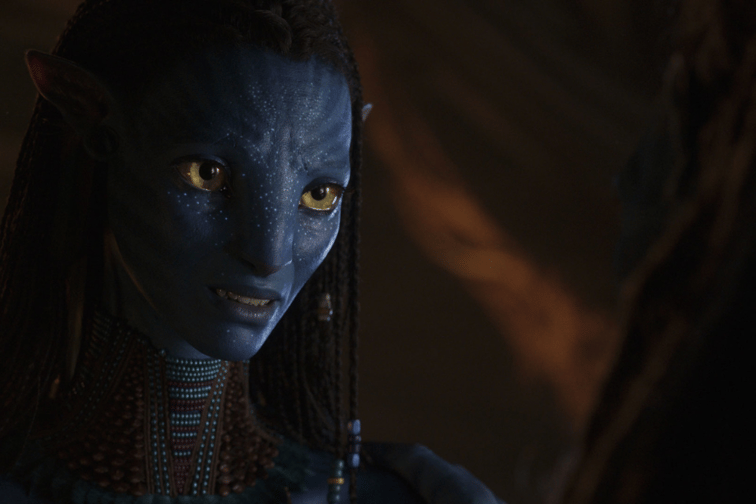

James Cameron’s blockbuster movie Avatar broke post-pandemic onset records when it was released last December, and the way the films’ protagonists, an alien species known as Na’vi, interact with the world around them could act as a blueprint for professionals looking to better understand the potential that generative AI might have to change how they work amid numerous talent and workforce challenges.

Generative artificial intelligence (generative AI) exploded into public consciousness in late 2022 with the emergence of popular online platform ChatGPT. A record-breaking 100 million people flocked to Microsoft-backed ChatGPT within its first two months, leaving rival Alphabet, parent company of Google, rushing to push out its Bard alternative.

In August 2023, Gartner placed the technology at its peak of inflated expectations on the hype cycle, with a senior VP analyst commenting that its popularity will have a “profound impact” on both business and society.

In the space of just one year, big businesses, from entertainment giant Disney to shopping titan Walmart to insurance colossus Chubb, have come out and said they are looking at how generative AI, or large language models (LLMs), could work within their industries. Seventy per cent (70%) of global CEOs cited AI as their top investment priority in KPMG’s 2023 CEO Outlook survey.

OpenAI, which owns ChatGPT, has been in talks to sell employees’ shares at a whopping $86 billion valuation, Reuters reported in October. A boardroom coup attempt this month, reportedly by individuals concerned by the potential commercial trajectory of the firm, ousted OpenAI CEO Sam Altman, before he was swiftly returned to the hot seat.

There have been words of caution, including from within the insurance industry. In November, MAPFRE CEO and chairman Antonio Huertas added his voice to calls for legislation around AI and ethics.

With the hype cycle in full swing and policymakers, technologists and businesses themselves still zoning in on ethical, legal, and security considerations, it remains to be seen how LLMs will impact on insurance and other industries. Nevertheless, it has undeniably been a big year for generative AI.

It’s also been a pretty good year for Hollywood director James Cameron, whose blockbuster sequel to Avatar, Avatar Way of the Water, defied a box office slump and became the highest-grossing film since the COVID pandemic when it burst into cinemas in December 2022.

Both the Avatar movies and generative AI speculation invoke a healthy dollop of modern-day future‑gazing, but Cameron’s vision for a species tapped into its ancestors could also provide a handy metaphor for how businesses undergoing talent crises might end up making the most of generative AI tech to keep knowledge flowing, according to one technology expert.

“With friends, how I describe it is, if you’ve seen the movie Avatar, and you plug into that tree, and you have the inherent knowledge, this is what generative AI can do for you,” said Sasha Korol, head of research and innovation at software business Duck Creek.

NOTE: Editorial use only – copyright Disney

Avatar’s humanoid blue Na’vi characters, whose lives are disrupted by the arrival of humans on their moon habitat of Pandora, may not be technologically savvy – but they do have a way of understanding and sharing their history and their environment that dwarfs human capabilities.

Using their braids to plug into a sacred tree (known as the ‘tree of souls’), the creatures are able to link into what they perceive as their deity, ‘Eywa’, and connect not just to their ecosystem, but also to memories and voices of their ancestors. Effectively, the tree acts as a giant brain, or neural network.

In practical terms when it comes to potential generative AI uses, the tree might represent a gigantic network or system, each ‘memory’ might be made up of a series of datapoints, and the Na’vi accessing and interrogating the ecosystem might be workers tapping into a wealth of past expertise and information that constantly improves and adapts its output to what the user requires based on their interaction with the model.

Industries have been using traditional machine learning for over a decade, but generative AI and LLMs are said to represent the next step in AI development.

Machine learning techniques bloomed in the first decades of the 2000s, analyzing big tranches of data to draw conclusions, according to Accenture. This included finding patterns, making predictions and automating tasks.

It was in the 2010s that ‘deep learning’ progressed, which included what Accenture has described as “computer vision” used by self-driving cars to detect and classify objects and obstacles, in addition to voice recognition techniques that power voice activated assistants like Alexa and Siri.

The 2020s will now be all about “language mastery” as LLMs develop capabilities that enable users to engage and build with them in new ways, Accenture predicted.

Generative AI technology, or LLMs, could impact 40% of all working hours, Accenture found, citing that language tasks account for 62% of the time that employees work.

“The effect on organizations will be profound,” Accenture stated in a 2023 briefing document.

“The ability of LLMs to process massive data sets allows them to potentially ‘know’ everything an organization has ever known—the entire history, context, nuance and intent of a business, and its products, markets and customers.

“Anything conveyed through language (applications, systems, documents, emails, chats, video and audio recordings) can be harnessed to drive next-level innovation, optimization and reinvention.”

There is hope that generative AI models might go further than cutting down on costs and making everyday processes more intuitive and could help address an “age-old”, in the words of Duck Creek’s Korol, challenge: talent and knowledge transfer.

A global talent crisis threatens to shift the “balance of economic power”

AI advances come as financial services is expected to face an increasing talent dearth. In 2018, prior to the generative AI hype onset, Korn Ferry research warned of a “global talent crisis” and an imminent crunch that could “shift the global balance of economic power” and lead to a talent shortage of 85.2 million people by 2030, with the deficit most keenly felt across financial and business services.

Insurance industry has been engaged in its “war for talent”

The insurance industry is often said to be embroiled in a “war for talent”, with this reflected across underwriting, claims, distribution, and compliance functions, according to experts.

Several solutions have been mooted, including an industry rebrand and – for Western based insurance industry players – investing in the talent pipeline in emerging nations, a move that has been championed by claims group Crawford & Company CEO Rohit Verma, who has cautioned that a global demographic shift needs to be “talked about more” in the talent context.

The great insurance retirement – a growing knowledge gap risk

In the US alone, the insurance industry faces a 400,000 worker shortage, driven by a swathe of retiring experienced baby boomers, according to BLS figures shared by the US Chamber of Commerce.

As of 2023, the UK’s London Market specialty insurance hub was made up of more over 50s than under 30s, prompting London Market Group CEO Caroline Wagstaff to warn that insurance remains “dogged by a decades-old image problem that labels it ‘dull’”.

While insurance is working to tackle its talent challenge, whether through university and college programs, like Canada’s Humber College insurance management course, or its risk centered rebranding, knowledge continues to be lost every day as senior professionals head to the door to retire.

Generative AI, with its ability to assess vast tranches of data and turn it into understandable plain language results and image outputs, could play a vital part in plugging knowledge and skills gaps exacerbated by retirement trends, according to Korol.

“Knowledge sharing is so hard in the virtual world and in insurance specifically, especially when you consider that remote working is far more prevalent than it was 10 years ago” said Korol. “Creating this kind of exchange capability [like in the Avatar example] does supplement this and helps share more historic knowledge across the board.”

While the dawn of generative AI has raised concerns around workers’ future, within insurance the US National Association of Insurance Commissioners (NAIC), which has launched an AI working group, has said that limitations including hallucination risk and a lack of emotional intelligence and understanding of context mean it’s unlikely that ChatGPT-type tech will replace underwriters, claims handlers, or customer service representatives in the “near future”.

LLMs and machine learning won’t be replacing insurance’s “highest skilled” workers anytime soon, but the technology will enhance their capabilities, Chubb CEO Evan Greenberg told analysts in April.

While insurance has been affected by a spate of recent layoffs, these have been, for the most part, limited to personal lines insurance providers that have undergone underwriting profitability issues in the wake of natural catastrophe impacts and inflation. In recent commentary, AM Best analysts suggested that these job losses are more likely to be due to cyclical factors and it is “too soon” to cite AI as the leading driver of cuts.

For some workers, though, the future may look somewhat different.

The World Economic Forum (WEF) listed statistical, finance and insurance clerk roles at number nine out of the top 10 fastest declining jobs in its Future of Jobs Report 2023, which included a range of clerical professions.

On the flip side, AI and machine learning specialists topped the WEF’s list for fastest growing jobs, and non-tech companies needing to carefully consider how they attract AI-savvy talent in a red hot competitive market, Boston Consulting Group has cautioned.

There may be some good news for insurance businesses when it comes to attracting AI talent, and it involves its reservoirs of data.

“We’ve got some really smart people who are excited by the insurance industry, because this is truly a playbook for it – there’s so much data and workflow to access,” Applied Systems CEO Taylor Rhodes told members of the media at Applied Net 2023.

The bigger picture – could generative AI and LLMs disrupt the wider job market?

Two-thirds of occupations in the US could be exposed to some degree of AI automation. However, this would not necessarily result in layoffs for all; rather, most jobs and industries were likely to be “complemented rather than substituted” by AI, the Goldman Sachs researchers predicted.

“The benefit of AI to society as a whole will depend on the adaptability of workers’ skills, how well they are retrained or redeployed, and how policymakers choose to support the groups that are hardest hit by these changes,” Lisa D Cook, American economist and US Federal Reserve System board of governors member, told attendees of the National Bureau of Economic Research’s Economics of Artificial Intelligence Conference this autumn.

For now, most generative AI programs within insurance – and across other industries – are very much in the research and test phase with insurance stakeholders feeling a varying level of comfort when it comes to the technology, industry sources at global insurance technology conference InsureTech Connect told Insurance Business. However, pilot progress is moving swiftly.

An early use case that has emerged on the distribution side is a broker email tool built by Applied Systems, which helps agents construct messages to clients, with options to set the tone and autofill details.

Applied Systems’ Rhodes has cautioned that while generative AI use may move “more quickly” than other previous artificial intelligence and machine learning developments, barriers remain for insurance companies and other stakeholders looking to capitalize on the emerging technology.

“In this industry, it will be immensely expensive to train the language models to handle really sensitive insurance use cases, and so somebody has to be willing to put in the capital to do that training,” Rhodes said.

One startup that has generated investment – with $60 million in backing from Softbank, Founders Fund, and Khosla Ventures – and set tongues wagging is Florida-based LULA.

LULA’s generative AI, known as GAIL, this year became the first AI to pass an insurance licensing exam, according to a news update from the business.

GAIL even “learned insurance so well it began correcting the tutors hired to train it,” it was said in the LULA announcement.

The tool, expected to launch in 2024 with a sales and customer service focus, has already generated millions of dollars in pre-orders with franchisee groups for Allstate, Farmers, and Travelers having all signed on for early access.

While this news might make some agents nervous, LULA said it is “adamant” that the technology is not intended to replace them.

Rather, the company set out that GAIL is intended to “increase overall productivity by taking on routine tasks like call scheduling, customer qualification and enable agencies to focus on customer relationships and providing high value service.”

Experts have suggested a number of ways that artificial intelligence technology may be used to streamline processes with the industry in time, but have stressed that, at this stage, human interaction and input remains critical. Seven ways generative AI could be used include:

LLMs could be used to analyze large volumes of data to identify trends and build more tailored offerings. This could include looking at driving records or current occupations, according to AM Best examples.

Predictive analytics could be used to customize policies based on individual needs and may facilitate real-time risk assessments, AM Best has suggested.

Artificial intelligence could be used to better assess risk exposures of insureds through assessing applications against “billions of data points”, which could be particularly useful in more complex lines of business like cyber, AM Best said.

“Generative AI is poised to reshape the cyber insurance industry, making it more efficient, responsive, and customer-centric,” Dr. Padmanabh Dabke, chief product officer of cyber insurance business Measured AI, said in a recent Press release.

While chatbots are not a new phenomenon, generative AI could improve conversational output and improve customer satisfaction with the tools. Many insurers are already experimenting with generative AI in customer service, according to AM Best.

AI is already being used in the claims handling process, including through image recognition techniques. AM Best has suggested that generative AI advances could help adjustors summarize data and produce reports.

Insurers could “dramatically” compress the claims lifecycle, EY has predicted.

Everest Group research, in partnership with EY, has suggested that a “dominant proportion” of property and casualty (P&C) insurers will prioritize claims when it comes to generative AI research, testing, and implementation.

Insurance fraud experts believe they are already seeing the impact of generative AI on fraud, as the technology can be used to create images that can appear lifelike. On the flip side, insurers could further build on AI technology for fraud detection efforts to recognize faked images and trends.

Artificial intelligence, generative AI, and insurance – embracing a cautious sense of optimism

The jury is out on the impact that generative AI and artificial intelligence more broadly will have on industry and insurance, but with insurers, startups and software houses experimenting with the technology and looking for use cases, it could only be a matter of time until gradual changes start to be phased in.

Whether the tech results in an Eywa-like knowledge and process revolution, flips the Avatar script on its head by acting as an unwelcome and unethical invader, or fizzles out with the hype remains to be seen. For now, though, many insurance workers might want to hold on to a cautious sense of optimism and think about how they might make the tech work for them, rather than how it might make them work for it.

What impact do you think artificial intelligence and generative AI will have on insurance and the workforce and whether it has Avatar-like potential? Leave a comment below?