind in knowing once they hit you, you have the financial safety net to help you recover.

But one thing to keep in mind is that tenant insurance is not for everyone. If you can afford to replace all your possessions if it gets damaged or lost, then you need not purchase coverage. Same if you have very few possessions.

However, if you own several valuable items that you cannot easily replace, then having this kind of protection is vital. Tenant insurance is likewise essential for those living in high-crime areas where theft is rampant or those prone to natural disasters such as forest fires and flooding. As many industry experts attest, tenant insurance is among the cheapest and easiest types of coverage you can obtain, making it generally a smart investment.

Tenant insurance works almost the same worldwide but there are slight differences keep in mind that if you are moving outside of Canada, in most countries tenant insurance is actually called renters’ insurance. Check out our global renters insurance guide to learn more.

Do you think tenant insurance is a worthwhile investment in Canada? Share your thoughts below.