Updated 10-13- 2023

If you want to become an insurance agent or broker, there are several requirements that you must meet. One of these is obtaining the proper licenses.

But each state imposes different licensure requirements, which can make the process a bit complicated.

In this article, Insurance Business focuses on getting your insurance license in NY. We will give you a step-by-step walkthrough of the entire process, from application to job search. If you’re aspiring to be an insurance sales professional in the Big Apple, then this guide can prove useful. Read on and find out what it takes to obtain a NY insurance license.

All insurance agents and brokers who wish to practice in New York must get a license from the state’s Department of Financial Services (DFS). To be eligible, you must be at least 18 years old and able to successfully complete a background check.

Aspiring insurance agents and brokers must also:

Once you meet these requirements, you can then proceed with the next steps:

Those seeking an insurance license in NY are required to complete a pre-licensing course for the state licensure examinations. This involves picking an insurance line to specialize in, also referred to as a line of authority. Some of the most common specializations are:

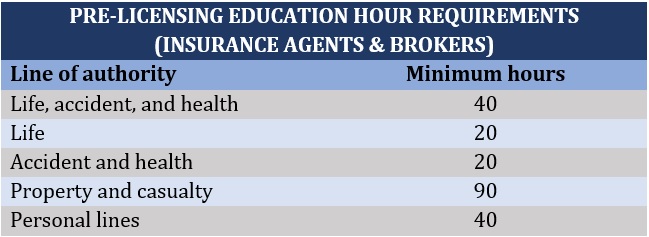

Pre-licensing courses can be taken online or in a traditional face-to-face setting. They come with the minimum required hours, which vary depending on the line of authority. These requirements are detailed in the table below.

Not every aspiring agent and broker, however, needs to complete pre-licensing education to obtain an insurance license in NY. You can skip this step if you meet the following criteria:

Find out how long it takes to obtain an insurance license if you’re planning to become an agent, broker, or claims adjuster in this guide.

After completing the pre-licensing coursework, it’s time to take the state licensure exam. The tests are divided into:

Each test consists of 150 items and must be completed in 2 ½ hours. If you wish to practice in both combined lines, then you must pass both exams. Otherwise, you will only need to take the test for the line you plan on specializing in.

The exams are proctored, meaning you will be taking them in a classroom environment with someone – called a proctor – supervising the test. If you’re not used to being in such situations, you can work on calming your nerves before taking the test.

Just like in the pre-licensing exams, you must score at least 70% to pass. The test results are valid for two years. This means that you must apply for your NY insurance license within that timeframe. If you fail to do so, you will need to retake the tests.

Each attempt of the New York insurance licensing exam costs $33. Before taking the test, you will be asked to present one valid signature-bearing ID with your photo and the original copy of your pre-licensing education certificate.

Here’s a list of what are considered valid identification documents:

If you can’t provide the required documents, you will not be allowed to take the test. You will also forfeit your payment.

License applications are submitted to the DFS. However, you will need to wait at least 48 hours after passing the exam before applying for an insurance license in NY. This is intended to give the department enough time to process the exam results.

You can fill up the application form on DFS’ website. Individual license fees cost $40. If you’re applying for insurance licenses for different lines of authority, you will need to pay separate fees.

Non-residents are required to submit a non-resident application form and pay the appropriate fees, which vary depending on the state where they live. They must also carry insurance licenses in their home states.

All NY insurance license applications are reviewed by the DFS. There is no specific timetable for this as, according to the department, “every application is different.” If something comes up from your background check, the DFS may contact you to provide clarity, which can slow down the process.

You can find out if your application has been approved or rejected through the NY Insurance License Lookup Tool. Once approved, you can use the DFS portal to request a PDF copy of your license.

The department doesn’t mail printed licenses. You will need to save and print your license yourself.

If you feel that there’s a delay and suspect an error, you can contact the licensing department at 518-474-6630 or send an email to [email protected].

Congratulations! Now that you have your license it’s time to chase your dream job. To make the task easier, Insurance Business has compiled a list of the best websites to search for insurance jobs.

An insurance broker in New York earns an average annual salary of $82,246 or about $40 per hour. An insurance agent, meanwhile, has a median wage of $65,279 per year or about $31 an hour. These are the latest figures from the employment website ZipRecruiter.

Many insurance sales professionals, particularly those working in insurance brokerages and agencies, receive regular salaries. However, they can also earn an income in different ways. These include:

You can check out how much insurance agents make and how much insurance brokers make in these guides.

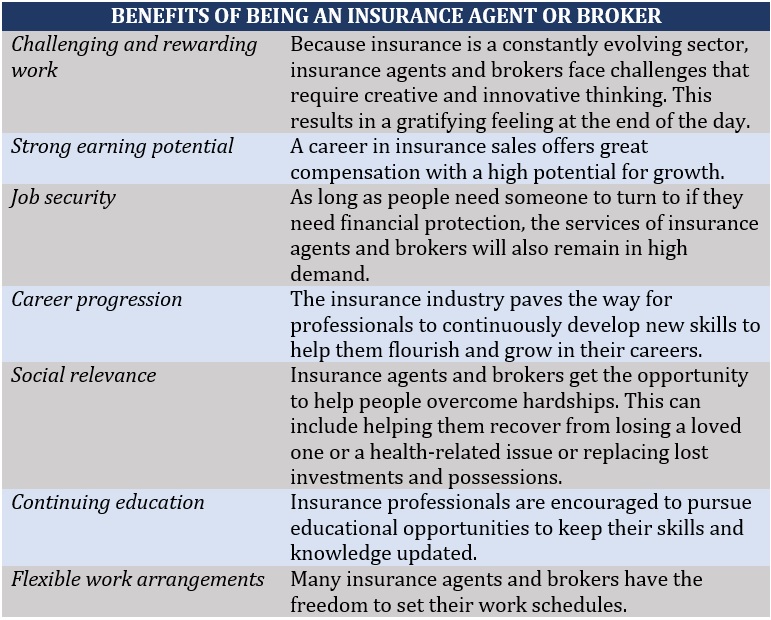

Knowing that you played an important role in helping clients achieve financial protection is among the biggest factors that make being an insurance agent or broker a rewarding profession. That’s why it’s not surprising that many are considering pursuing this career path.

This sense of fulfillment, however, is just one of the many reasons why being an insurance agent or broker is an appealing profession. The table below lists some of the other benefits of choosing this insurance career.

If these benefits seem enticing to you and you feel that you’re up to the task, this step-by-step guide on how to become an insurance broker can help jumpstart your insurance career.

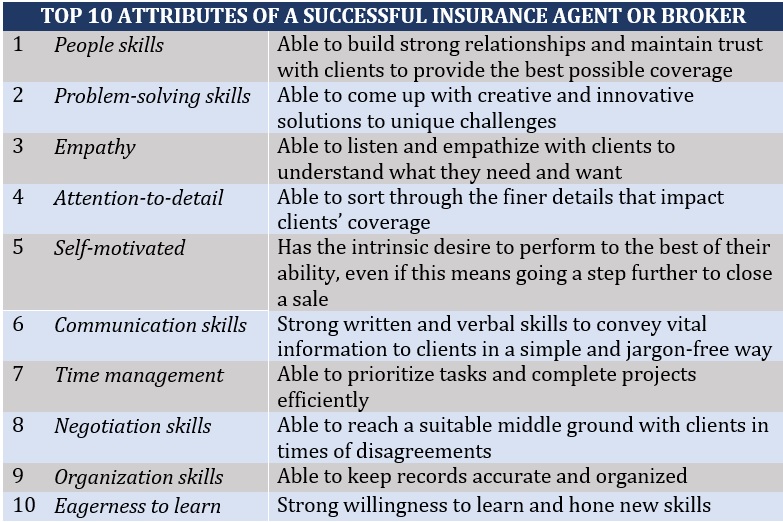

To be a successful insurance sales professional, you must have a combination of hard and soft skills that allow you to connect with clients and offer them the best coverage possible. The table below lists some of the most important skills and attributes that you should possess to be among the best in the field.

If applying for insurance jobs is not your thing and you prefer instead to run the entire show, this guide on how to run your own insurance brokerage firm can help give you a head start.

Our Best in Insurance America Special Reports page is the place to go if you want to find the top agencies and brokerages to start and build your insurance career with. The companies featured in our special reports have been nominated by their peers and vetted by industry experts as respected and trusted market leaders.

If you choose to work with these agencies and brokerages, you can be sure that you’re going with a company that prioritizes employee wellbeing and provides a positive workplace culture. These attributes will allow you to thrive in your insurance career.

Did you find this guide to obtaining an insurance license in NY helpful? Do you want to share tips on how to get a New York insurance license? Feel free to comment below.