Car insurance in Florida ranks as among the nation’s costliest, primarily because of the state’s unique insurance situation. But this doesn’t mean that drivers there don’t have access to cheaper coverage.

In this guide, Insurance Business will list some of the state’s leading auto insurance providers offering affordable coverage. We will also give you a walkthrough of how Florida car insurance works and what factors are driving up premiums.

If you’re searching for a local insurer that can provide protection that best fits your needs, this article can give you options. Read on and find out how you can access the best car insurance in Florida.

Florida is one of the most expensive states when it comes to car insurance. That’s why it can be tempting to go with an insurer that offers the lowest premiums. But as we have stressed in our previous guides, cheaper doesn’t necessarily mean better when it comes to insurance.

The table below lists some of the leading providers of car insurance in Florida, along with the types of coverage they offer and their average annual premiums.

This table also includes links to each company’s auto insurance page, where you can request a quote or find a local insurance agent.

|

Insurers |

Coverage offered |

Average premiums* |

|

Monthly: $367 Annual: $4,400 |

|

|

Monthly: $184 Annual: $2,215 |

|

|

Monthly: $218 Annual: $2,620 |

|

|

Monthly: $175 Annual: $2,100 |

|

|

Monthly: $294 Annual: $3,530 |

|

|

Undisclosed** |

|

|

Monthly: $312 Annual: $3,740 |

|

|

Monthly: $282 Annual: $3,385 |

|

|

Monthly: $376 Annual: $4,515 |

|

|

Monthly: $240 Annual: $2,885 |

|

|

Monthly: $148 Annual: $1,770 |

|

|

Monthly: $226 Annual: $2,715 |

|

|

Monthly: $245 Annual: $2,945 |

|

|

Monthly: $460 Annual: $5,525 |

|

|

Monthly: $120 Annual: $1,450 |

*Premiums are based on full coverage for 35-year-old driver with a clean record and good credit history.

**Liberty Mutual doesn’t publicly disclose insurance rates, but you can get personalized quotes based on your driving profile and coverage needs by contacting the insurer directly.

If you want to get a national perspective, you can access our car insurance comparison guide, where you can do a side-by-side analysis of the country’s largest auto insurance carriers.

Learn how liability car insurance can protect you in this guide.

Car insurance is mandatory in Florida just like all other states except New Hampshire and Virginia, where coverage is not legally required.

Unlike other states, Florida doesn’t require bodily injury (BI) liability insurance, which pays for the injuries you caused others.

Instead, Florida’s no-fault car insurance laws require you to file claims with your own insurer for the injuries you sustain in a vehicular accident, regardless of who is at fault. That’s why personal injury protection (PIP) coverage is compulsory. This covers your medical expenses and lost income if you’re injured in a car collision.

But being a no-fault state doesn’t mean that an at-fault driver is immune from lawsuits. While no-fault car insurance laws prevent injured motorists from suing at-fault drivers for compensation, you can still file a lawsuit if your injuries are severe. You can also file a lawsuit if your medical bills go over the state’s minimum requirement to sue.

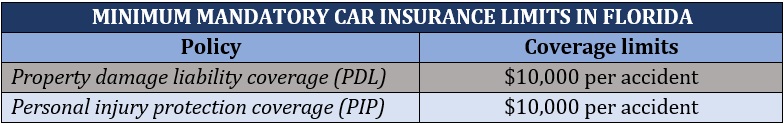

Each state has its own minimum requirements when it comes to coverage limits. The table below shows the minimum mandatory coverage you need to operate a vehicle in Florida, according to the Florida Highway Safety and Motor Vehicles (FHSMV) department.

Because the figures above are just minimum requirements, they don’t always provide sufficient coverage.

Industry experts recommend that you take out the highest coverage you can afford, as well as other optional policies – including collision and comprehensive car insurance– to get full coverage. You can learn more about the benefits of full coverage car insurance in this guide.

Motorists with traffic-related offenses may be required by the courts or the FHSMV to get an SR-22 or an FR-44 form, which raises the minimum coverage needed to legally drive.

While these are often mistaken for insurance, these documents serve as proof of financial responsibility. They certify that you have coverage that meets Florida’s minimum requirements. Your insurer files these with the FHSMV to prove that you have adequate car insurance.

You may need to obtain an SR-22 form if one of the following applies:

If you’re required to get an SR-22 form, your car insurance needs an additional:

These are on top of the mandatory minimum coverage for car insurance in Florida.

An FR-44 form, meanwhile, is needed if you have committed more serious traffic offences. These include the following instances:

If you need this form to drive, you need to take out coverage of at least:

These requirements can increase your premiums considerably – but there are still ways for you to reduce insurance cost. Check out our guide to finding cheap car insurance for practical tips.

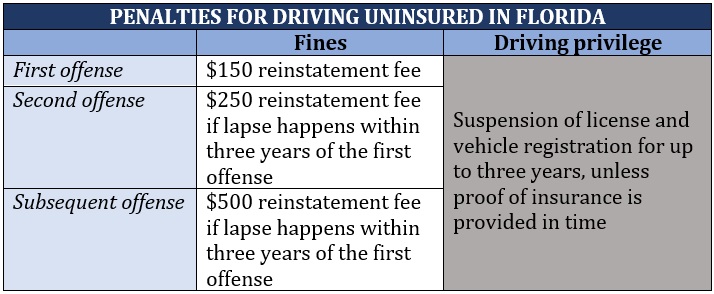

Because you’re legally required to take out coverage before operating a vehicle, getting caught driving without one has serious legal and financial ramifications. The table below details the penalties for driving uninsured on Florida’s roads.

Annual premiums for car insurance in Florida are about double the national average. This can be attributed to a range of factors, including:

Florida’s exposure to these weather-related events is also among the reasons why many insurance companies are pulling out of the state.

AAA recently announced that it won’t renew homeowners and auto insurance policies of some of the state’s residents. The insurer said the “unprecedented” rise in reinsurance rates resulting from last year’s hurricane season has made it more costly to operate in Florida.

This followed a similar move by Farmers – one of the state’s largest home and car insurance providers – that affected more than 100,000 policyholders. Florida CFO Jimmy Patronis pledged to hold the company accountable.

I’ve always said that when big decisions are made on insurance the policyholder is rarely in the room; unfortunately @WeAreFarmers proved me right. I’ve asked my team to put their heads together in holding Farmers Insurance accountable. I want additional scrutiny on this company. pic.twitter.com/fDgadXndfx

— Jimmy Patronis (@JimmyPatronis) July 12, 2023

Because of the high cost of car insurance in Florida, it can be tempting to go with the insurer that offers the cheapest coverage. But doing so comes with a risk. You may end up losing more, especially if the level of protection you get is inadequate.

To get the most out of your auto insurance, you need to understand what options are available to you and what kind of coverage these policies offer. Shopping and comparing quotes can help provide a picture of the policies you can access. Triple-I suggests that you compare the policies of at least three insurers before picking one with the best coverage.

Apart from the price, the institute recommends that you base your decision on these factors:

Auto insurance works differently in each state. If you want to learn more about this type of coverage, you can check out our complete guide to car insurance in the US.

Do you have additional tips on finding the best car insurance in Florida? Type in your suggestions in the comments section below.